Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 1 Feb, 2023

By Sean DeCoff

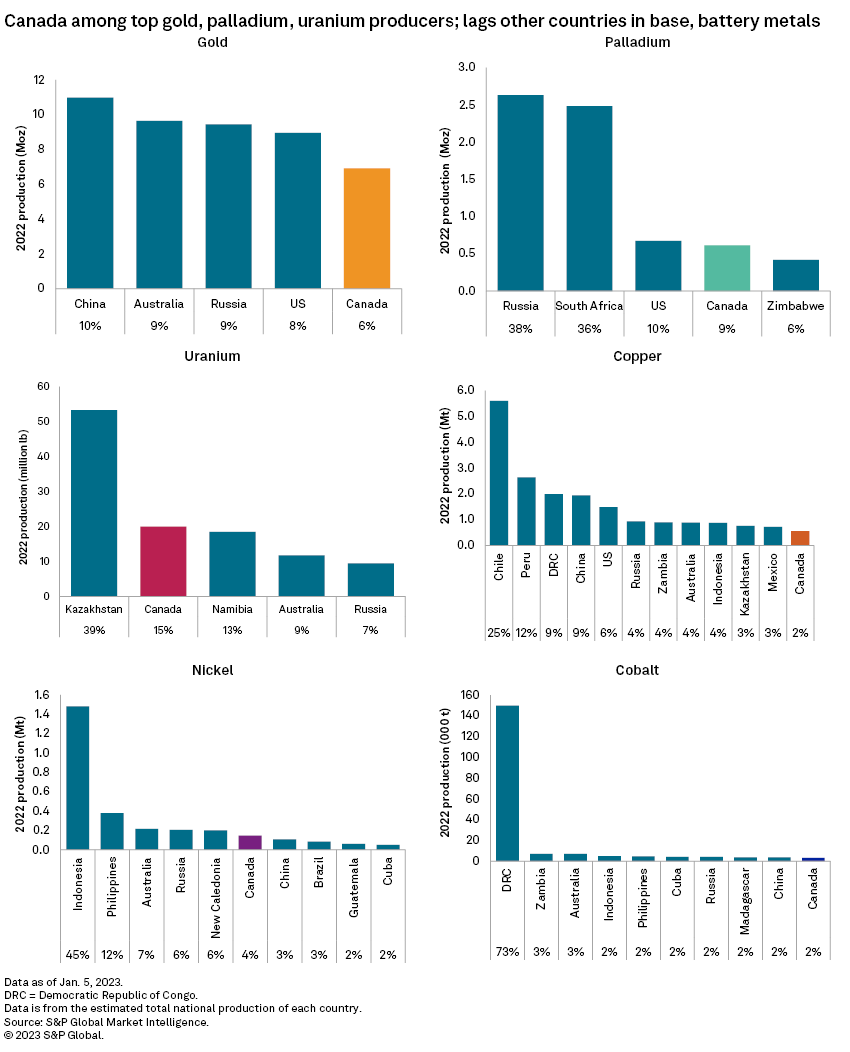

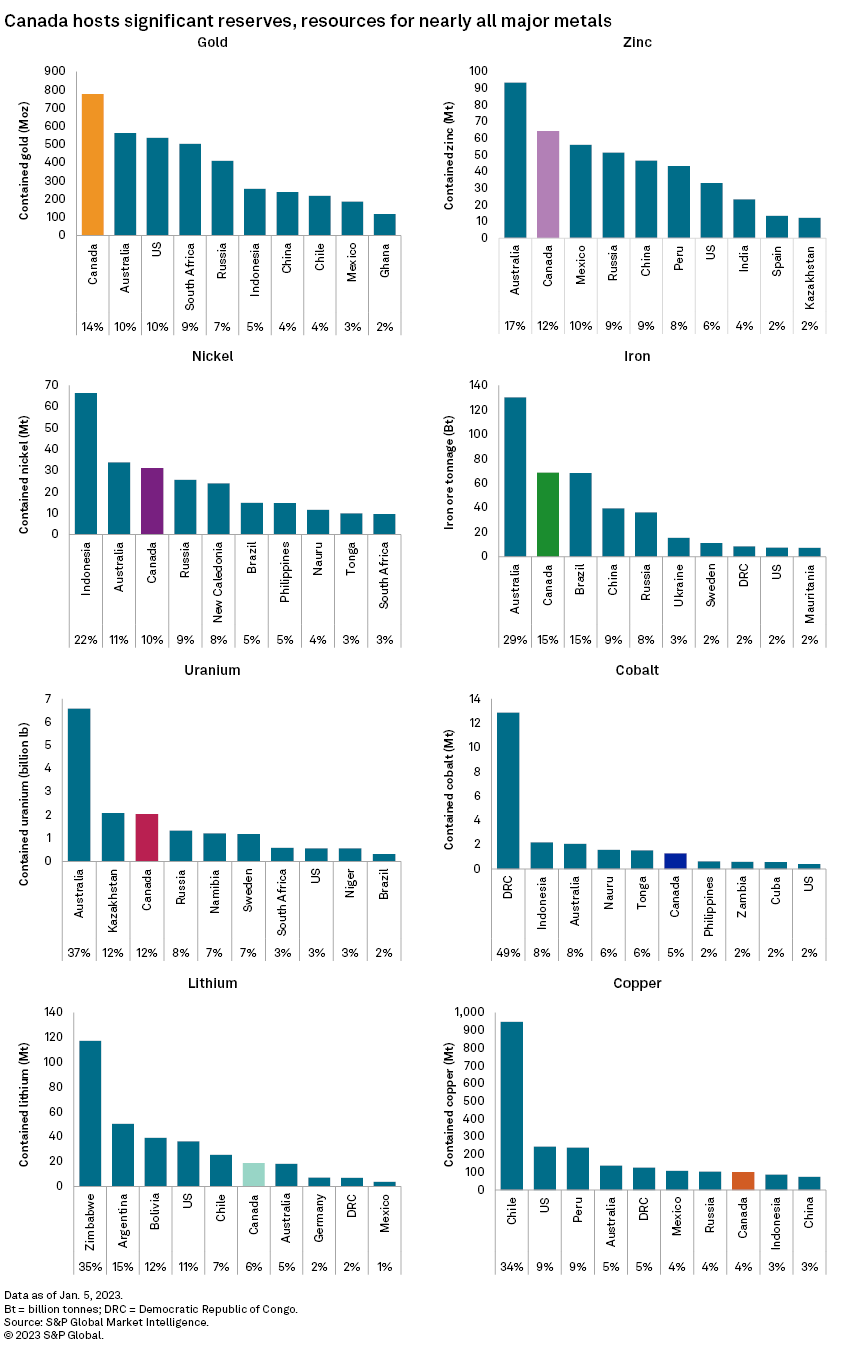

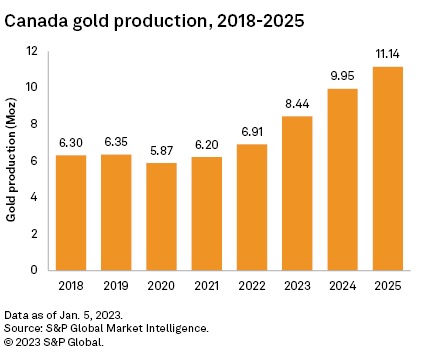

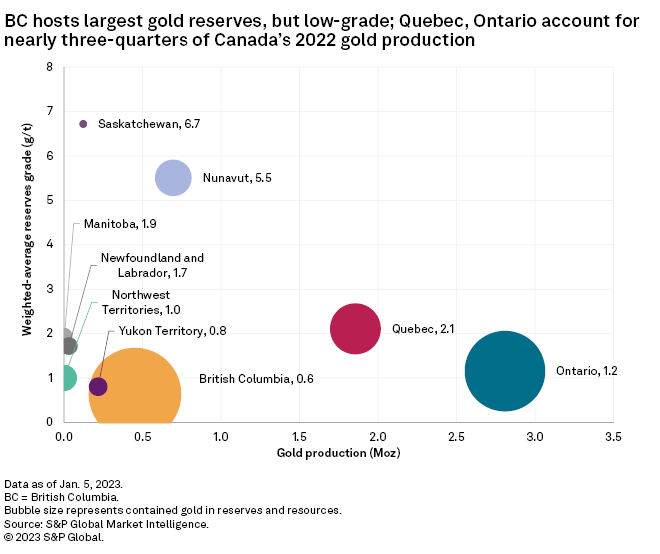

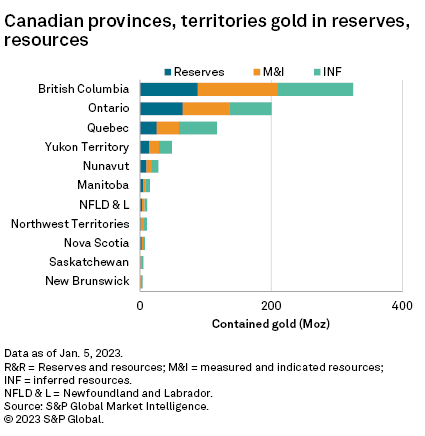

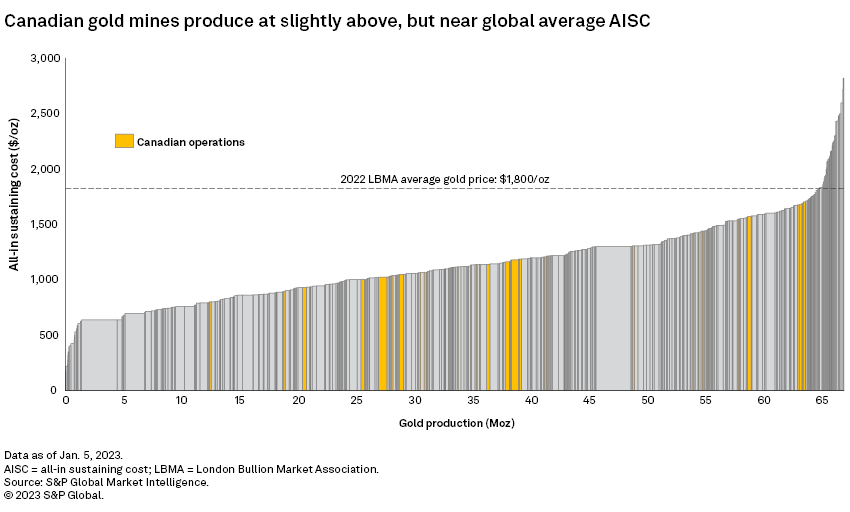

Canada's production of most metals remained strong in 2022. Most notably, gold output grew to 6.9 million ounces, which ranks the country as the fifth-largest producer. Based on estimates by S&P Global Commodity Insights, production from Canadian gold-producing assets will rise 61% between 2022 and 2025.

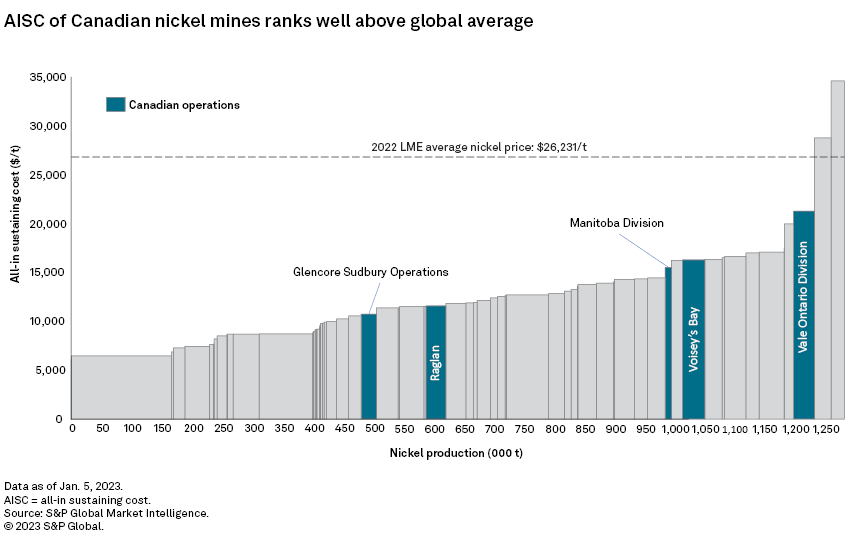

While Canada slipped to fourth place for global palladium production, it rose to second place for uranium. The country continues to lag in base metals production, ranking outside the top 10 for copper, zinc and cobalt production. While Canada ranks as the sixth-largest nickel producer, it accounts for only 4% of global output. Additionally, the average all-in sustaining cost of Canadian nickel mines is well above the global average.

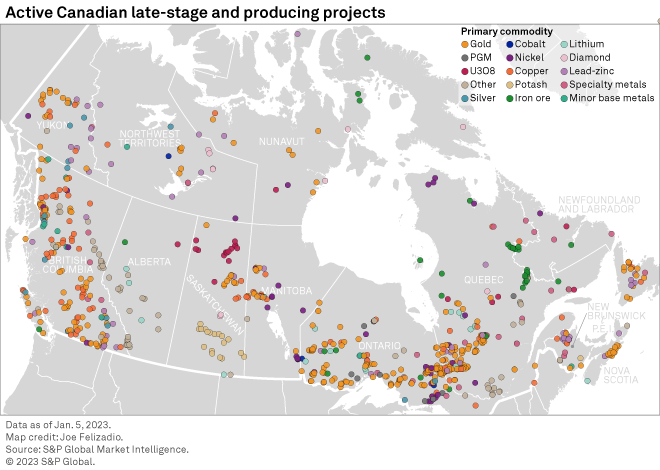

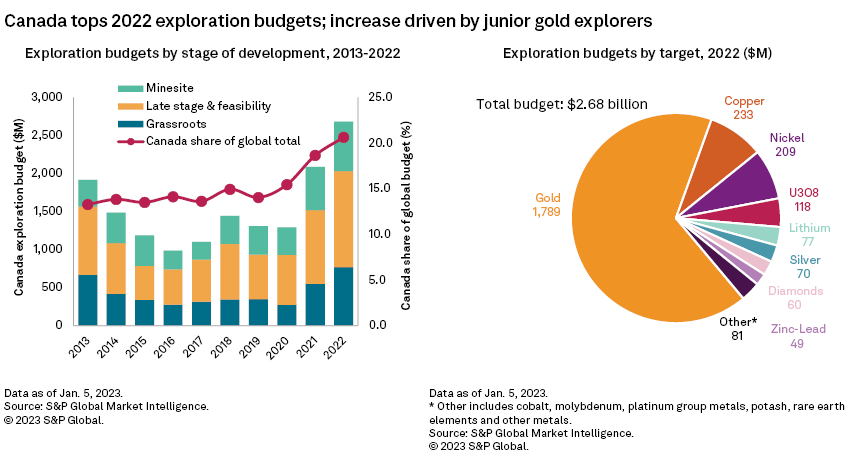

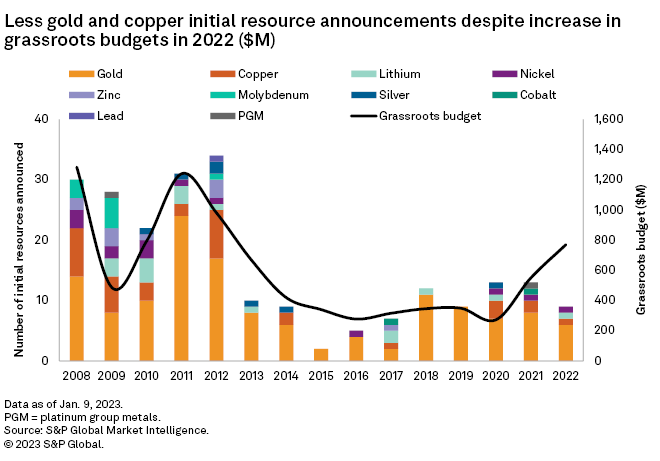

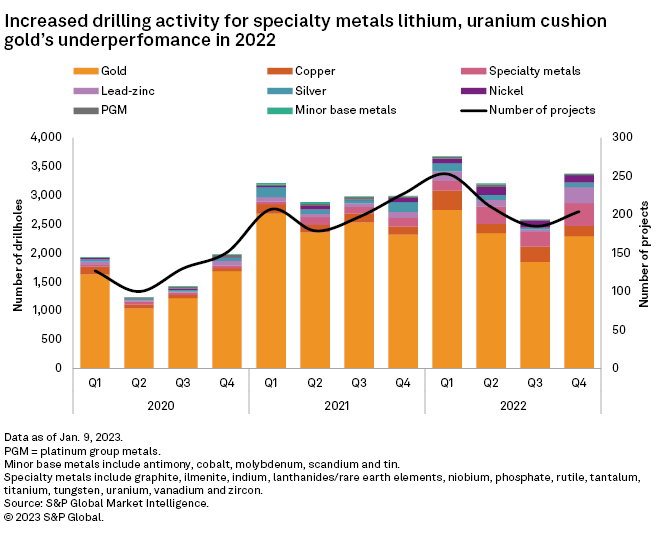

Canadian exploration budgets increased 29% year over year in 2022 to $2.68 billion — a decade high. The country's budget growth was nearly double the 16% global average growth for the year and outpaced budgets for comparable exploration destinations, such as Australia and the United States. S&P Global Commodity Insights identified 651 companies exploring for nonferrous metals in Canada in 2022 — the most in 10 years — up from 583 in 2021. The average budget per company increased 15% year over year to $4.1 million.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.