S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

Research — 23 Jan, 2023

The year 2022 will go down as a historically bad one for investment bankers working on M&A and equity offerings, and they will need greater market stability in order for dealmaking to turn around.

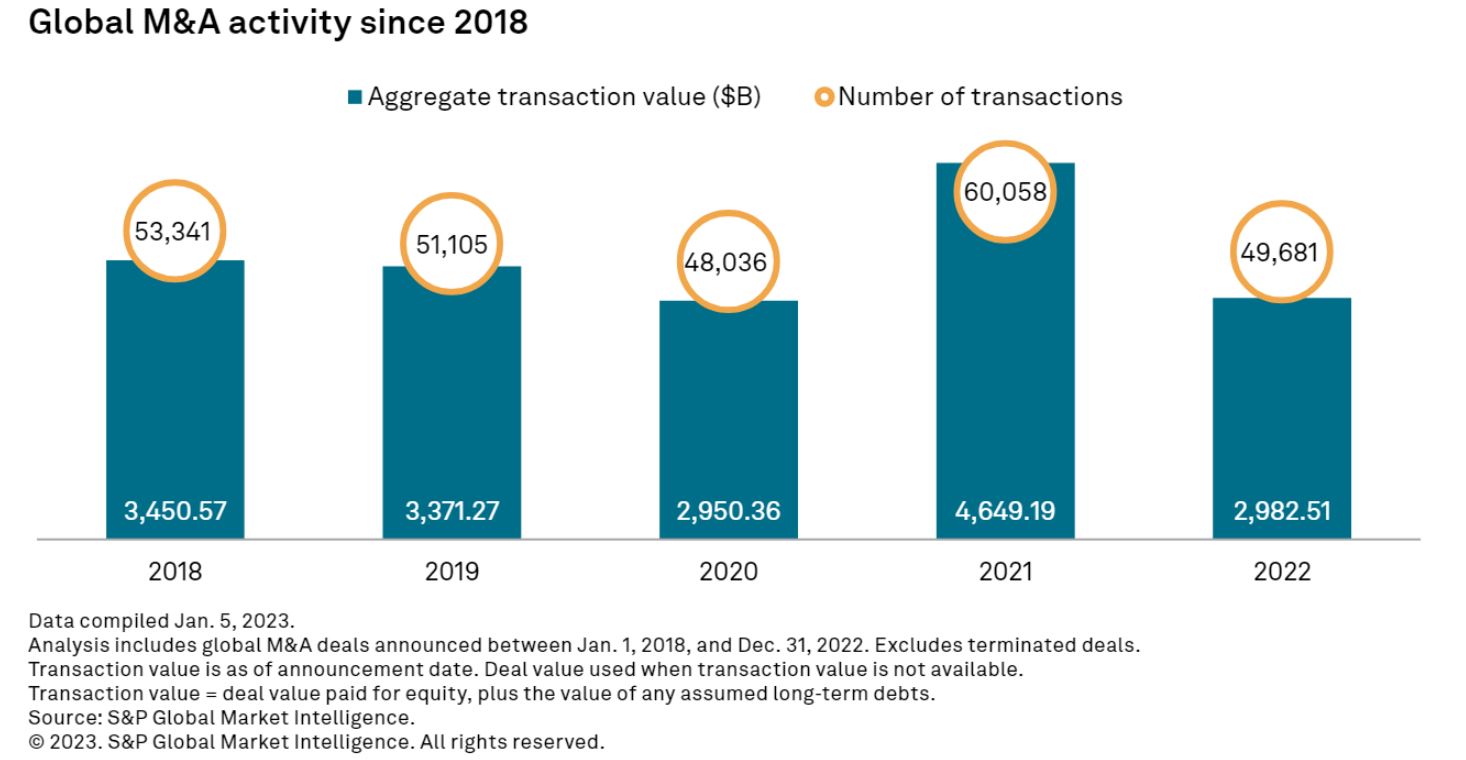

The total value of global announced M&A fell 35.8% year over year to $2.983 trillion, while the total value of global equity issuance plummeted 66.6% to $351.76 billion, according to S&P Global Market Intelligence's latest M&A and equity offerings market report. Deal activity slowed as higher interest rates and geopolitical concerns increased, while valuations and executive confidence in the economic outlook fell.

The fourth quarter offered some hope for a more opportunistic 2023, but 2022 was a dismal year for global equity issuance and M&A announcements. The total value raised in 2022 from equity deals was the lowest since at least 2006, and it was the second-lowest year for M&A announcements since 2013. While the full-year 2022 totals were much lower year over year, the total value of M&A announcements increased quarter over quarter globally and in key markets such as the U.S., developed Europe and Asia-Pacific. Activity in the Asia-Pacific region was especially noteworthy in the fourth quarter, with a 23.6% quarter-over-quarter increase in the total value of M&A announcements.

Equity prices also rebounded somewhat during the fourth quarter and helped pave the way for some issuance activity during the period. IPO activity has remained subdued. The total value of global IPOs fell 71.3% year over year to $179.73 billion in 2022, while the number of global IPOs fell 48.7% to 1,671 during the same period. Economic indicators provide some evidence that inflation is slowing, which should temper rate hikes. A less hawkish monetary policy could boost equity prices, which would bode well for M&A and equity dealmaking.

Some large M&A deals returned to the market in the fourth quarter, with seven of the fourth quarter's eight $10 billion-plus deals being announced in the final two months of 2022. Recent equity market performance in the early part of 2023 has offered some signs of hope. The average close of the VIX — the Chicago Board Options Exchange S&P 500 volatility index — was down to 20.9 through the first half of January from an average close of 25.6 in for the entire year of 2022. The S&P 500 has been moving higher in 2023 after the index finished 2022 with a total return of negative 18.1% — the worst annual performance since 2008 during the global financial crisis.

A better-performing market can lead to a more conducive dealmaking environment. Typically, equity issuance activity bounces back before M&A because acquisition discussions can take time before buyers and sellers agree on pricing. However, reduced volatility should narrow the gap on the bid-and-ask spread between potential buyers and sellers discussing M&A transactions.

In 2022, lower equity prices and greater volatility gave issuers little incentive to sell shares at reduced valuations, nor did they motivate potential sellers to pursue M&A transactions, and they gave buyers less wherewithal to make acquisitions. Buyers also faced escalating financing costs as central bank actions to combat inflation pushed benchmark interest rates higher.

The backdrop was a stark difference from 2021, which set records for M&A and equity issuance activity. Some of the momentum carried over to the early part of 2022 as Microsoft Corp. announced a $68.99 billion acquisition of video game company Activision Blizzard Inc. on Jan. 18. That early-year deal ended up being the largest U.S. M&A transaction in 2022, and it came before a global drought in large M&A transactions that included a three-month period with no $10 billion-plus M&A announcements.

Investment bankers have said throughout the 2022 downturn that deal talks among their clients have remained active, but actions from the Federal Reserve may serve as a better proxy for transactions. Signs that the Fed will loosen its monetary policy stance could send stocks higher. A rebound in the equity markets would help open up the IPO window, while lower rates would create better conditions for the financing markets. However, continued rate hikes or even persistently higher interest rates will pressure asset prices and challenge dealmaking.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.