Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 1 Aug, 2024

By Jean Atelsek

The Big Three cloud hyperscalers — Amazon.com Inc.'s Amazon Web Services Inc., Microsoft Corp.'s Azure and Alphabet Inc.'s Google Cloud — took center stage at this year's FinOps X conference, pledging mutual support for the FinOps Foundation's ambitious FinOps Open Cost & Usage Specification for normalizing billing data from multiple providers. As IT environments grow more diverse and distributed, automation is necessary to tackle resource optimization, and sustainability benefits come along for the ride.

Four large cloud providers — AWS, Azure, Google Cloud and Oracle Corp. (OCI) — have announced support for exporting billing and usage data in FOCUS format, but all are also improving native tools to set apart their reporting, forecasting and querying capabilities. Early adopters of FOCUS say it encourages the cultural change among engineers needed to truly take advantage of the FinOps Framework, which is expanding to encompass spending on SaaS, private cloud and AI. Other themes at the event included sustainability reporting and generative-AI-driven natural language interfaces for querying cost data.

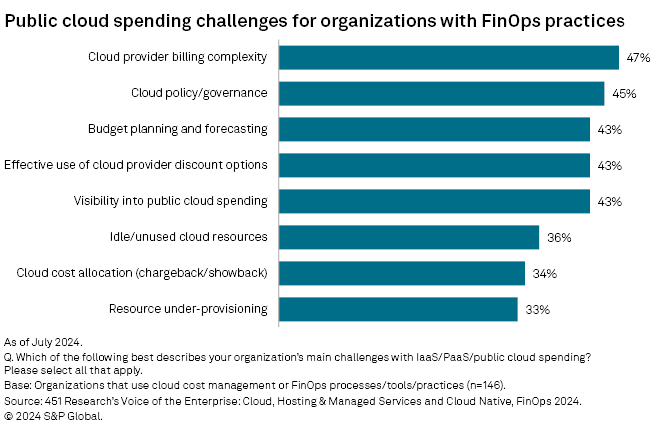

The FinOps Foundation is part of the Linux Foundation, which has a long history of building consensus among technology providers, end users and software vendors to reap the benefits of open-source collaboration while leaving room for commercial value creation. Since 2019, the FinOps Foundation has succeeded in promoting the term "FinOps" for cloud financial operations, establishing a framework and nurturing a community of practitioners in the discipline. Yet among organizations with a FinOps practice in place, cloud provider billing complexity is the top challenge for managing public cloud spending.

First announced in May 2023, FOCUS offers a common schema for multicloud cost and usage data — at FinOps X, the big three hyperscalers announced that they would support delivery of billing data in FOCUS format, with the goal of making it easier to visualize, collect and analyze costs from multiple providers without using multiple interfaces and metrics. Having data classified by deploying a common schema should unlock opportunities for automation and innovation for software providers, global systems integrators and enterprises.

FOCUS does not represent a lowest common denominator among suppliers — the FinOps Foundation and cloud service providers are not letting the perfect be the enemy of the good. Vendors can add schema definitions unique to their product lines, but key to adoption will be to find common ground that unifies categorization for the lion's share of available products and pricing models.

Broad and deep adoption is critical to the success of the FOCUS initiative. The FinOps Foundation has recruited cloud suppliers and done the hard work of standardizing terminology and arriving at an initial list of column headers to make billing data queryable across domains — to continue investing in this effort, providers will need evidence that the specification is landing with enterprises and being integrated into their workflows.

The hyperscalers are hedging their bets, adding features to proprietary tooling while acknowledging the value of supporting a cross-cloud schema. Practitioners need to put pressure on software vendors (especially Snowflake Inc. and Databricks Inc.) to support FOCUS and broaden the ecosystem with the goal of making it a de facto standard.

The roster of contributors includes cloud service suppliers, enterprises (e.g., Capital One Financial Corp., Workday Inc., Walmart Inc., American Express Co. and Uber Technologies Inc.), platform specialists (VMware LLC, Salesforce Inc., Harness, Snow Software, Spot by NetApp Inc.), global SIs (Accenture PLC, Kyndryl, EY) and FinOps independent software vendors (Flexera, Finout, DoIT, CloudKeeper).

For its part, the FinOps Foundation is offering FOCUS training and certification, and is widening the FinOps Framework to incorporate SaaS, licensing, private cloud and artificial intelligence. Enterprise practitioners note that their FinOps teams are being asked to manage more spending in hopes of achieving efficiencies across the IT estate. The ultimate prize is the ability to model IT operating environments to facilitate data-driven (and ideally autonomous) workload placement for optimal cost and performance.

Automation is the endgame — sustainability goes hand in hand

FinOps stakeholders see a separation developing between rate optimizers and technology-led initiatives. Broadly speaking, rate optimization is the practice of taking advantage of cloud provider discounts — such as reserved instances, savings plans and spot instances — to minimize the cost of resources in use. These offers primarily apply to compute and database resources. Usage optimization aims to minimize the amount of resources deployed to achieve a given task, which has a sustainability as well as a cost benefit.

Software vendors have for years been employing algorithms to maximize discount coverage on cloud supplier platforms, especially AWS, which offers the most extensive set of tools for this purpose. What FinOps has done is "shift left" to infuse cost awareness into the provisioning process so that business, development, finance and operations teams can set policies and take action to achieve optimal price performance. Several players are going a step further, using automation and near-real-time price and performance data to continually tune workloads before, during and after deployment.

Onstage during a FinOps X keynote panel, representatives from AWS, Azure and Google Cloud all cited automation and deeper integration of AI and machine learning into FinOps workflows as the future of the practice, citing generative AI as both a tool to enhance the user experience and (especially given the resource intensity of AI applications) a stimulus to find ways to squeeze more value out of their own and customers' cloud environments.

The hyperscalers and the FinOps Foundation also highlighted the growing importance of sustainability as a decision factor — efforts to incorporate carbon consumption as a data type along with cost metrics are underway. The practice of FinOps has strengthened the muscle for balancing constraints and making trade-offs, which is what's needed here.

Natural language interfaces for cost reporting; evolving pricing models

Anyone who has struggled with data visualization tools knows how time-consuming it can be to arrive at just the right view of your data, and FinOps practitioners are no exception. The level and granularity of information being tracked by FinOps teams lends itself to the deployment of generative AI for gleaning insight from that information.

Natural language tools for performing forensic queries on spending data (e.g., "What were my company's top five cloud expenses for the past month?") abounded at FinOps X. Google Cloud announced an "understand my costs" report generator powered by Gemini Cloud Assist, promoting its AI franchise while addressing a chief practitioner pain point. Microsoft noted that it was bringing ChatGPT-driven copilots into the cost management experience, citing the seamless integration of ML and AI into productivity tools as a way to democratize FinOps.

Anodot, DoIT and Tanzu CloudHealth also showcased natural language interfaces for tapping into spending data. Demos of these capabilities ranged from impressive to not quite ready — if GenAI and its associated technologies (i.e., retrieval augmented generation for honing large language model outputs, vector databases to offer context and memory) are going to prove their value in the enterprise, this is an ideal use case.

Another potential area of disruption is in pricing models for FinOps capabilities. Cost optimization platforms such as IBM Apptio's Cloudability and VMware's Tanzu CloudHealth continue to charge based on a percentage of overall cloud spending; rate optimizers such as Spot by NetApp, ProsperOps and Xosphere use a pay-as-you-save model, charging based on the differential between what the customer would have paid if resources were purchased on demand (the most expensive option) and what they pay by using the software. As deployments grow and cloud spending and automation proliferates, look for startups to offer more predictable pricing to reflect the reality that, when automation is running the show, a tenfold boost in spending does not represent a tenfold increase in effort or investment by the optimization vendor.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

451 Research is a technology research group within S&P Global Market Intelligence. For more about the group, please refer to the 451 Research overview and contact page.