Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 13 Aug, 2024

By Temilade Oyeniyi and Amritpal Sidhu

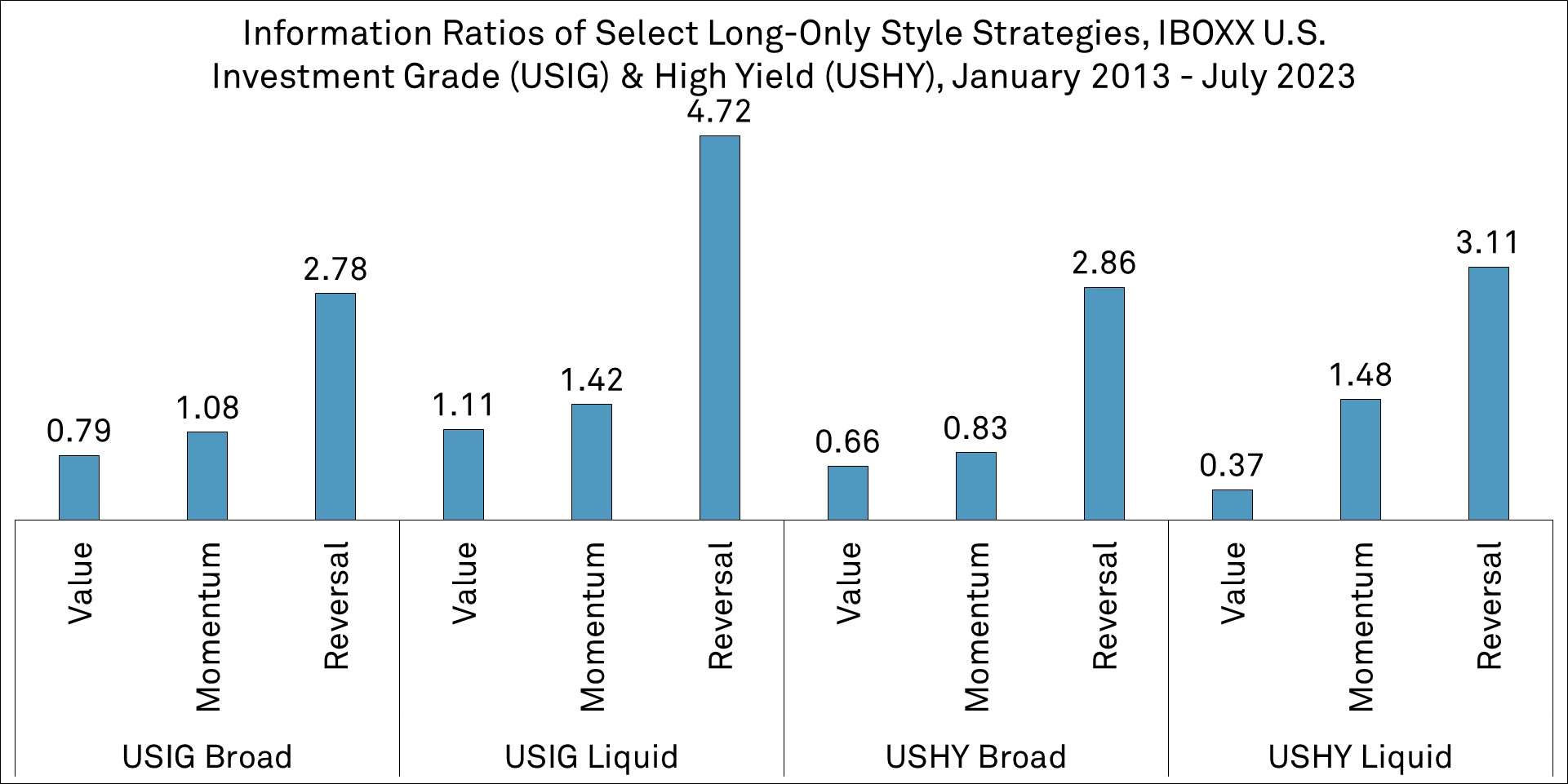

The application of 'smart beta' strategies is expanding into corporate bonds, beyond its equity roots. This paper explores value, momentum, and short-term reversal styles in fixed income, highlighting the potential to enhance returns and diversify portfolios. The analysis shows that value and momentum strategies in iBoxx U.S. investment-grade (USIG) and high-yield (USHY) bonds generated statistically significant alpha, with low correlations to the comparable equity styles and markets premia.

VIEW THIS PAPER’S SOURCE CODE

(with your S&P Global Marketplace Login)

Source: S&P Global Market Intelligence Quantamental Research. Data as of July 2023.

Key research findings include:

Explore the data used to conduct this research

S&P Global Market Intelligence bond pricing and liquidity data forms the basis of bond returns and liquidity-related robustness checks. Bond pricing data is updated daily covering US, European and Asian corporate bonds with historical records available since January 2013. We used the following S&P Markit iBoxx fixed income indices and their analytics in signal and factor portfolio construction.

RESEARCH