Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 16 Dec, 2022

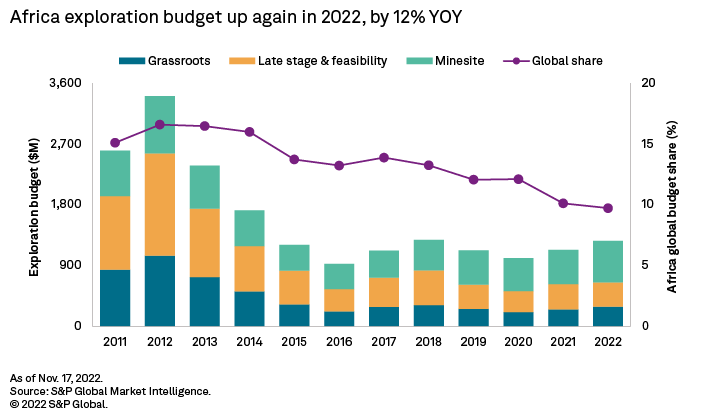

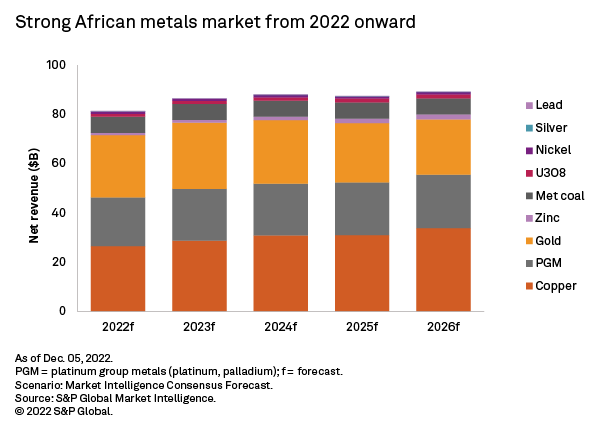

Currency volatility, policy revisions, agreement cancellation and deteriorating infrastructures are some of the risks facing investors in Africa. But investor interest is getting stronger with the green energy transition at full steam and turmoil outside the region due to the Ukraine invasion. Exploration budgets targeting Africa continued to grow year over year in 2022, maintaining their 10% share of the global budget.

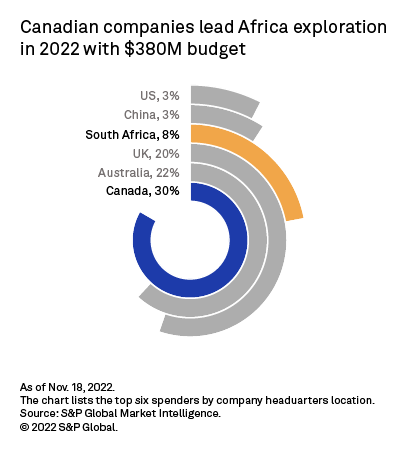

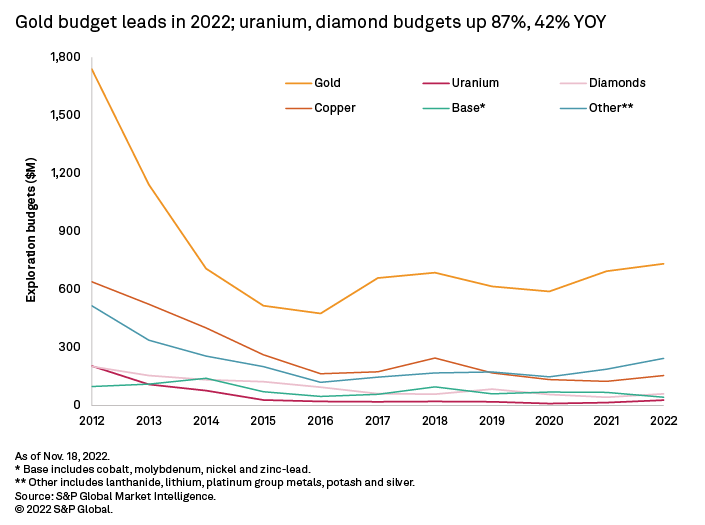

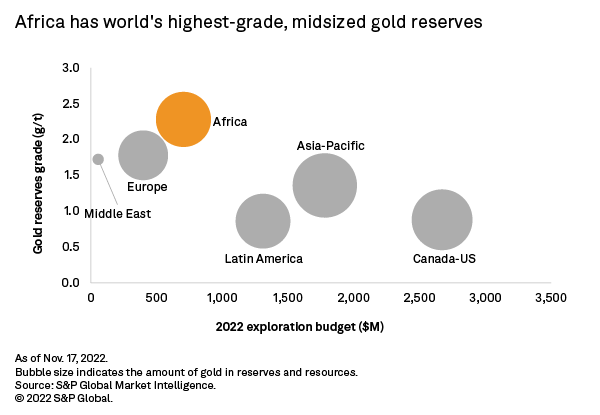

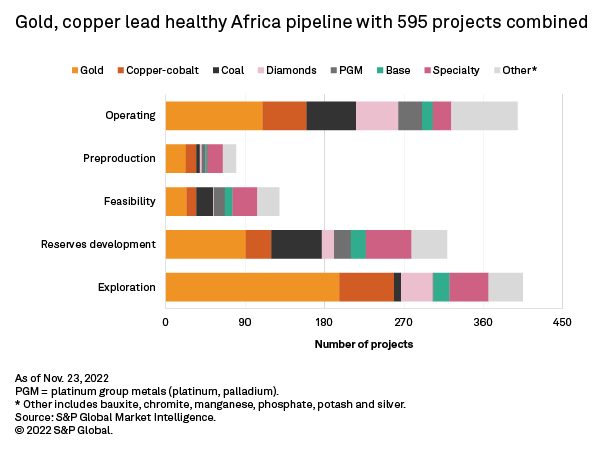

Half of the exploration funds focused on Africa are from Canadian and Australian companies, while South African companies' total budget increased by an estimated $8 million. Gold-focused exploration budgets led with a total of $733 million and are likely to continue leading in 2023, driven by the region's high potential, with 1.3 billion ounces of gold contained in reserves and resources at an average grade of 2.28 grams per tonne of ore.

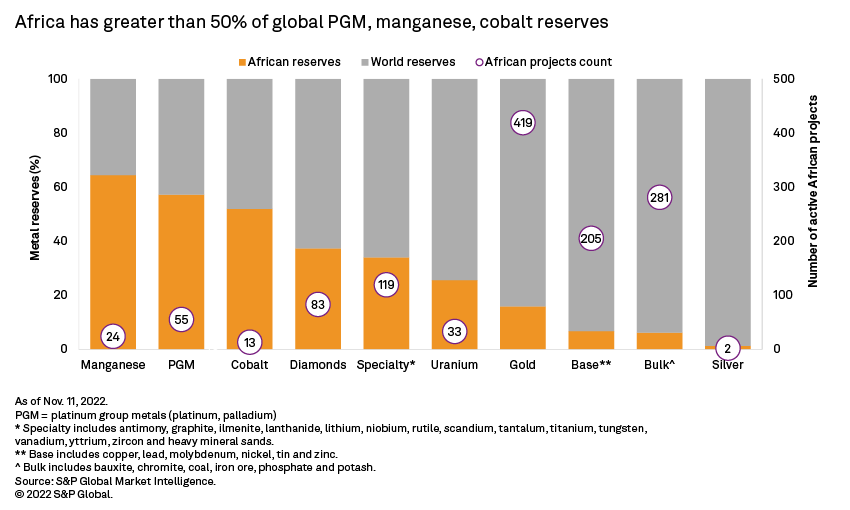

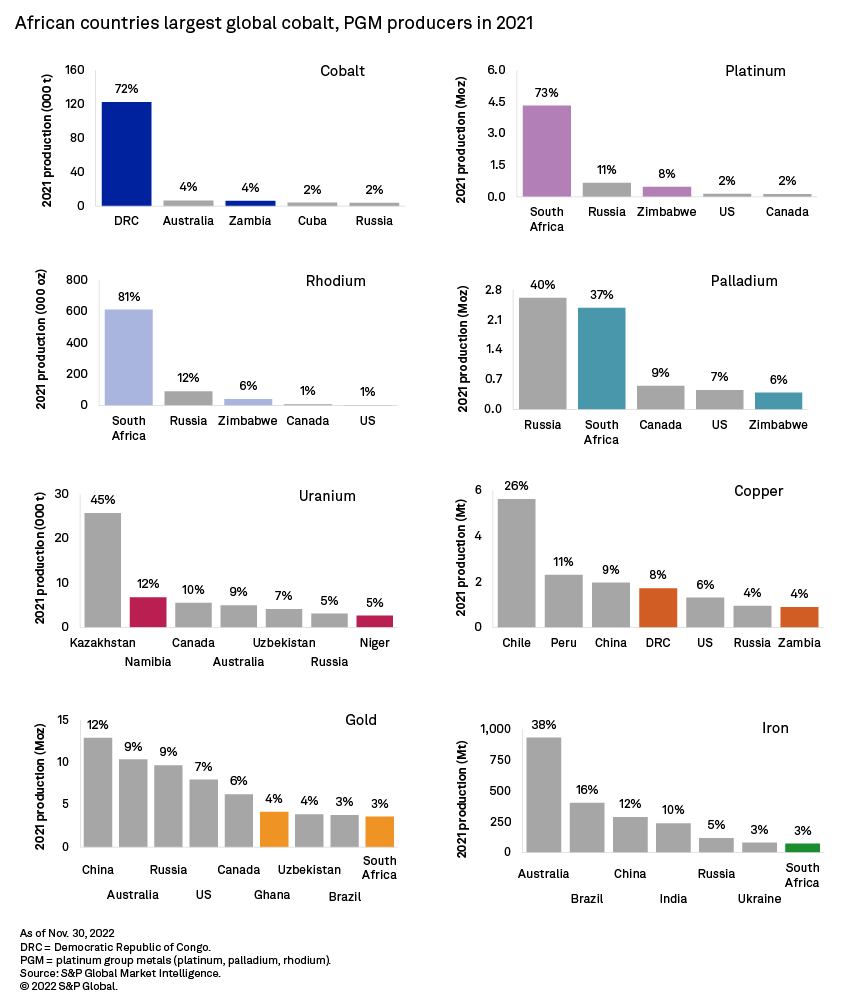

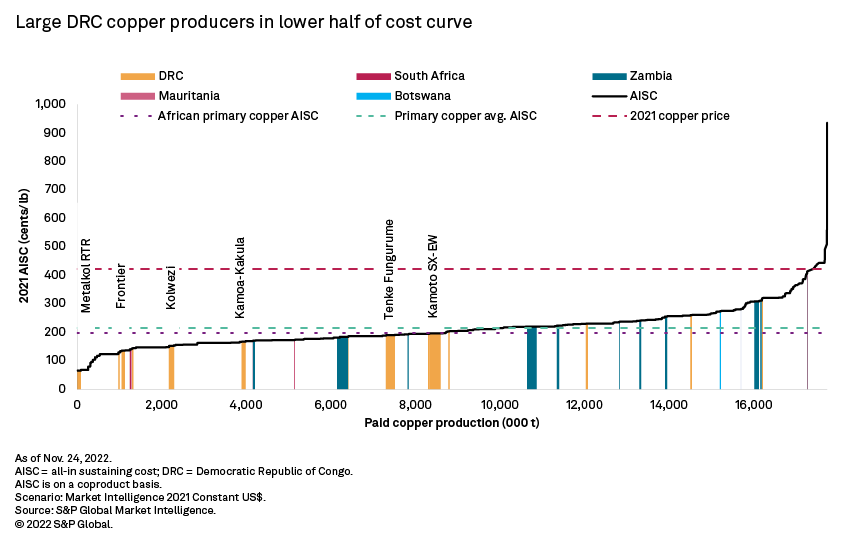

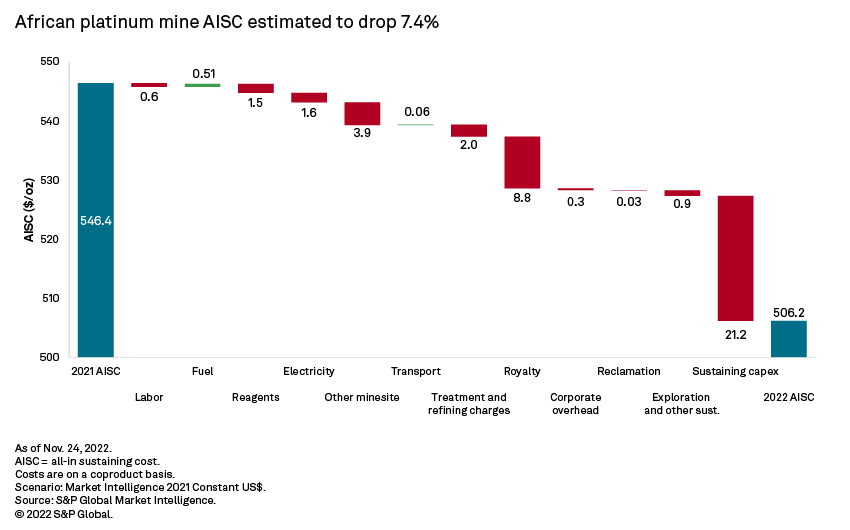

Africa can also boast of being the world's top producer of rhodium, platinum, cobalt and palladium in 2021. The 2022 average all-in sustaining cost to produce one pound of copper in Africa is estimated at 207 U.S. cents, lower than the global average of 231 cents/lb.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.