Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 9 Mar, 2023

By Alexander Johnston

In this two-part series, 451 Research looks at the link between blockchain and the emerging metaverse wave of innovation. In part 1, we considered the opportunities for distributed ledger technology and looked at definitions, drivers for convergence, and blockchain use cases in the metaverse. In part 2, we consider the challenges of both potential convergence and codependence. S&P Global's extended metaverse coverage is described in our metaverse primer.

For this report series, "blockchain" refers to a distributed ledger technology that stores data in the form of immutable, cryptographically secured, and connected blocks, with strict sequential ordering. "Distributed ledger technology" is a family of technologies used to enable data storage across multiple locations in a network. "Metaverse" is the long-term vision for the next phase of the internet, which will feature a single, shared, immersive, and persistent 3D virtual space where humans interact with one another and with data, enhancing the physical world as much as replacing it.

A decentralized metaverse faces serious barriers, due as much to social, legislative and economic factors as to technological limitations. Improved network scalability, with higher-throughput protocols and stronger scaling technologies for Ethereum, is addressing challenges around cost, energy intensity and speed — factors that derailed early approaches to a distributed ledger foundation for the metaverse.

Improvements to tooling and interoperability, as well as the availability of blockchain services, are increasing the viability of applying the technology to complex enterprise use cases. More work is required to mature the technology — off-chain, on-chain and cross-blockchain connectivity are ongoing hindrances — but hurdles in a decentralized road map for the metaverse will increasingly be cultural and legal. Whether the building blocks are to be centralized or decentralized will likely be shaped by future regulation and concerns over decentralization as much as by technical considerations.

Blockchain and metaverse convergence

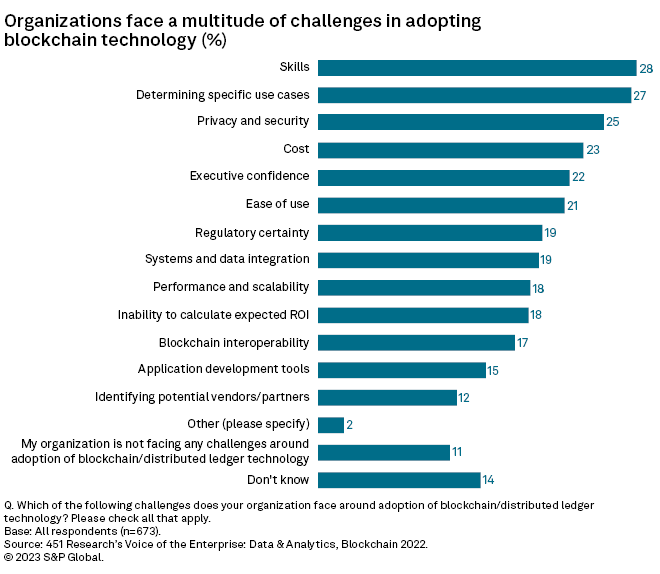

The bottlenecks to enterprise adoption of blockchain are varied. As the figure below reveals, just 11% of respondents to 451 Research's Blockchain 2022 survey felt their organizations faced no challenges in adopting the technology. Over a fifth of respondents faced challenges around skills, determining specific use cases, privacy and security, cost, executive confidence, and ease of use.

Interoperability

The concept of a metaverse made up of different interconnected spaces is unlikely to be built on a single ascendent blockchain. Blockchain protocols have varied strengths and weaknesses around speed, security and scalability and have a range of ways they are governed. Many enterprises using blockchain primarily engage with permissioned blockchain networks, such as Hyperledger Fabric or Corda, where they have greater control over access to the network and greater privacy. Public blockchain networks are associated with decentralization and openness, with large networks like Ethereum representing major ecosystems of developers, startups and participants.

Different protocols are optimized for different use cases. Some organizations, for instance, may have data residency concerns, so the ability to bridge data and assets across networks will be central to the viability of blockchain as a means of proving identity or ownership. Although interoperability is a major focus for many developers and vendors, it remains a serious bottleneck to scaling out pilot networks.

Interoperability challenges also extend into connecting on-chain and off-chain systems. Companies may want to analyze data stored on-chain within their standard analytics workflows, establish a more holistic developer experience, or augment decentralized applications with non-blockchain-based storage or faster off-chain interactions. Additionally, few vendors are able to accept cryptocurrency payments, and few assets stored on-chain have any off-chain utility; this lack of connectivity may limit the appeal of storing value or earning money in cryptocurrency.

This is a challenge to many Web3 metaverse projects, particularly those built with play-to-earn mechanisms, or where cryptocurrency is seen as a means of powering commerce. The value of cryptocurrencies — important not just in how they can be applied in metaverse projects but as a means of raising capital for development — is further depressed by the volatility of un-pegged cryptocurrency assets, concerns about the resiliency of exchanges used to transfer assets, and negative associations with the technology.

Scarcity

The value of ownership is closely associated with scarcity. If blockchain forms the underpinning of commerce, ownership and identity, the role of technology is closely associated with financialization and asset availability in metaverse spaces. Design choices may limit the availability of digital land or restrict what can be created or who can create it. This may elevate the importance of verifiable ownership. Many blockchain-based video games, prominent examples being Axie Infinity and CryptoBeasts, support unique digital assets known as non-fungible tokens that can be earned and transacted and may enable a degree of governance over the game through ownership.

The value of the tokens, or land, in blockchain-based game worlds, is based on their scarcity, and assets commonly have in-game rarity rankings. Usually, these assets are purchased using cryptocurrency, sometimes on secondary markets if earned in-game. Associated business models have already faced significant backlash over their application in gaming and are unlikely to appeal to all metaverse users if extended more widely. Metaverse projects will likely evolve with different philosophies, and many users may prefer spaces built around abundance, or without active support for commerce. This could limit the role distributed ledger technology plays within those ecosystems.

Legal and regulatory challenges

The regulatory environment for blockchain is still being developed. Underpinning metaverse projects with a technology that is facing significant regulatory scrutiny may generate uncertainty in investors and/or development teams. The obstacles are likely to center on the use of cryptocurrency or other tokenized asset classes.

In some markets, such as Bangladesh, cryptocurrency transactions are illegal. In others, like mainland China, cryptocurrencies are not recognized as legal tender, investment vehicles like initial coin offerings are banned, and access to exchanges is blocked. The Reserve Bank of India in 2018 banned regulated financial institutions from providing services to people or businesses that deal with cryptocurrencies. In the U.S., the SEC has been actively scrutinizing exchanges and has suggested the U.S. Treasury will complete an "illicit finance" risk assessment on decentralized finance.

Many regions lack cryptocurrency-specific laws, and taxation approaches vary substantially. This may restrict the use of blockchain as a means of payment, place constraints on the partners that metaverse developers will be confident about working with, or even lead to regional restrictions on which metaverse spaces users can transact in.

A major reason for the hardening regulatory environment for blockchain is the reputation of cryptocurrency, in particular, around volatility, illicit activity and scams. Advocates of blockchain stress its security and immutability, but vulnerabilities exist in smaller networks where malicious actors can gain influence more easily and can intercept data or compromise a user's system. The volatility of cryptocurrency valuations has also contributed to a vendor space prone to collapse, and the technology's reputation may dent the confidence of users and developers to the extent of seeking alternative architectural choices.

Licenses are also an evolving challenge, particularly for NFT projects. A user may purchase a token, but existing platforms for buying these assets do not commonly support getting a license at the point of sale. Even where licenses do exist, they are infrequently carried through to a secondary buyer. In many instances, NFT buyers have little awareness of what they are purchasing and how they can use these assets. Over time, this situation may change with the evolution of processes and technology enabling the digital asset exchange. However, the backdrop to these changes is a rising tide of court cases surrounding NFT IP infringement and consumer protections.

Enterprise resistance

Enterprise resistance to decentralizing governance and data ownership has received little attention. A company may have concerns when assets it has designed are taken out of the digital geographies they were built for or are sold into secondary markets. Companies may want restrictions on how assets are used and who accesses them, in part to insulate the business against reputational damage.

The ability to financially benefit from assets being sold secondarily — valuable in the often highly liquid market associated with public blockchain — will also factor into enterprise decision-making. These considerations are not diametrically opposed to blockchain; indeed, existing token standards are able to support restricting an asset to a single identity. But stronger enterprise controls have serious implications for the concept of ownership built into the vision of a decentralized metaverse.

Decentralization has major implications for commercial practices and competitive positioning. A company investing heavily in metaverse development may see a lower return if third parties are able to sell into their spaces or if users can shape governance in ways that limit the monetization opportunity.

For revenue generation, a metaverse developer will likely prefer an audience restricted to certain purchasing channels to a world where users can easily build new assets or bridge existing ones. A portable blockchain-based identity that can move assets between worlds will likely mean fewer exit barriers for users. This architectural consideration may lead developers to place limitations on interoperability, and the spirit of open-source development often associated with Web3 may erode as product leadership teams look to maintain competitive advantage.

Expertise

The shortage of developers capable of using Solidity, the primary programming language for establishing smart contracts in Ethereum and compatible blockchains, has been a major limitation. More significantly, few technology vendors are experienced with decentralized applications, and many may lack the expertise to address pain areas such as updateability or scalability.

As our figure above illustrated, skill was the most commonly identified challenge to enterprise blockchain adoption. The quality and availability of developer tooling and resources when dealing with a relatively nascent technology can hinder upskilling. Without the ability to identify optimal partners or select a well-suited technology stack, companies eyeing a stake in the metaverse may be reluctant to build on distributed ledger foundations.

Decentralization

Decentralization is a particular challenge when extended to governance. A creator or organization with a singular vision and a clear development road map does not align well with a decentralized approach. The need to engage a large community of users to push through an update could lead a project to be too slow to react in a fast-changing environment.

Decentralized autonomous organizations, or DAOs, are perceived as a future foundation of a decentralized metaverse by many — part of the drive to distribute governance. However, DAO members that are less connected to projects may delegate voting responsibilities or rely on a small sector of members to adopt managerial responsibilities. These structures are therefore not always decentralized and often lack a legal wrapper, which has implications for liability.

A developer who provides code to a DAO project may be held responsible for how users apply that code, perhaps for actions undertaken within a metaverse space they contributed to designing. This could discourage building out metaverse initiatives as part of a DAO, and development could be biased toward corporations, which may be less committed to decentralized approaches.

Providing transparency to users — of the data or the source code or internal governance — can also raise security challenges because malicious actors may find it easier to identify vulnerabilities. Another security-related issue is that networks can centralize over time. A decentralized governance model that weights influence by token volumes, for example, could lead to a small community dominating a metaverse space, with that influence having a snowball effect.

The security of blockchain networks can be undermined by reduced decentralization if malicious actors are gaining increased influence over a network. Centralization also has implications around diversity. Wealthy users that buy into a project may get more of a say than those from less privileged backgrounds. If wealthy individuals are able to shape governance to strengthen their position, the views of other users could be diminished.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.