S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

Research — 21 Sep, 2023

By Thomas Mason

Banking as a service seems increasingly relevant in the face of banking industry liquidity pressures, as it continues to offer robust deposit growth. However, there are challenges that come with offering such a model. Below are some of the main pros and cons we see.

In general, banking as a service (BaaS) seems an ideal partnership. Financial technology companies have proven their ability to innovate and create modern, user-friendly interfaces, with the rapid deposit growth of direct-to-consumer neobanks attesting to this. The banks they partner with have things fintechs often lack, including the back-end architecture for account management, Federal Deposit Insurance Corp. insurance and deep regulatory knowledge.

BaaS has proven highly successful for some, but there are also costs to consider. The business might require significant up-front tech investment and, as real-life examples have shown, it can take a few years to build and become profitable. Banks might also need to increase their spending substantially on compliance to ensure their fintech partners are adhering to banking regulations.

Pros

Low-cost deposits

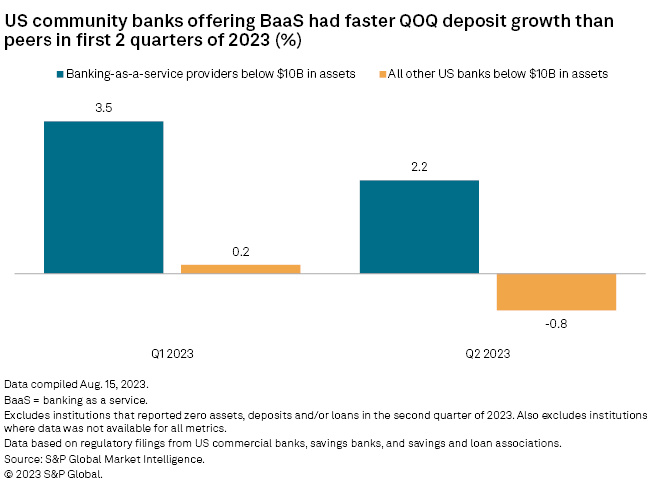

Community banks offering banking as a service once again outpaced peers on quarterly deposit growth, with a median sequential growth rate of 2.2% for BaaS banks in the second quarter and a decline of 0.8% for the rest of the US banks below $10 billion in assets.

Given the expectation for deposit pricing pressures to persist, BaaS seems a particularly enticing proposition, as it can potentially bring in low-cost, non-interest-bearing deposits. Pathward Financial Inc. offers a prime example. As of June 30, 96% of its total deposits were non-interest-bearing and its total cost of deposits was 0.01%, according to an investor presentation. The Sioux Falls, SD-based bank's BaaS segment has a heavy focus on prepaid cards, which it issues through BaaS partnerships with payments companies.

That said, BaaS banks are not immune to changes in customer behavior and competitive pressures. Depositors in non-interest-bearing accounts could switch to interest-bearing accounts at any point.

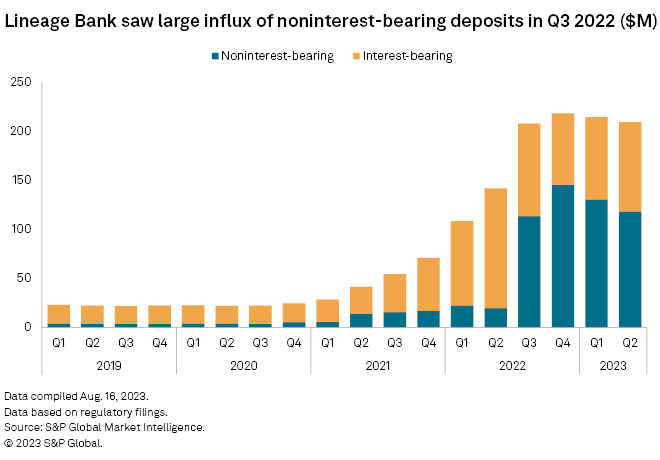

Often we cannot tell how much of a bank's business comes from BaaS. But in some cases, we assume that large changes in the overall bank's results are due to BaaS. Data from Lineage Bank, based in Franklin, Tenn., shows the impact we would expect: Non-interest-bearing deposits jumped from $19.9 million in the second quarter of 2022 to $113.4 million in the third quarter of that year.

Fee income

BaaS can provide new revenue streams for banks. There are different varieties of such revenue, but interchange fees are a common one. BaaS banks that serve as the issuing bank of credit and debit cards receive interchange fees from the merchant's bank (known as the acquiring bank) when customers use them to pay for transactions. Typically, the issuing bank gets 30% of the revenue and the fintech partner receives 70%, according to Synctera Inc., a company that helps banks and fintechs create BaaS programs.

Visa Inc. and Mastercard Inc. are reportedly planning to hike the fees paid by merchants on credit and debit card transactions, per an Aug. 30 article from The Wall Street Journal. If enacted, it should provide increased interchange revenue to issuing banks and fintechs providing those cards.

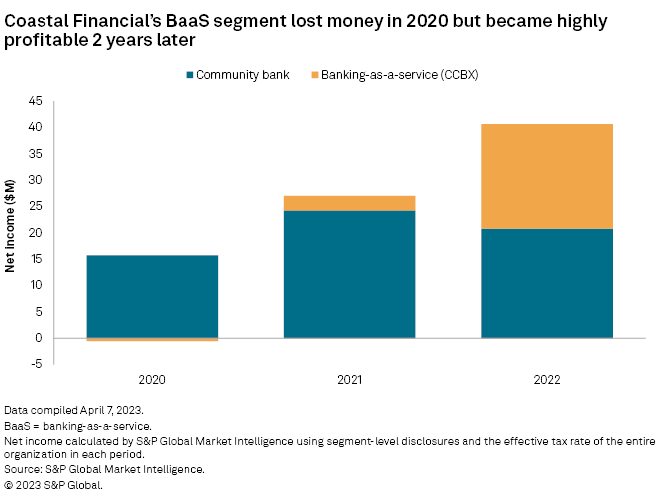

BaaS can meaningfully add to a bank's bottom line, judging by Coastal Financial Corp.'s results. The Everett, Wash.-based bank generated $19.8 million in net income in 2022 from its BaaS division, dubbed CCBX, which was 49% of its total net income for the period, according to S&P Global Market Intelligence calculations.

BaaS partnerships might offer deposits and loans outside a bank's traditional customer base. For instance, MVB Financial Corp. has built a sizable deposit base of gaming deposits through relationships with online sports betting sites. The Fairmont, W.Va.-based bank's gaming deposits increased from less than 4% of total deposits at the end of 2018 to about 12% as of June 30.

On the asset side of the balance sheet, BaaS can lead to new lending channels. In the case of Coastal Financial, its BaaS segment has a much different loan portfolio composition than its community bank. About 65% of the BaaS division's gross loans receivable were classified as consumer and other as of June 30, whereas 68% of the community banks were commercial real estate.

As neobanks and buy-now, pay-later companies strive for profitability, we think they will increasingly focus on interest-bearing loans; some, like Affirm Holdings Inc., already have. This could bode well for their BaaS bank partners as well.

Cons

Regulatory scrutiny

Blue Ridge Bankshares Inc. and Cross River Bank have made compliance a chief concern in the BaaS realm, in our view, given the Office of the Comptroller of the Currency (OCC) and FDIC scrutiny, respectively, those two companies have received. We think regulators are signaling that products issued by the bank via fintech partnerships are still subject to all banking regulations, despite the fintech not being a bank.

Martinsville, Va.-based Blue Ridge Bank NA must, among other things, enhance oversight of its third-party fintech partnerships, improve its control framework related to anti-money laundering and Bank Secrecy Act compliance as well as adopt, implement and adhere to revised and expanded risk-based policies, procedures and processes, per an August 2022 written agreement with the OCC.

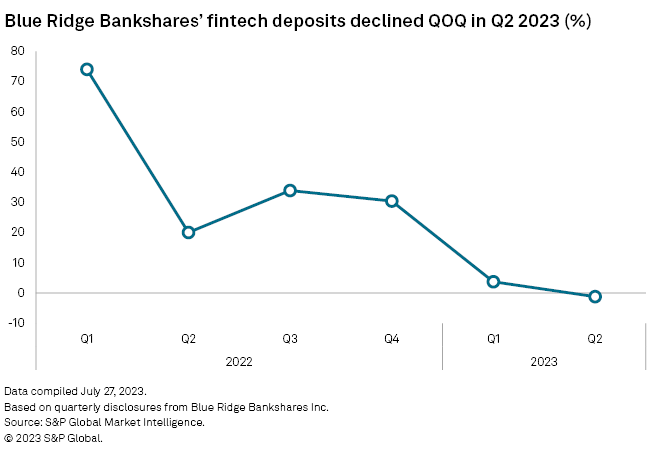

This has created tangible costs for Blue Ridge Bankshares. The company incurred $11 million in regulatory remediation expenses from the third quarter of 2022 to the second quarter of 2023. The company plans to reduce its partnerships but not exit the BaaS space entirely, as Blue Ridge Bankshares' CEO recently told S&P Global Market Intelligence. This might explain why its fintech deposits fell 1.2% sequentially in the second quarter of 2023, whereas they were up 20% in the same quarter of the prior year.

There are many BaaS banks that have successfully avoided regulatory intervention, but it could require additional investments. For instance, Coastal Financial has significantly increased its risk personnel, going from one CCBX Risk employee in the second quarter of 2019 to 32 employees four years later. As of June 30, 31% of its total full-time equivalent employees were risk personnel, according to a presentation, including CCBX risk, risk management, compliance, BSA and internal audit hires.

Initially unprofitable

As Coastal Financial's results show, a new BaaS division will probably not be profitable out of the gate. Coastal Financial said 2019 was the first full year it offered the BaaS service and the segment lost about $560,000 in 2020. Lewis & Clark Bancorp, based in Oregon City, Ore., had a similar experience. It entered its first partnership in 2017 but did not consider it a full-fledged division until 2020 and, financially speaking, its return on investment did not shift into positive territory until the first quarter of 2023, according to remarks from the company.

This is not surprising to us. Depending on the bank, significant investments in technology and other functions (notably, compliance) might be required before launching a BaaS program. Banks might also start with only a few partners in the initial stages, testing the waters before ramping up, limiting the revenue potential of the business in the early going.

But, on the bright side, banks only have to develop the so-called back end in such arrangements, e.g., the architecture for account management and transaction processing. The BaaS partner incurs the costs of developing the front end and acquiring customers. Additionally, a bank's tech investments can pay off internally; for instance, it can create more efficient mechanisms for departments to exchange data.

Concentration risk

As with other business lines, banks have to manage becoming too dependent on any one BaaS relationship. One of Pathward's acknowledged risk factors is that if a significant program manager relationship is terminated, it could materially reduce deposits, assets and income.

For banks that partner with fintech startups, we see a few ongoing challenges in this area. First, the fintech partners might start or buy their own banks. Second, fintech companies, particularly startups, might fail or sell to another institution. Third, the fintech might choose a different partner for a variety of reasons. We have seen examples of all three.

However, BaaS banks have developed strategies to address these challenges. Some potential solutions are to work with several partners at the same time and have contingency plans for winding down a relationship.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.