Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

25 Jan, 2021

This research was written collaboratively by 451 Research analysts including Simon Robinson, Sheryl Kingstone, Christian Renaud, Scott Crawford, Melanie Posey, Liam Eagle, Kelly Morgan, Brenon Daly, William Fellows, Chris Marsh, Owen Rogers, Matt Aslett, Nick Patience, Jordan McKee and Eric Hanselman

To quote the 20th century Danish cartoonist and humorist Storm P., "It is difficult to make predictions, especially about the future." But such things are expected of analysts, even if it is something of a fool's errand. Casting our eye back a year to our 2020 predictions wrap-up report, few of us had any real sense of how fundamentally our lives were about to change, and the even greater role that technology was about to play in it. To a large extent, technology came to our collective rescue; such a rapid shift to mass work-from-home (WFH) policies, supported by goods ordered online and delivered to our homes, and the procurement of digital experiences – from movie streaming to the virtual classroom – was entirely possible due to the advances that the technology industry has delivered across the board over the last several decades. And, with many of us isolated at home (with or without company), often for long periods, tech also sometimes offered the only means by which to stay in touch with our loved ones.

So, with the benefit of all that '2020 hindsight,' what can we expect from 2021, except to expect the unexpected? Here we present an overview of some of the key themes that we expect to drive the industry narrative over the next 12 months and beyond. As with last year, it's not intended to be exhaustive; instead, it offers a flavor of the insight our analyst team presents in the collected Technology & Business Insight 2021 Trends reports, which span all nine of our research channels. With your appetite duly whetted, please dive into those individual reports for a much deeper perspective.

The 451 Take

With all the upheaval, anxiety and, for many, loss that will characterize 2020, the overriding sentiment as we enter the new year is one of hope; in a geopolitical narrative dominated by enmity and division, the en masse arrival of multiple vaccines (developed in record time) promises a glimpse of post-pandemic life in the not-too-distant future – surely a reason to celebrate the wonder of modern science, not to mention the life-affirming abundance of collaboration and collective effort.

So how will the prospect of a post-pandemic world impact our industry, which has itself played no small part in helping the developed world at least get through the last year? First, let's not kid ourselves that COVID-19 provided the spark that lit the touch paper of transformation; technology-driven transformation has been well underway in most organizations for many years. But it undoubtedly accelerated the pace of technology-driven change for many, while giving those firms clinging to the rock of resistance a reason to let go. Moreover, many firms found out that this transformation was not necessarily as difficult, or as risky, as they had presumed; they are also finding out that the benefits may be much more abundant, in terms of customer experience, employee satisfaction and so on. In this sense, 2020 may turn out to be a leveling event, though we recognize that for many firms – and industries – recovery may take years, if at all.

All of this means that we can banish any ideas about getting back to the ‘old normal'; this is good news for our industry, where change is a constant. This change will drive opportunity, which technology entrepreneurs are particularly good at exposing and attacking. There will be losers as well as winners, and the 451 analyst team is looking forward to helping you understand the dynamics that will help drive both.

For many organizations, COVID-19 offers an opportunity to transform to the 'new normal'

With the distribution of vaccines ongoing, 2021 will hopefully see, if not the end of the pandemic, then a means to control it. However, COVID-19 changed the working world for good in 2020, as spending has broadly shifted toward resources that support digital methods of workforce collaboration, sales and customer experience delivery. For many organizations, IT Initiatives that were shelved in 2020 – such as hiring, updates to infrastructure, new product rollouts – will be revived, but with significant changes. Though the pandemic necessitated a short-term priority shift, many firms have discovered – some latterly – that 'digital first' remote engagement has myriad benefits for employees and customers; for many, the genie is out of the bottle, and these shifts won't be reversed anytime soon.

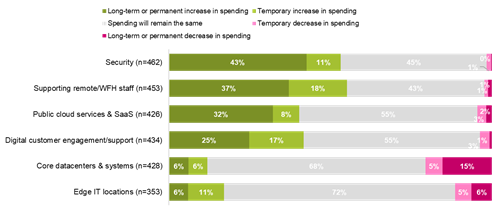

Our survey research supports these shifts. Measures implemented in response to the virus are becoming permanent changes – our Voice of the Enterprise: Digital Pulse October Coronavirus Flash Survey found that 64% of businesses are planning permanent and significant increases in remote working and that 32% expect to reduce the office footprint. Accompanying this is a broader redistribution of IT spending; for many organizations, this means greater spending on IT security, supporting remote/work-from home employees and digital customer engagement, as well as on cloud-based infrastructure, especially for public cloud. For some firms, this will come at the expense of datacenter facilities, core IT infrastructure and even IT staffing.

The good news for the tech industry is that these shifts guarantee that IT is going to be even more critical to an organization's overall success than it was previously. But there will be losers as well as winners as IT organizations transition to a post-pandemic 'new normal.' We are in for a fascinating and potentially defining year of transformation.

Figure 1: Spending Changes Due to COVID-19

Convenience, context and control will define experiences in a post-pandemic world

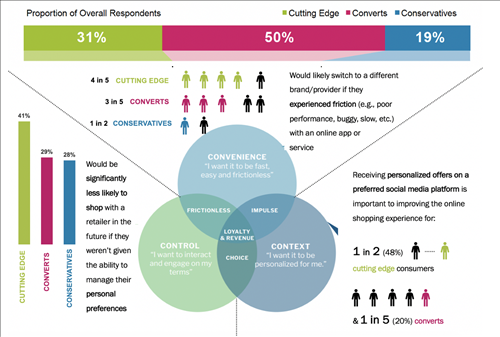

The pandemic is changing the face of customer experiences while igniting dramatic shifts in consumer spending patterns, economic confidence and trust. As we plan for the reimagined future, we expect that over 80% of consumers will embrace long-term behavioral shifts to digital-first engagement. Our research shows that certain segments of consumers will adopt more enduring behavioral shifts, while others will revert to pre-pandemic behaviors.

COVID-19 will further catalyze the already steady migration of consumer spending from offline to online sales channels. 451 Research's Global Unified Commerce Forecast indicates that the impact of the pandemic on consumer shopping behavior helped propel global e-commerce transaction volume over the $4 trillion mark in 2020 and is on pace to exceed $5 trillion globally in 2021. This represents a 22% increase over the year prior. We expect this to further solidify the importance a compelling digital experience in 2021.

Figure 2: 80% of Consumers Will Embrace Long-Term Behavioral Shifts to Digital-First Engagement

For businesses, this has altered strategic priorities and related technology spending trends. The result will be an inflection point for the market that drives a reshuffling of the proverbial deck of priorities. Specifically, the widespread economic and societal impacts have accelerated enterprises' adoption of digital technologies in order to stay relevant in the eyes of their customers. While enterprises may be able to skate by with a generic customer journey in their physical stores, a better experience is just a click or a tap away online. Just one friction point can be enough to send shoppers looking elsewhere.

As businesses work to simultaneously secure loyalty and revenue, technologies that facilitate experiences that drive stickier relationships and competitive differentiation are likely to rise to the top of that deck. We expect innovations in cloud infrastructure, application architecture, and AI and machine learning will serve as catalysts for these digital transformations that deliver new experiences centered on convenience, context and control.

As we shift to a digital-first world in light of COVID-19, data will continue to play an essential role in this endeavor. It will remain at the heart of organizational success given rapid shifts in customer behavior due to the coronavirus, impacting everything from fraud prevention to frictionless experiences. Effectively harnessing data requires modern data management platforms to tap into the voice of the customer to gain real-time context, sentiment and sensitive insight. This allows companies to make data-driven decisions on how best to adapt and retain customers. Businesses need to capture and unify disparate sources of consumer data, and effectively contextualize and operationalize information to push critical insights across channels and stakeholder groups that shape the customer journey.

In 2021, cybersecurity will have to go wide as well as deep

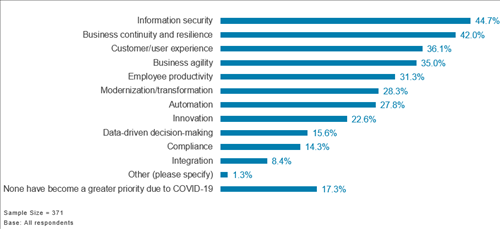

The COVID-19 pandemic turned much attention toward technology as a key enabler for sustaining businesses across the globe. But with substantial investment in enablers such as digital workspaces, virtual conferencing and collaboration, and customer experience for booming online retail, security inevitably rises to the fore as a concern. In fact, in our most recent Coronavirus Flash Survey, information security was the priority respondents cited most often as having become greater due to COVID-19.

Figure 3: Priority Shifts in Technology Objectives Due to COVID-19

This means more, however, than just a greater emphasis on securing 'work from anywhere.' It comes alongside substantial expansion in multiple aspects of IT. At the center, organizations expect to see a variety of deployment models for cloud and datacenter computing that span the gamut of options. At the edge, dramatic growth in OT and IoT are rising alongside millions of new remote user endpoints, helped along by developments such as 5G. For security, this explosion of the attack surface will necessitate 'going wide' to contain exposure, as well as 'going deep' to better understand the adversary's tactics and practices. The need for both was pointedly driven home by a recent wide-scale adversary campaign that compromised the well-adopted IT management systems of SolarWinds to target a host of organizations in both the public and private sectors.

An unprecedented focus on the 'S' of ESG strategies

The pandemic is undoubtedly reshaping the technology landscape, but the other major development of 2020, precipitated by the murder of George Floyd, is ushering in profound changes at a societal level – changes that demand more equality of opportunity for all. As a result, organizational social policies – one of the three legs of a broader 'environmental, social and governance (ESG)' strategy – will receive much attention throughout 2021, and will have a major impact on the technology industry over the coming year and beyond.

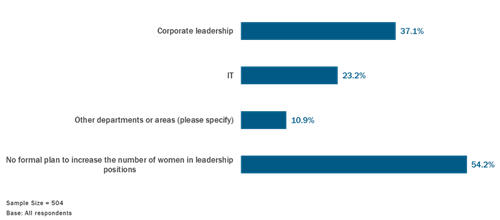

In particular, it's clear that stakeholders – including, increasingly, investors – will want to see that the diversity and inclusion commitments that many organizations made to increase opportunity for all in the immediate aftermath of the global Black Lives Matter demonstrations – regardless of gender, ethnicity or sexual orientation – are real and not merely platitudes. This impacts the technology industry disproportionately because it remains, with few exceptions, an overwhelmingly 'male and pale' environment). Our research suggests that although many organizations have made commitments to effect real and lasting change, delivering this is an altogether more challenging prospect (see Figure 4 below). We'll be placing a much greater focus on understanding diversity and inclusion efforts in tech throughout the coming year.

This is not to say that the other aspects of ESG become any less relevant; quite the contrary, in fact. With a new occupant in the White House, we expect the focus on improving environmental sustainability to intensify over the coming year and beyond, and with power-hungry datacenters a significant contributor of carbon emissions, the IT contribution will not escape closer examination. But it's the social dimension of ESG that will deservedly hog the attention over the coming 12 months.

Figure 4: The Majority of Organizations Have No Formal Plans to Increase the Number of Women in Management

Accelerated AI drives more intelligent data management and analytics

Enterprise investment in AI and automation continues apace, as does cutting-edge research – the emergence of pretrained large language models being a good example of the latter. They have the potential to provide a step change in our ability to interpret and generate language. The greater the number of parameters, the better a language model is at interpreting information in context, even with limited training. In recent years, the number of parameters supported by large language models has jumped from hundreds of millions to hundreds of billions, significantly increasing their potential use cases.

Mainstream adoption is still on the horizon, but in the interim, AI and automation continue to have a significant impact within the data management and analytics sector. In particular, they are driving the increased delivery and adoption of augmented analytics functionality (our survey data points to substantial growth in the adoption of automated business metric/incident detection and alerting tools for senior and departmental/line-of-business decision-makers, for example), as well as automated and enhanced data management functionality, providing the foundation for organizational efforts to establish a pervasive data culture.

The need to improve trust in data and other assets has also been amplified, so we can expect increased focus on products and services that address core aspects of data integrity (provenance, reliability, accessibility and enrichment, for example) – including blockchain and digital ledger technology – as well as help support confidence and trust in AI models and applications.

Automation and agility outcomes will frame every IT investment

In 2021 business leaders will pursue a reconstituted set of IT stack initiatives heavily embossed by the black swan that was 2020. If there was a silver lining to 2020, it was that the pandemic was adept at shining a light on IT strengths and weaknesses equally, providing clarity on necessary course correction. This was particularly true in dealing with a nearly overnight and massive transition to WFH, and digital channels becoming the most critical path of customer experience for all types of businesses. Sudden and disruptive changes such as these heavily favored infrastructure and operations environments that are flexible, automated and adaptable. The ongoing COVID-19 experience dictates that nearly every IT investment spanning infrastructure, software, services and skills in 2021 must bring measurable benefits in overall automation and agility.

Our viewpoint is codified by 451 Research's most recent Coronavirus Flash Survey results. As Figure 3 above shows, 36% of survey respondents indicated that they are putting greater priority on customer/user experience while 35% said they are accelerating initiatives that support greater business agility, and nearly 28% are placing greater emphasis on process automation.

The agility/flexibility narrative will permeate all modern IT stack layers in 2021, which we predict will drive trends across several discrete yet interrelated areas. We predict a busy year in the performance monitoring and observability segment as enterprises demand a simplified yet powerful set of tools to better support digital experiences delivered from any IT venue. We are predicting significant supplier consolidation to better support demand. Infrastructure and operations agility and automation will drive increasing interest in running containers on hyperconverged infrastructure, increased usage of flash storage beyond high-performance workloads, accelerated adoption of enterprise DevOps to enable improved responsiveness, and an extension of the SD-WAN market to cover WFH populations. Emerging technologies like 5G and edge computing will find their footing after taking some delays in 2020, but only for use cases that can clearly articulate positive impact on agility and automation.

IoT technologies to play a key role in return to normal in post-COVID world

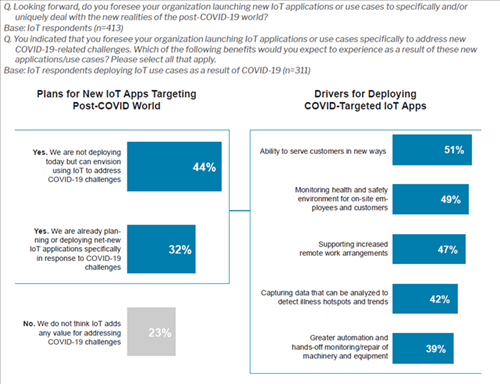

IoT has become an essential component of enterprises' COVID-19 responses. The use of IoT technologies in a post-COVID-19 world will likely include workplace and worker/customer monitoring to ensure safety, supporting the increase in remote working arrangements, and greater automation of monitoring and maintenance of machinery. Interestingly, respondents to a recent Voice of the Enterprise survey indicated that the primary driver for deploying IoT is the ability to serve customers in new ways (see Figure 5 below). The monitoring and remote-control capabilities synonymous with IoT will play a key role in post-pandemic recovery for economic and social distancing. Worker and customer safety, as well as potential liability concerns, will drive the adoption of workplace monitoring technologies.

Customers and employees will seek assurances from businesses before returning, paving the way for environmental and social monitoring 'scorecards' for businesses seeking to reopen with safeguards in place. These needs will drive an increase in spending on IoT sensor technology and on the back-end platform and security infrastructure necessary to enable it. Sixty-three percent of respondents to the survey indicated that they have either made no changes to or accelerated their IoT implementation plans in the face of the pandemic.

Figure 5: IoT Use Cases and Insights Are Critical in Post-COVID World

Cloud efforts will further intensify

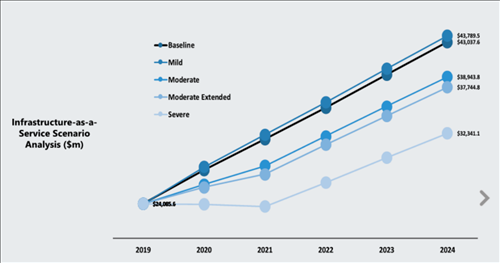

Cloud's value in this crisis results from two key characteristics inherent to the cloud paradigm: the on-demand scalability of resources, and the centralization and outsourcing of labor. The protective measures brought about as a result of COVID-19's spread meant businesses have needed to scale quickly to meet demand and to rebuild their business models for a locked-down world, without having to buy infrastructure, hire employees and put them at risk by sending them into datacenters. It is COVID-19's unpredictability and the cloud's ability to scale without reservation that has made cloud crucial for survival for many enterprises.

Since the pandemic began, enterprises have put time and effort into immediate survival rather than longer-term growth. This means cutting costs by delaying projects focused on strategic growth and spending more on tactical projects likely to result in immediate gains in productivity, revenue or business resiliency. Cloud has enabled enterprises to rapidly change their business and operating models to make the best of a bad situation.

Once the dust has settled, the pandemic's biggest impact on cloud will be that enterprises will take advantage of what worked for them during the crisis and incorporate these measures into their IT operations playbooks. Similarly, organizations will take note of where they were unprepared, increasing adoption of what kept them operating and investing in technologies to address areas in which they struggled. These common threads of capitalizing on the situation and defending against it happening again will ultimately act as a catalyst to cloud adoption. We can expect enterprises to intensify their efforts to manage all their applications across hybrid environments using a single control plane, and to use consumption-based pricing to obtain only the resources they need, when they need them. Adoption of service meshes and other cloud-native frameworks will be accelerated to help applications become more resilient and scalable and to increase developer productivity. Enterprises will look to make savings through optimal use of cloud resources, and cloud providers will increasingly innovate to squeeze their own costs further.

Figure 6: Infrastructure-as-a-Service COVID-19 Scenario Analysis ($m)

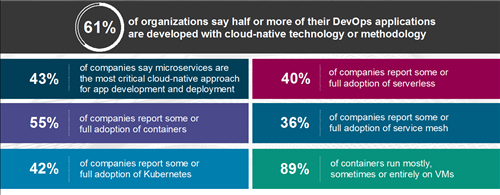

Re-platforming to cloud native will continue

The re-platforming to cloud native is well underway across organizations, driven not only by digital transformation projects, but more generally by the need to do things faster, do them more securely and do them more efficiently, as the data in Figure 7 below shows. COVID-19 has underlined the imperative of being able to react to unpredictable events. Modern application development is already a de facto cloud-native, DevOps undertaking, and developer enablement is now a critical component and driver of enterprise IT strategy.

Cloud native is allowing organizations to operate with cloud independence. The increased level of abstraction provided by cloud-native constructs enables workloads to be executed at any place and at any time, supporting the operation of heterogeneous IT estates (hybrid/multicloud), which will be the dominant IT architecture for years to come.

At a strategic level, the key question for the industry is how best to adapt applications to take advantage of cloud-native constructs, at what speed and over what time period. There's a lot of interest, and it's a big opportunity (5G/edge/IoT is shaping up to be the outstanding market-buildout opportunity here). However, the market is thrashing and crowded – a confusing market for buyers.

Figure 7: Cloud-Native Adoption

Tech M&A outlook – expect more 'transformational' transactions

COVID-19 may have locked down acquirers and locked up the tech M&A market for much of the first half of 2020, but buyers more than made up for lost time in the back half of the year. They went on a record-shattering shopping spree, closing multibillion-dollar deals that would have been unimaginable during the early days of the costliest and deadliest viral outbreak in a century. That late momentum is expected to carry over into 2021 and further boost a market that has already rebounded much higher than most.

In order to transact, acquirers need two things: confidence and cash. Both of those indispensable commodities, much like toilet paper and bleach, were in short supply last spring, when spending on tech M&A dropped to its lowest level in a decade, according to 451 Research's M&A KnowledgeBase. But as confidence quickly returned to the tech market – registered in the ever-rising stock market performance of some of the industry's leading names – acquirers have capitalized on that resurgence to do blockbuster deals at an unprecedented rate. Overall spending on tech acquisitions last year topped $600bn for the first time in our M&A database, which goes back to the dotcom collapse.

The specific strategies that pushed tech M&A to new heights during the pandemic are yet another example of a key change that echoed throughout much of the broader tech industry: COVID-19 accelerated many of the plans that companies had already been considering, pulling forward years of transformation into mere months. It's a trend that will continue to play out, particularly as the economy recovers and life normalizes once again. Increasingly, as more tech companies put together the will and the means to pull off massive M&A bets, the pace and scale of these 'transformational transactions' will pick up as well.

The datacenter industry continues to provide the infrastructure for digital transformation

The COVID-19 pandemic has boosted demand for many cloud and IT services. This has, in turn, led to increased demand for leased datacenter space from cloud and IT service providers, as cloud providers' need for infrastructure has grown faster than expected and faster than they can build datacenters themselves. There has been record demand in markets where cloud providers were already present, such as Northern Virginia, but also in smaller markets that had not seen cloud deployments previously. Cloud and IT service providers may need to work with small local datacenter suppliers they have not worked with before to reach new markets, and the demand will also likely encourage construction of larger-scale, purpose-built space not previously available in smaller markets.

Meanwhile, the COVID-19 pandemic has caused many IT elements to become decentralized as employees have shifted from working in a central office to working from home. This has impacted connectivity and security requirements, boosting demand for datacenters offering connections to networks, service providers and clouds. In addition, content providers such as Netflix that were heavily dependent on interconnection centers in major cities started looking more seriously at edge deployments in smaller cities, partly in response to the growing demand for their services as a result of lockdowns and WFH policies. The pandemic halted the delivery of servers and IT equipment for many of these firms early on, while site restrictions made it difficult for staff to enter datacenters to install gear, so it has been challenging for content providers to deploy at new edge sites. However, we believe many of these smaller datacenter markets will be part of strategic expansions sooner than previously thought.

A new people management stack will emerge for an increasingly distributed workforce

The COVID-19 pandemic has meant that the working world is becoming increasingly dynamic, laser-focused on productivity and results, and (in many cases) almost entirely remote. That dynamism and complete upending of how we perceive work and its execution is affecting tooling and technology investments as well, with the brunt of that impact facing productivity and collaboration tools.

That sets the stage for a turning point in workforce productivity and collaboration software that will begin to materialize more fully in 2021. This will be marked by a new people management stack that will bring transparency to talent management and unite goals and outcomes from the top down. We expect increased investment in tools such as performance management and objectives and key results, and new attention on more pragmatic and focused resource management and skilling strategies.

Additionally, new collaboration and team models will drive demand for, and concurrently be driven by, more immersive work experiences and a mainstream focus on agile methodology. Organizations will pay more heed to remote and frontline workers, with enablement and communication a key priority, while new levels of democratization will proliferate to fill gaps in expertise left by hiring freezes and worker furloughs. And a lot of money will be spent – not just by users – as M&A activity explodes across the categories that exist to drive productivity and collaboration.

Conclusion

With the past year straining the capabilities of IT teams, they'll carry the many lessons learned into the year ahead. As we've pointed out, that will drive a focus on agility and efficiency. While there will be a strong desire to return to that 'old normal' for some, those that do will risk being overrun by those that have integrated and mastered new skills and technologies that can increase their competitive might. Predictions may indeed be hard, but the one thing we know for certain is that more change is in the wind. Keep your eye on the weather vane of our coverage, and we'll work to guide you through these choppy waters.

Download The Reports