Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 7 Mar, 2024

By Jean Atelsek

Cloud provider parent companies Amazon.com Inc., Microsoft Corp. and Alphabet Inc. are stepping up capital investment to power AI offerings at the infrastructure, platform and application levels. For the first time since the dawn of the cloud era, enterprises are reassessing their primary cloud supplier as they seek the best partner to guide them through the coming AI revolution. The challenge now is to avoid churn for future workloads while satisfying existing, substantial customer bases.

The business dictum that, "It's not what you've spent, it's what you're going to spend," is taking on increased urgency as enterprises consider their options for deploying AI to leverage customer and company data. In recent quarters, the parent companies of hyperscale cloud providers AWS, Azure and Google Cloud have touted the growing number of large deals and long-term contracts for their public cloud services. Amid economic uncertainty along with rising interest rates and inflation, enterprises have been leaning in on their primary clouds to make commitments and lock in discounts for the next year, three years, five years or even 10 years. As the disclaimer goes, past performance is not an indicator of future results. The seismic impact of generative AI is stirring the pot, and cloud suppliers are boosting capital investments to reassure customers that they will have what it takes to move beyond the current wave of IT transformation and into the promising and more expansive AI era.

Capex intensifies at hyperscaler parent companies

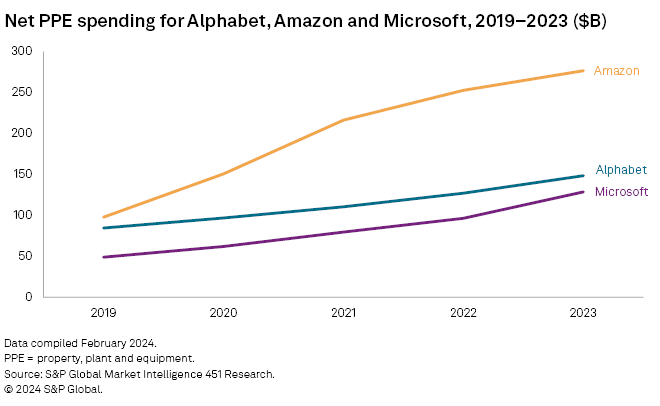

A five-year look at capital expenditure at Alphabet, Amazon and Microsoft shows growing capital intensity despite less-than-favorable macroeconomic conditions. During their recent quarterly earnings calls (covering results through the fourth quarter of 2023), executives at all three companies stressed that capex would continue to increase in coming quarters, with much of it dedicated to the buildout of technical infrastructure in support of AI business. Spending on property, plant and equipment (PPE) net of depreciation has increased 183% for Amazon, 75% for Alphabet and 164% for Microsoft since 2019. Training large language models is a capital-intensive endeavor that requires lots of power, memory and accelerated compute.

Amazon's retail operations are more capital-intensive than the software and services activities of Alphabet and Microsoft, but management made it clear that near-term capex would be concentrated in its AWS business. "As we look forward to 2024, we anticipate capex to increase year over year, primarily driven by increased infrastructure capex to support growth of our AWS business, including additional investments in generative AI and large language models," said CFO Brian Olsavsky.

Alphabet officials have spoken for several quarters about "durably reengineering" the vendor's cost base to support areas of future growth. Part of this includes shedding real estate assets and investing in technical infrastructure. As President, Chief Investment Officer and CFO Ruth Porat put it, "Our reported capex … in the fourth quarter … was driven overwhelmingly by investment in our technical infrastructure with the largest component for servers followed by datacenters. The step-up in capex … reflects our outlook for the extraordinary applications of AI to deliver for users, advertisers, developers, cloud enterprise customers and governments globally the long-term growth opportunities [AI] offers. In 2024, we expect investment in capex will be notably larger than in 2023." In terms of public cloud growth, Google Cloud's regional footprint has caught up with and even exceeded that of cloud market leaders AWS and Azure.

Microsoft, a longtime partner of OpenAI LLC, which launched the generative AI revolution with its release of ChatGPT in November 2022, is not pulling any punches in its determination to remain at the forefront of the shift to AI-enabled services. During its recent earnings call, CFO Amy Hood noted, "We expect capital expenditures to increase materially … driven by investments in our cloud and AI infrastructure." In terms of increasing capacity, she added, "You started to see the acceleration in our capital expense starting almost a year ago [for] servers and also new datacenter footprints to be able to meet … changing demand as we look forward."

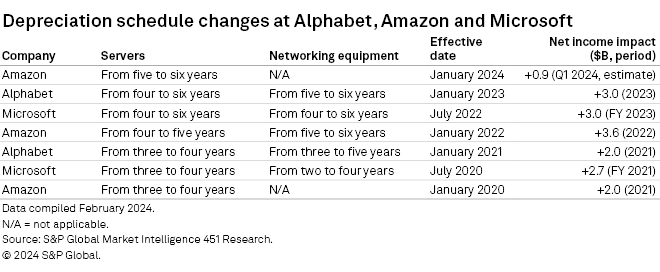

Slower depreciation schedules have contributed to net PPE expansion but only slightly. During the company's fourth-quarter 2023 earnings call, Amazon's Olsavsky confirmed that as of January 2024 the company is extending the useful life of its servers from five to six years. At this point, all three vendors' server and networking equipment is being depreciated on a six-year schedule.

Enterprises are not alone in puzzling through how to cost-effectively train and deploy new AI models to attract their customers. With their vast compute resources, the hyperscale cloud providers have an advantage in terms of capacity, and their most prominent generative AI releases are in keeping with their business expertise. Cases in point:

– Microsoft is getting plenty of leverage from its focus on productivity and developer software. During his initial comments on the company's fourth-quarter 2023 earnings call, CEO Satya Nadella noted a 30% quarterly increase in subscribers to GitHub Copilot, its AI-driven developer tool. Other products cited by Nadella included Copilot for Enterprise, Copilot for Microsoft 365, Copilot for Service, Copilot for Security, Copilot Studio, Copilot Key and Copilot Pro.

– Alphabet is focusing on its ad and search products as targets for generative AI development. In highlighting the year-end release of the vendor's Gemini multimodal (text, images, audio, video and code) AI models, CEO Sundar Pichai said Gemini was already improving responsiveness of the Google Labs' Search Generative Experience and is starting to power new conversational experiences for creating ad campaigns.

– On the morning of its earnings call, Amazon launched Rufus, an AI shopping assistant trained on the company's product and customer data to help customers find and learn about items for sale on Amazon's shopping sites. CEO Andrew Jassy noted that the vendor is building dozens of GenAI applications across its businesses and that generative AI will remain an area of focus and investment.

What largely remains to be seen is how enterprises will apply their unique expertise and customer data to develop and launch their own AI-powered services and features, and which cloud supplier(s) — if any — they will partner with to do so.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

451 Research is a technology research group within S&P Global Market Intelligence. For more about 451 Research, please contact .