S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

Research — 11 Sep, 2023

By Seth Shafer

While the rise of streaming alternatives has played a key role in the wave of cord cutting roiling the traditional multichannel TV industry in the US, pay TV households tend to be heavy users of subscription video-on-demand services as well as free video streaming offerings. As traditional TV network owners Comcast Corp., Walt Disney Co., Paramount Global and Warner Bros. Discovery Inc. shift programming to streaming services such as Peacock, Disney+, ESPN+, Hulu, Max, Peacock, Paramount+, Max and Discovery+, some pay TV households may effectively be "paying twice" for the same programming depending on pay TV package, what streaming services households subscribe to and what programming they typically view.

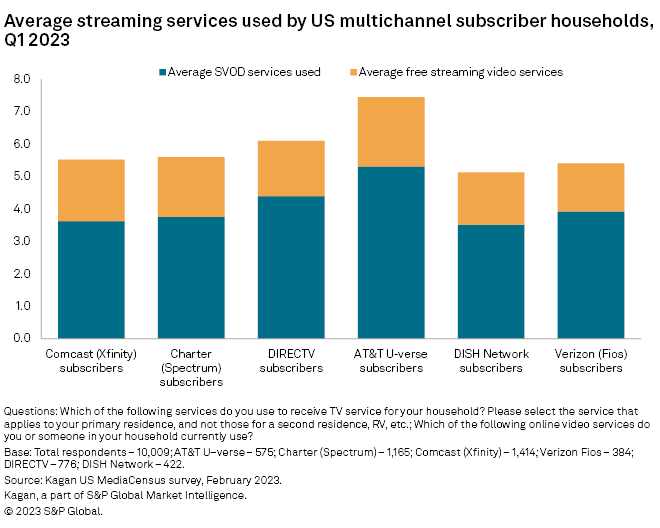

Data from Kagan's 2023 MediaCensus survey of 10,009 US online adults illustrates how commonplace it is for traditional multichannel households in the US to tap into a range of streaming services. Households subscribing to major cable, satellite and telco TV packages on average used about 5.5 to 7.5 streaming services, with SVOD services used ranging from about 3.5 to more than five services per household. Netflix Inc. and Amazon.com Inc. are consistently the top two services used, followed by Hulu, Disney+ and Max.

Charter and Comcast multichannel TV subscriber homes (which together represented about 30 million combined subscribers as of the close of the second quarter) are roughly in the middle of the pack as far as total number of SVOD services used, coming in ahead of DISH Network Corp. but trailing DIRECTV LLC and AT&T Inc. U-verse subscribers in affinity for adding SVOD services alongside their pay TV subscriptions.

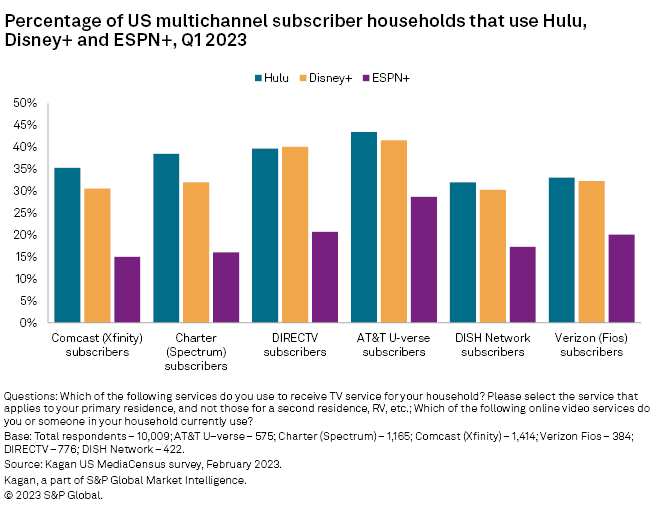

Usage of Disney's trio of streaming services — Disney+, ESPN+ and Hulu — was commonplace across survey respondents in pay TV homes. Thirty-nine percent of Charter Spectrum TV homes used Hulu, 32% accessed Disney+ and 16% reported using ESPN+, results that were generally in line with other traditional multichannel TV households.

While usage of Disney's DTC services is high among pay TV homes, it does not necessarily follow that these homes are paying for and viewing streaming content that is also available through their multichannel TV package. Some may subscribe to Disney's streaming services for original programming the company spends billions on each year that is not typically accessible on the company's linear networks, while others may get access to Disney's DTC services for free as part of their wireless service from Verizon Communications Inc. Twenty-five percent of respondents that reported living in a home with Spectrum Charter TV service said they use Verizon for their wireless services.

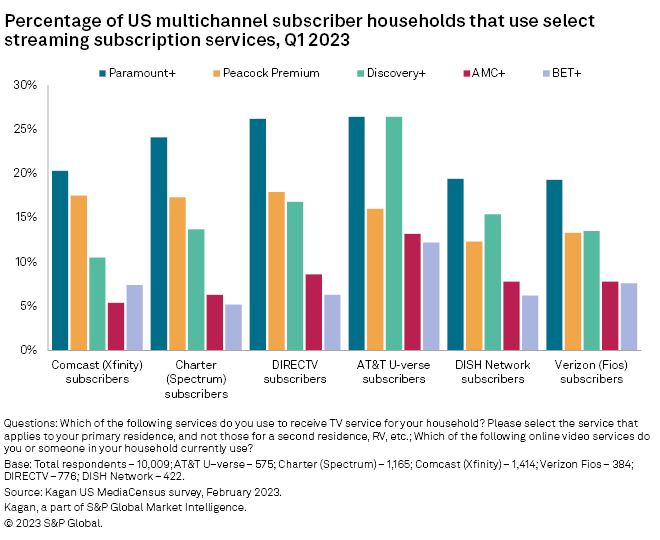

Traditional multichannel subscriber homes also turned to streaming offerings such as Paramount+, BET+, Peacock Premium, Discovery+ and AMC+ that feature various degrees of content also available on broadcast and cable networks owned by parents Paramount, Comcast, Warner Bros. Discovery and AMC Networks Inc. About 20% to 25% of surveyed pay TV homes reported using Paramount+, with slightly lower levels of usage for Peacock Premium, while Discovery+ and AMC+ and BET+ are even more infrequently used. It remains to be seen if Charter will take a similar stance in future carriage negotiations with other network owners outside of Disney but the issue of potentially overlapping subscriptions and content is unlikely to disappear after being broached so publicly in the dispute between Charter and Disney.

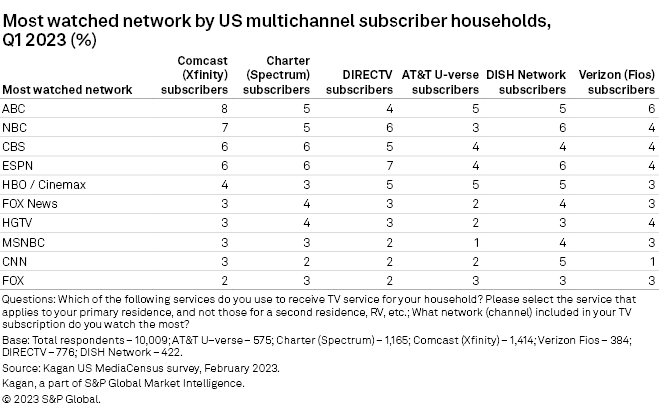

Charter has also maintained that Disney's linear programming is only regularly engaged with by 25% of its video subscribers and that only half of that cohort could be considered highly engaged viewers of Disney fare. MediaCensus survey respondents in pay TV households were asked to select the single network in their TV package that they watched the most, with both ABC and ESPN being top choices across major multichannel TV operators. As part of the dispute, Charter video subscribers lost access to ABC in seven markets where Disney owns and operates local stations: New York City; Los Angeles; Chicago; San Francisco; Houston; Fresno, Calif.; and Raleigh-Durham, NC.

While ESPN and ABC were among the top ten channels selected as most watched among respondents with a pay TV subscription, a very long tail of networks were selected by respondents and no single network was selected by more than 8% of subscribers to any major pay TV service. Respondents were also asked to select just a single most watched network and not to select all the networks they typically watch.

Data presented in this article is from the general population sample of the MediaCensus survey conducted in first quarter of 2023. This sample included 10,009 US internet adults matched by age and gender to the US Census. The survey results have a margin of error of +/-0.98 percentage points at the 95% confidence level. Survey data should only be used to identify general market characteristics and directional trends.

Products & Offerings