Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 2 Mar, 2021

GPs share their perspectives for 2021

For the fourth consecutive year, S&P Global Market Intelligence conducted an annual survey among PE and VC professionals globally to gauge industry sentiment for the upcoming months.[1] The study covered GPs’ expectations around deal-making, fundraising and exit activity, investment preferences, threats to growth, and approaches to Environmental, Social and Governance (ESG) factors.

Bullish PE investors set to focus on new opportunities

2020 has been a year like no other and the PE industry has felt the impact. But despite its challenges, the industry has proven resilient and adaptable to the new working environment.

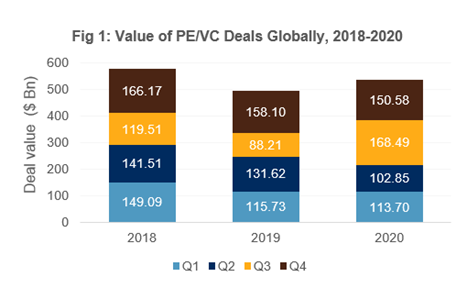

As the pandemic hit the market at the end of Q1 and going into Q2, the PE market saw an abrupt and strong decline in deal-making. Transactions were put on hold while GPs shifted their focus toward stabilizing existing portfolio companies and providing operational support. As the COVID-19 situation normalized over the summer, PE investors turned their attention back to executing deals, leading the industry into a strong rebound in the second half of the year. In fact, Q3 hit a three-year high with total transaction volume reaching $168bn, a 90% increase over the same period the year before (Fig. 1). Although deal count fell slightly in Q4 year-over-year, capital deployed was almost on par over the same period in 2019, bringing the total amount invested in H2 to $320bn. The top performer, Asia-Pacific (APAC), almost doubled the money invested in H2 over the same period in 2019, while North America registered a 30% increase in deal value in the second half year-over-year.[2]

Source: S&P Global Market Intelligence. For illustrative purposes only.

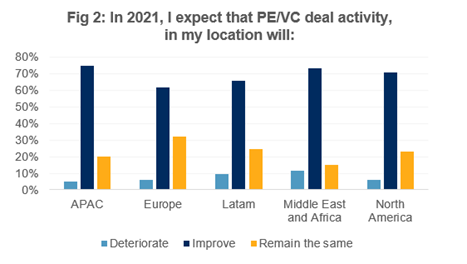

Against the backdrop of the worldwide rollout of vaccination programmes, the new U.S. presidency, and Brexit finally coming to a close, PE investors are demonstrating an overwhelmingly bullish outlook for the industry. Likely, this relatively optimistic dynamic will continue over the next 12 months. Despite ongoing economic uncertainty, on average, 68% of survey respondents believe investment activity will improve (Fig. 2). APAC investors are the most buoyant among all respondents; three quarters of PE professionals from the region anticipate the upward trend of transaction volumes to continue. On aggregate, only 7% of those surveyed believe the investment landscape will deteriorate in the coming months. This is in stark contrast to last year’s survey, where almost 20% of respondents anticipated a worsening investment outlook. While European PE players do see investment opportunities arising in the market, with 62% expecting deal-making conditions to improve, they also form the largest group (32%) that believe that investment activity will remain the same. This is a view, however, that is shared by fewer than a quarter of investors from other regions, underlining the overall sentiment that 2021 will be a year of robust deal-making.

Source: S&P Global Market Intelligence. For illustrative purposes only.

In light of this upbeat market expectation, it is not surprising that 56% of survey respondents (up from 52% in 2020) intend to target new investment opportunities, while 20% plan to focus on managing existing investments as core investment activities. Realization slumped further from investors’ minds, compared to last year, with PE firms largely postponing divestment plans. On aggregate, only 6% of respondents anticipate selling part of their holdings in the coming months.

With an estimated $1.9 tn[3] in dry powder globally, a low interest rate environment, and promising new opportunities arising in the market, it is likely that the hunt for good assets will continue to be very competitive. To better adapt to a prevailing market environment, PE players are increasingly seeking platform acquisition strategies, both to add value to their existing portfolio companies and to deploy capital more efficiently. More than 40% of PE firms surveyed expect to make both buy & built and add-on investments their core investment strategies, with North American and European investors leading the way. In addition, minority investments in established businesses have gained in popularity among PE investors. The number of respondents expecting to implement a growth capital strategy grew from 36% in 2020 to 52% in 2021, as the pandemic exposed a great deal of trapped liquidity, as well as a number of underperforming private businesses seeking capital injections.

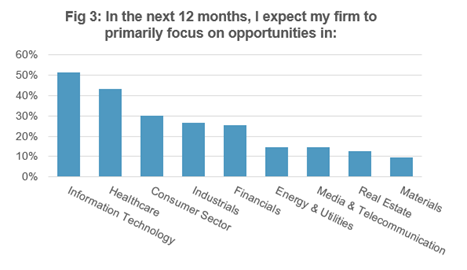

In terms of industry focus, unsurprisingly, the two most attractive sectors are Information Technology (51%) and Healthcare (43%) – two sectors positively impacted by the pandemic (Fig. 3). According to S&P Global Market Intelligence data, PE investment in both industries grew by 18% and 23%, respectively, year-over-year.

The Consumer sector rounds up the top three most favoured industries of interest.[4] However, only 30% of respondents expect to invest in the sector, a drop from the 40% recorded last year – a shift observed across all regions. APAC players appear most attracted to the sector, with nearly half of respondents planning to invest in 2021. In 2020, the total transaction value in the Consumer Discretionary sector, a sub-segment of the broader consumer sector, stood at $55bn, a decline of 23% compared with 2019. Aware of drastic changes in consumer behaviours, some of which are expected to stay, overall, PE/VC firms appear cautious about investing in certain consumer sectors.

Another notable decline in attractiveness was registered by the Industrials sector, with nearly a quarter of respondents planning to invest in the sector in the coming months; however, this is very far from the 41% declaring to do so in the 2020 outlook.

Source: S&P Global Market Intelligence. For illustrative purposes only.

When it comes to geographical focus, the vast majority of PE/VC firms (62%) surveyed are planning to concentrate their investments locally, which is a significant increase from last year’s outlook (51%). In APAC alone, 75% of capital invested by domestic PE/VC firms was deployed locally. Investing locally has always been the preferred and logical approach for investors, but COVID-19 has imposed limitations on face-to-face business interactions at all stages of investments, particularly due to travelling restrictions, that has made it all the more attractive. PE/VC firms investing locally now have a competitive advantage over foreign investors, as they can turn to a more established regional network for deal origination, negotiating and the management of current portfolio companies.

Fundraising suffers drop but remains resilient in the wake of the pandemic while exits stall

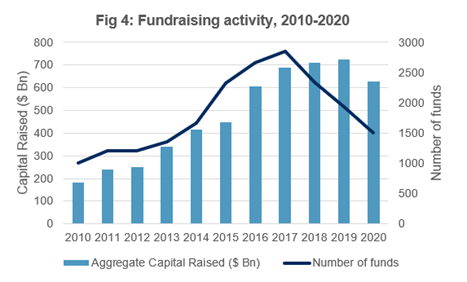

Despite pandemic-induced challenges, such as travel restrictions, lockdowns and widespread economic disruption, fundraising activity has remained relatively resilient. In total, 1,502 PE funds held a final close in 2020. Although this number has dropped for a third consecutive year, on aggregate, $628.26bn was raised, which is just a 13% drop from 2019 (Fig.4).[5] Established firms were able to raise most of the capital, which is perhaps unsurprising given that Limited Partners (LPs) prefer to turn to managers they have built relationships with and to firms they are most familiar with.[6]

Going into 2021, around half of the respondents (53%) expect fundraising conditions to improve, 32% believe it will remain the same, and 15% anticipate fundraising condition to decline, with European and North American investors taking the most cautious view among those who responded.

Source: Preqin. For illustrative purposes only.

Divestment activity has been particularly impacted by the pandemic, dropping by 16% from the previous year to just 2,185 exit transactions, due to pricing uncertainty and market volatility in Q2/Q3. On aggregate, almost one third of survey respondents (32%) are not planning exits in the coming year, the highest tally since we launched the annual survey four years ago. As investors grapple to understand the full impact of COVID-19 on certain sectors, postponing divestments will allow them to take advantage of the expected growth among the most impacted businesses and to carefully assess market conditions for a planned exit process. For investors that do consider exiting investments in the coming year, there is an apparent regional divergence in terms of preferred exit routes. APAC players, particularly Chinese PE firms, expect IPOs to be the main exit strategy (38%), with a likely shift toward domestic stock exchanges – primarily due to rising liquidity and valuation, but also on account of growing regulatory uncertainty abroad.[7] While European investors are most likely to exit via trade sale (33%), their North American peers are opting for secondary sale as the top exit strategy, a trend representing shifting industry dynamics.

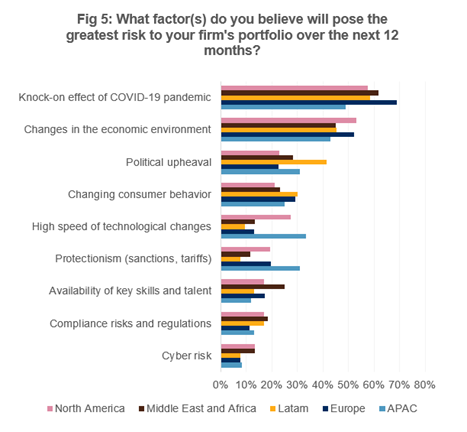

Knock-on effects of pandemic top risk concern

As anticipated, a clear majority of PE/VC firms (61%) identified the “knock-on effects of COVID” as the greatest risk factor to the growth of their portfolio, although APAC investors are marginally less concerned by the effect of COVID-19 compared with their peers from other regions (Fig. 5). Changes to the economic environment were ranked as the second biggest risk factor (49%). The third-highest threat varies regionally and is tied to localized issues; political upheaval is a major concern in Latin America (42%) and Middle East & Africa (28%), while the high speed of technological change is a concern for a third of APAC and North American respondents (27%). For 26% of respondents, shifting consumer preferences are one of the top risks to the stability of portfolio companies, up from the 20% of respondents who marked this as a top risk in 2020.

Going into 2021, North American and Latin American respondents appear to be less concerned about protectionism, with results steeply decreasing from 32% and 33%, respectively, to 19% and 8% over the last year. This could be the result of the revised North American agreement last summer, as well as the new US presidency, both of which are opening up the country again to global organizations. On the contrary, for APAC investors, protectionism still remains one of the top risks to their assets.

Concern over cyber risk has increased this year to 10%, from just 7% the year prior, as more and more industries are going digital, and workplaces, virtual.

Source: S&P Global Market Intelligence. For illustrative purposes only.

Staying for good

ESG factors continue to grab PE/VC firms’ attention, with 40% of firms reporting that they are planning to work on improving ESG standards within their current portfolio companies. The number of firms not considering ESG in the decision-making and post-investment process decreased from 25% last year to 19% this year, whereas the number of firms just starting to introduce ESG in their strategy increased from 18% to 24%. This trend is particularly evident in North America, which has lagged behind on the ESG front but appears to have caught up. The results show a clear shift indicating that many firms that had not tackled ESG last year will be working on it this year. ESG was already gaining in momentum but the pandemic amplified and accelerated the need for improved social welfare and governance.[8] Added to this, regulations are steadily increasing pressure for firms to get on board. As of March 2021, when the Sustainable Finance Disclosure Regulation comes into effect in Europe, PE/VC firms will be required to report on their sustainability strategy. Other respondents will either be prioritizing investments with good ESG track records (29%) or re-evaluating existing ESG diligence (24%). It is clear that increasing pressure from investors on reporting and action is pushing PE/VC firms to adapt their ESG strategy,[9] even if there is still much to be done on this front.[10]

Conclusion

As the survey results show, PE/VC investors are optimistic about deal activity and are gearing up to deploy a vast amount of capital that could not be put to work last year. The pandemic has opened an array of opportunities in sectors that have been positively impacted by COVID-19, such as Healthcare Technology, Life Sciences, and Information Technology. On top of inorganic growth strategies to enhance the value of their existing portfolio, PE players are increasingly turning their attention to minority investments in response to rising numbers of cash-strapped companies in need of liquidity injections. Exits, on the other hand, will be temporarily put on hold, as deal makers try to assess the long- term impact of COVID-19 on certain industries and set affected businesses on a recovery path.

While in the last 12 months ESG has slightly shifted focus from environment to social and governance factors, PE/VC firms have on the whole accelerated the adoption of ESG methodology into their investment workstreams, no longer seeing it as a trend, but as an enduring reality.

Although this welcomed positive outlook on the industry mainly reflects the vaccine-fuelled economic recovery expected in 2021, it also shows how confident PE/VC investors have become in navigating the unprecedented challenges of the previous year and adapting to “the new normal,” boding well for any future storms which may arise.

[1] The survey was conducted over the period of 12 weeks between October 26, 2020 and January 15, 2021. In total we received 477 responses from PE and VC investors globally. 46% of respondents were senior level professionals. Geographically, 35% of respondents were from Europe, 24% were from North America, 18% were from APAC, 13% were from the Middle East & Africa and 11% were from Latin America.

[2] S&P Capital IQ Platform (As of 29/01/2021)

[3] Preqin (As of 5/2/2021). Retrieved from https://pro.preqin.com/

[4] The Consumer sector comprises Consumer Retail and Consumer Producers segments as per the S&P Global Market Intelligence platform’s industry tree.

[5] Preqin (As of 27/1/2021). Retrieved from https://pro.preqin.com/

[6] US PE deal making dips to 5-year low in 2020 amid COVID-19 pandemic. (As of 4/2/2021). S&P Global Market Intelligence. Retrieved from https://platform.marketintelligence.spglobal.com/web/client?auth=inherit&ignoreIDMContext=1#news/article?id=62144282&KeyProductLinkType=23

[7] Hong Kong TMT IPOs end 2020 with a whimper as regulation bites. (As of 4/2/2021). S&P Global Market Intelligence. Retrieved from:

[8] The ESG Lens on COVID-19, Part 1. (As of 4/2/2021). S&P Global Ratings. Retrieved from https://www.spglobal.com/ratings/en/research/articles/200420-the-esg-lens-on-covid-19-part-1-11444298

[9] Private Equity Trend Report 2020. (As of 4/2/2021). PwC. Retrieved from https://www.pwc.de/de/kapitalmarktorientierte-unternehmen/private-equity-trend-report-2020.pdf

[10] Private Equity makes ESG Promises. But their Impact is often Superficial. (As of 4/2/2021). Institutional Investor. Retrieved from https://www.institutionalinvestor.com/article/b1m8spzx5bp6g7/Private-Equity-Makes-ESG-Promises-But-Their-Impact-Is-Often-Superficial