Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 19 Apr, 2023

By Fed Mendoza

Highlights

The Southeast Asia pay TV industry will push its customer base from 42.7 million in 2022 to 50.3 million in 2027, reflecting a 3.33% CAGR.

IPTV and DTH will display subscriber growth by year-end 2023 and will continue to do so in the next five years, while cable and pay DTT subscriptions are expected to decline gradually.

As of March 2023, 12 out of 16 IPTV operators in Southeast Asia offer IPTV-fiber broadband bundles while the rest offer IPTV as a value-added service to their existing fiber broadband subscribers or as a stand-alone package.

Cable has been Southeast Asia's longest-reigning top pay TV platform. In 2023, however, our data show that cable's dominance is expected to end as IPTV takes over the spot with a 33.7% subscriber share of multichannel households. Southeast Asian telco operators from Indonesia, Malaysia, Singapore, Thailand and Vietnam invest in offering IPTV and fiber broadband bundles, and give IPTV and the multichannel sector, in general, room for growth in the coming years.

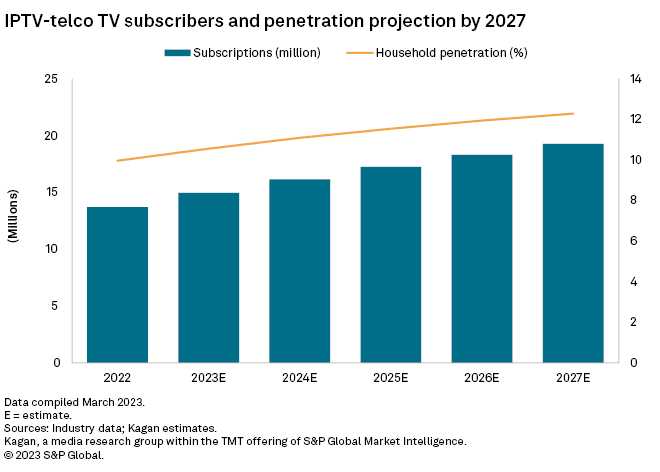

Southeast Asia's IPTV customer base reached 13.7 million as of year-end 2022, translating to a 10.0% household penetration as of year-end 2022. The number of IPTV subscribers is expected to increase to 19.3 million by 2027 with a 12.3% household penetration.

Southeast Asia's pay TV industry will push its customer base from 42.7 million in 2022 to 50.3 million in 2027, reflecting a CAGR of 3.33%, driven by growth in IPTV and DTH. Our model suggests that IPTV subscribers in Southeast Asia will keep growing at a five-year CAGR of 7.07% by 2027. Meanwhile, DTH will display slower growth from 13.8 million subscribers in 2022 to 16.6 million subs in 2027, with a CAGR of 3.89%. As IPTV and DTH grow in 2023 and will continue to do so in the next five years, we project cable and pay DTT subscriptions to decline gradually.

As cable dominance is soon to end and will be taken over by IPTV, Kagan estimates IPTV will retain its multichannel market top spot with a 38.4% subscriber share, while DTH, cable and pay DTT will obtain multichannel subscriber share of 33.1%, 28.4% and 0.2%, respectively, by year-end 2027.

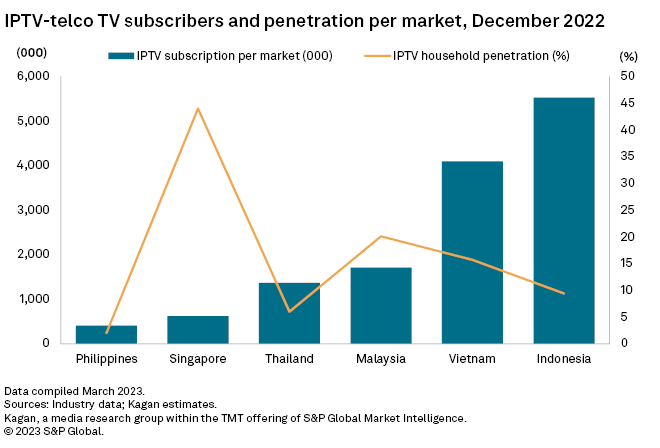

With the diverse video landscape in Southeast Asia, the leading pay TV platform in each market differs in 2022. In Thailand and Vietnam, cable dominates due to the platform's large number of service providers, whose small market shares when combined make up the biggest chunk of the multichannel market. In Malaysia and the Philippines, DTH holds the top spot as propelled by affordable prepaid and postpaid plans. After decommissioning cable and making IPTV a sole pay TV platform, Singapore continues to innovate its multichannel sector by starting to migrate to virtual multichannel platforms. Indonesia, despite its low broadband penetration, managed to make IPTV a top pay TV platform and proved IPTV-fiber broadband bundling strategies to be effective.

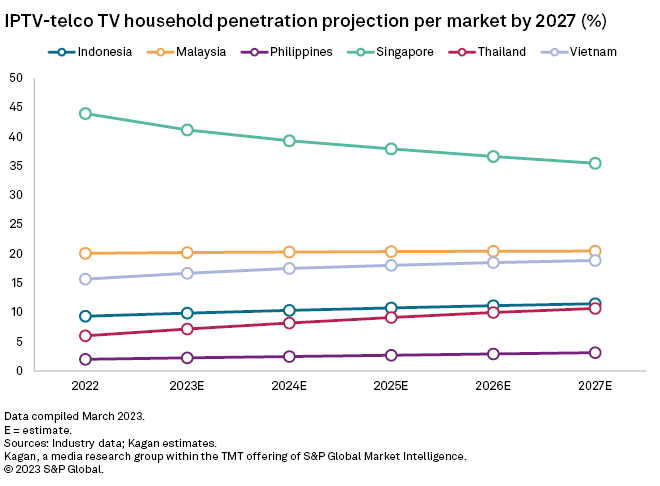

While bundling with broadband seems to be an effective strategy for IPTV at present, growth will not be exponential in the next five years as operators transition from bundling IPTV to streaming. The ability to stream both linear and on-demand content on multiple devices without the added installation fees, equipment and contract period makes streaming services more appealing than fixed video services. Broadcast networks discontinuing linear channels and moving to a direct-to-consumer approach have also put the multichannel business at a disadvantage.

Singapore

Despite the varying leading pay TV platform in each market, we observed that IPTV subscription growth is constant in most Southeast Asian markets, except Singapore, as traditional IPTV customers shift to streaming and virtual multichannel options. Singapore Telecommunications Ltd. offers TV everywhere service Singtel TV GO, a streaming application exclusive to pay TV subscribers that enables them to watch live channels from their pay TV subscription on different devices at home or on the go. Singapore's second pay TV provider, StarHub Ltd., discontinued sales of its traditional IPTV service to new customers in August 2020. It was replaced with a virtual multichannel option branded StarHub TV+ that uses an Android TV-based connected box. This single hybrid platform made linear TV available across multiple devices along with streaming apps instead of using a fixed set-top box. Our model indicates that IPTV churn will continue, and by the end of 2027, IPTV will serve approximately 547,000 subscribers, continuing to be the sole pay TV platform in Singapore.

Indonesia

Indonesia's IPTV customer base reached 5.5 million as of year-end 2022, translating to a 9.4% household penetration. Indonesia's sudden IPTV growth is attributable to Telkom Indonesia's aggressive fiber rollouts, pushing IPTV subscriber share to 45.4% of multichannel households by year-end 2022. By year-end 2027, IPTV is projected to strengthen its market hold at 47.4%. Major pay TV operators — PT Telekomunikasi Indonesia Tbk, PT MNC Sky Vision's MNC Play and Biznet — bundle their IPTV offering with their homegrown fiber broadband service while Dens.TV collaborated with ISPs to offer bundling packages.

Malaysia

IPTV in Malaysia served nearly 1.7 million subscribers as of year-end 2022. Telekom Malaysia's and Astro's effective broadband and TV bundles served as the driving force to penetrate the country's households by 20.1%. Kagan anticipates, however, that IPTV will gain minimal traction in the next five years, reaching 1.96 million households in 2027 as streaming services continue to thrive and possibly overshadow multichannel services.

Philippines

The Philippines had an estimated 405,000 IPTV subscribers as of year-end 2022, a mere 2.0% household penetration. We project this figure to increase to nearly 716,000 in 2027 with a penetration rate of 3.1% as major broadband operators aim to convert legacy copper connections to fiber, translating to a wider IPTV reach from the anticipated increase of fiber homes passed. Our recent survey identified PLDT Inc. and Converge Information and Communications Technology Solutions Inc., the Philippines' major broadband operators, tailored IPTV plans as a value-added service targeted to their existing broadband subscribers.

Thailand

Thailand's shifting video consumption behavior — extending content availability across multiple digital platforms, along with effective over-the-top and broadband bundling strategies — gives IPTV the highest potential to grow in the next five years. The ability to combine streaming services, broadband and IPTV in one single package serves as the IPTV providers' edge versus cable and satellite operators. As of year-end 2022, our model indicates that IPTV reached an estimated 1.4 million subscribers, which we forecast will increase to 2.6 million by 2027. The main active IPTV players in the market are Advanced Info Service PCL; state-owned National Telecom, formerly operating as TOT PCL; and Jasmine International PCL, operating under its subsidiary Triple T Broadband Public Co. Ltd., or 3BB.

Vietnam

IPTV service is gradually making its mark in Vietnam's multichannel space, serving around 4.1 million customers by year-end 2022. With a 32.4% share of all multichannel subscribers, IPTV has widened the gap between DTH's 4.1% market share in 2022. IPTV eventually picked up its pace through bundling, fueled by the increasing broadband penetration. VNPT's MyTV, FPT Telecom Joint Stock Company, Viettel Telecom Co and SCTV are the main active IPTV operators in the market. Kagan forecasts IPTV will latch onto FTTH's growth in the market through effective bundling strategies, reaching over 5.4 million IPTV customers in 2027. However, IPTV will not take up as fast as fiber broadband and is seen as an add-on benefit rather than a separate service.

IPTV services in Southeast Asia were generally affordable in 2022, whether bundled with fiber broadband service or as an add-on service, scoring a 0.7% affordability rate on average. Thailand and Vietnam had the most affordable IPTV services with affordability index of 0.4% while the Philippines had the least affordable service with a 1.7% affordability index.

Already a client? Click here to access the full article, including detailed data presentations and market analysis and the specifics of IPTV-broadband bundling strategies.

Global Multichannel is a service of Kagan, part of S&P Global Market Intelligence.

Research

Research