S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

Research — 1 Dec, 2022

By Keith Nissen

Whether an online subscription video on demand, or SVOD, service has a large customer base like Netflix and Amazon Prime or a growing volume of viewers, such as Peacock Premium and Paramount+, each SVOD service can count on at least three-quarters of its subscribers being TV sports fans.

* Six in 10 users of major SVOD services watch football on TV and approximately half watch live sports at least once a week (frequent sports viewers), according to Kagan’s third-quarter U.S. Consumer Insights survey.

* Approximately half of U.S. internet adults watch football and over one-third watch baseball and basketball.

* 18% of internet adults are avid sports fans watching football, baseball and basketball, while 17% watch only football.

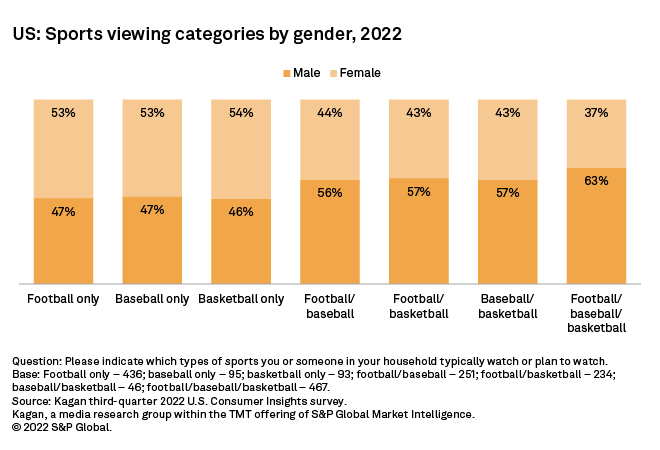

* The majority of those that watch only one sport (e.g. football only) are women. The majority of those watching multiple sports are men.

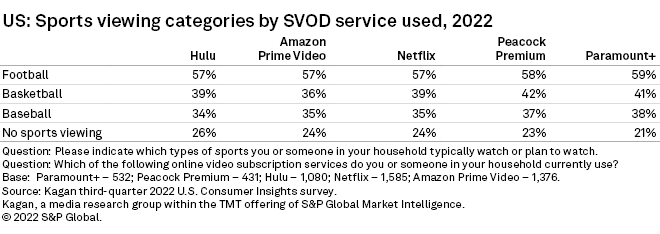

The Kagan third-quarter 2022 U.S. Consumer Insights survey found that three-quarters (74%) of internet adults watch some form of live TV sports. This is generally true for each of the major SVOD services as well, which helps to explain why SVOD services are eager to add live sports to their content offerings. The survey results show that across each of the major SVOD services nearly six out of 10 viewers are football fans, while basketball (about 40%) and baseball (about 35%) have somewhat smaller fan bases. Subscriber base size or whether an SVOD service currently streams live sporting events appears to have little to no effect on these TV sports viewing metrics.

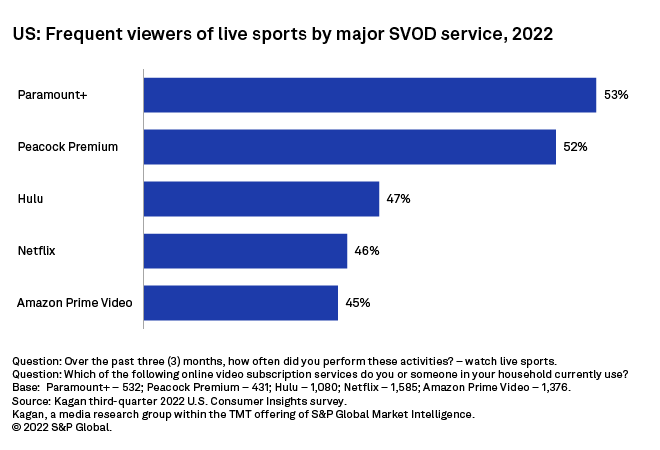

The survey data also reveals that approximately half of the viewers of each major SVOD service are frequent TV sports viewers who watch sports at least once a week. For SVOD services with smaller but growing customer bases, such as Paramount+ and Peacock Premium, carrying live sports may help attract new subscribers, as evidenced by the slightly elevated level of frequent sports viewers among their subscriber bases compared to those of larger services. For SVOD services with a large base of users, the percentage of frequent live sports viewers is generally the same whether live sporting events are available for streaming (e.g. Amazon Prime Video) or not (e.g. Netflix). This suggests that for Amazon Prime Video, live sports may serve to generate increased service usage and possibly reduce subscriber churn.

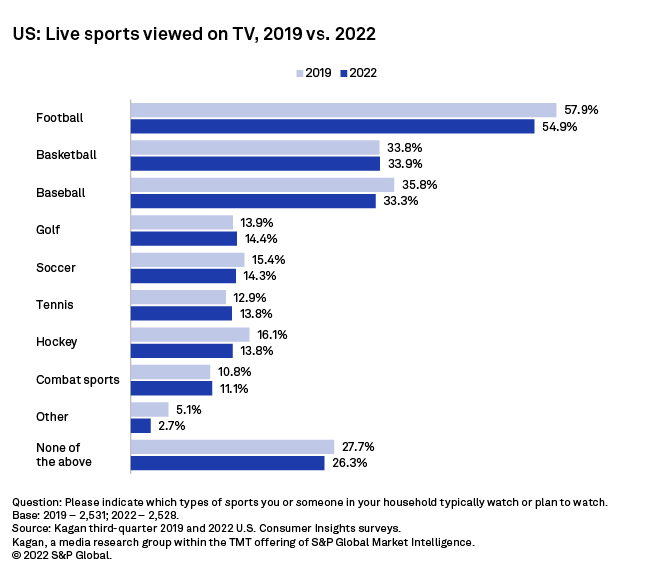

Another appealing aspect of carrying live TV sports is its stability. Historical survey data shows that overall viewing of TV sports has been essentially flat between 2019 (72%) and 2022 (74%). Similarly, viewing of football, basketball and baseball have remained largely unchanged over the past four years. While the fortunes of SVOD services may fluctuate over time depending on the popularity of their original TV programming, the popularity of live sports remains constant.

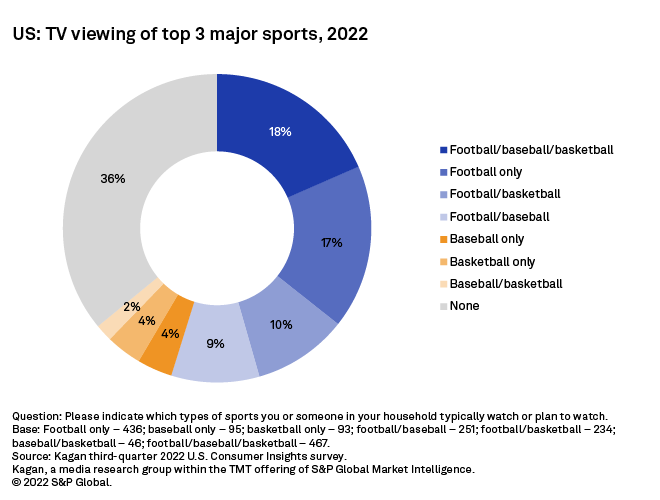

A breakdown of which major sports are being viewed reveals that two-thirds (64%) of internet adults watch football, baseball, basketball or some combination of the three sports on TV. Approximately two in 10 adults (18%) are avid sports fans watching all three major sports and 17% are football-only viewers. Football and basketball viewers account for 10% of internet adults, while 9% watch football and baseball. As a testimony to the popularity of football, only 4% of internet adults report watching only baseball or basketball, and 2% watch both basketball and baseball, but not football.

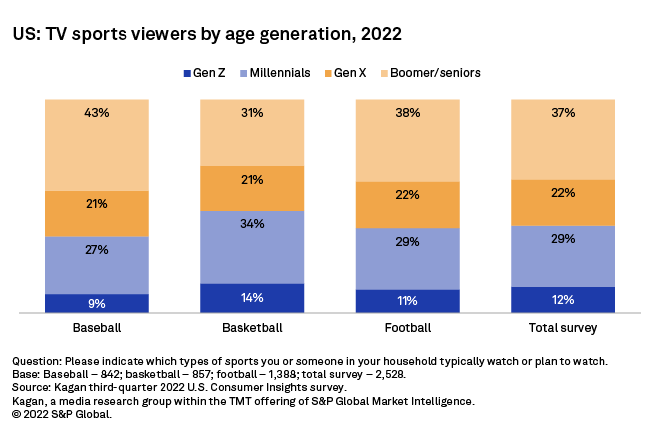

In terms of age distribution, football viewers mirror that of the overall internet adult population with 40% being young adults 41 years of age and under (Gen Z/millennials) and 38% being older adults over 56 years of age (baby boomers/seniors). Basketball viewers tend to skew slightly toward younger adults (48% are GenZ/millennials). In contrast, the largest percentage of baseball viewers are baby boomers/senior adults (43%).

Most avid sports fans watching multiple sports, such as football and baseball are men. The survey found that nearly two-thirds (63%) of those watching football, basketball and baseball were men. Among those watching just a single sport, such as only football, baseball or basketball, the majority are women.

Year-in and year-out, the vast majority of U.S. consumers of all ages and gender watch live TV sports, especially NFL football. Live TV sports can attract and keep loyal subscribers. Live sports can offer online SVOD services the same benefits that multichannel TV services have derived from live broadcast sports over the years. Most importantly, interest in watching live sports and the benefits it provides are strong regardless of SVOD market share.

The Kagan U.S. Consumer Insights surveys were conducted during third-quarter 2019 and 2022, totaling approximately 2,500 internet adults per survey wave. The surveys have a margin of error of +/-1.9 ppts at the 95% confidence level. Percentages are rounded to the nearest whole number. Survey data should only be used to identify general market characteristics and directional trends. For 2022, Gen Z adults are individuals age 18-24, millennials (25-41), Gen X (42-56), baby boomers/seniors (57+).

To submit direct feedback/suggestions on the questions presented here, please use the “feedback” button located above, directly under the title of this article. Note that while all submissions will be reviewed and every attempt will be made to provide pertinent data, Kagan is unable to guarantee inclusion of specific questions in future surveys.

Consumer Insights is a regular feature from Kagan, a group within S&P Global Market Intelligence's TMT offering, providing exclusive research and commentary.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Products & Offerings

Segment