Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 8 Feb, 2022

By Sean DeCoff

Australia remains a dominant global producer of mined commodities, and mining remains the largest sector by share of national GDP, with the Australian Bureau of Statistics reporting that the industry was responsible for 10.4% of GDP between 2019 and 2020.

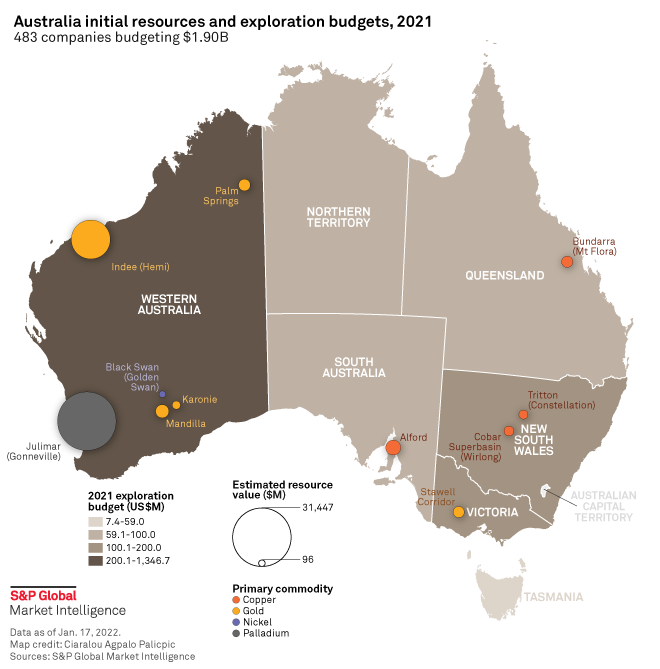

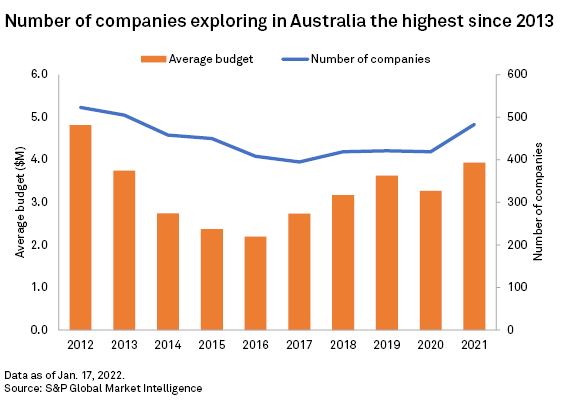

In 2021, Australia's mineral exploration sector remained on solid ground. Major mining companies took advantage of strong price-cost margins while maintaining a risk-averse strategy of enhancing value at already-producing assets. Global exploration budgets targeting Australia increased 38.8% year over year in 2021 to $1.90 billion, exceeding the average global budget growth rate of 35.0%. Western Australia remained the most popular exploration destination, especially for gold and copper. Allocations to the state alone totaled US$1.3 billion in 2021, up 50.1% year over year and increasing the state's share of the country's total budget to 70.8% from 65.5% in 2020.

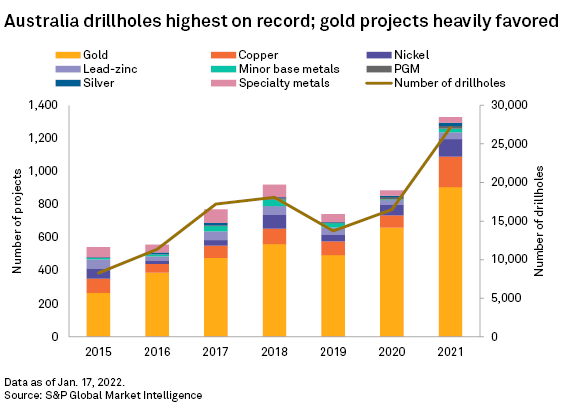

Among the country's active late-stage projects and producing mines, 36% are gold primary, 18% are coal and 10% are iron ore. Unsurprisingly, gold-focused deposits are the source of most announcements of drilling activity and initial resources. Drilling activity in the country for all commodities increased 50% year over year in 2021, suggesting a strong rebound from pandemic restraints.

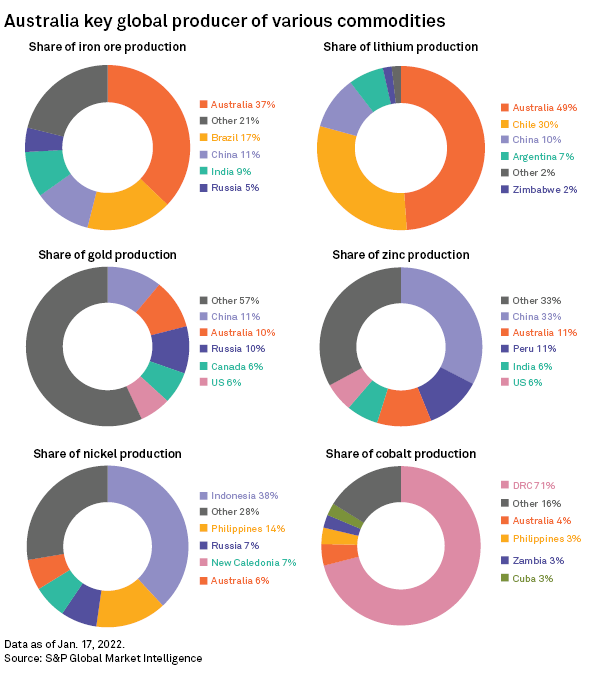

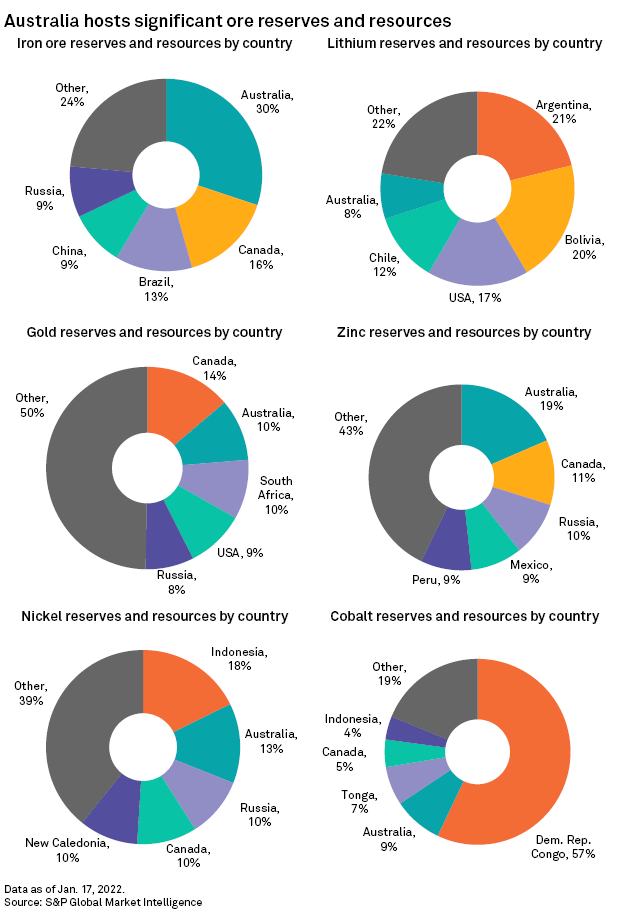

Australia's minerals production remained robust in 2021, with the country leading globally in production of iron ore and lithium, and ranking second in gold and cobalt. Australia's ore reserves and resources rank first for iron ore and zinc, and second for gold, coal, nickel and cobalt.

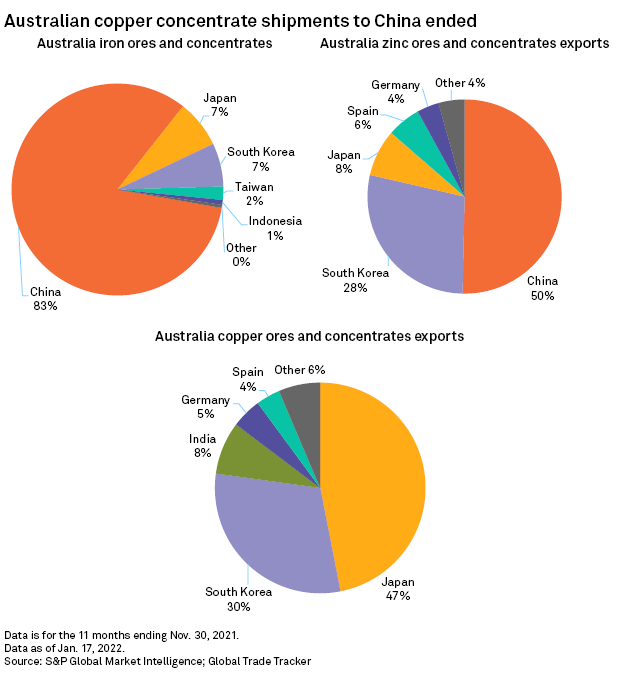

Despite diplomatic strains, Australia continues to sell most of its mining commodities to China, which is the main buyer of Australian iron ore, nickel and zinc; however, in late 2020 China advised copper smelters not to import copper concentrates from Australia.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Segment