Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

24 Nov, 2021

By Anser Haider

Zoom Video Communications Inc. continued its streak of delivering better-than-expected earnings, but the company's stock plunged amid concerns around diminishing revenue growth.

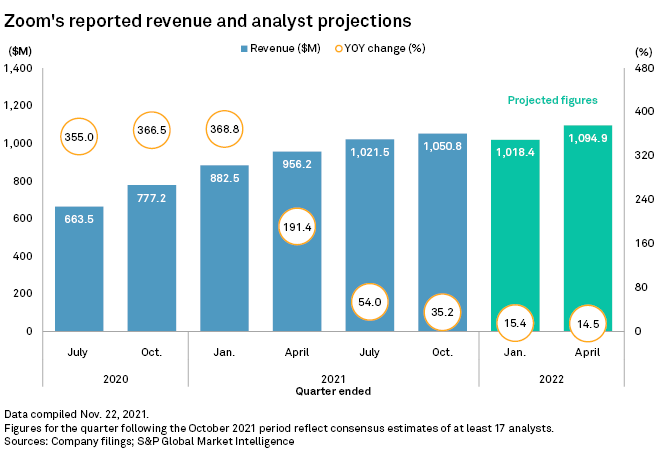

The COVID-19 pandemic turbocharged the demand for videoconferencing tools and collaboration applications in 2020, allowing Zoom to swoop in and transform itself from a relatively niche provider of business software to a household name. At the peak of its meteoric rise, Zoom posted three consecutive quarters with revenue growth that topped 350% year over year.

Those growth rates eventually slid as the company faced tougher year-ago comparisons, dropping into the double digits in the July quarter. For the period ended Oct. 31, revenue growth slowed further to 35.2%, compared to 366.5% in the prior-year period.

Analysts said this trend is likely to continue, putting pressure on Zoom to find new revenue streams and growth opportunities.

Post-pandemic slump

The company "zoomed to scale last year, but post-pandemic growth is a different story," Deutsche Bank's Matthew Niknam said in a research note, maintaining a "hold" rating on the company.

"While we're positive on Zoom's strategic initiatives and investments in key growth areas, we find it tougher to like a stock with more sharply decelerating growth and incremental pressure on profitability," Niknam said.

Looking across estimates, analysts expect Zoom's year-over-year revenue growth rates to decelerate to 15.4% and 14.5% for the quarters ending January 2022 and April 2022, respectively.

"For now, investors will need some patience as we do not see any upcoming catalysts that would change the sentiment on the stock," Evercore ISI analyst Peter Levine wrote in a note, maintaining an "in line" rating on the stock.

Beyond the hype

Other analysts note, however, that while not matching its meteoric rise during the pandemic, Zoom is not losing any ground and, in fact, continues to grow.

Zoom has been both a beneficiary and a victim of hype ever since it first exploded onto the scene at the dawn of the pandemic in 2020, said Raul Castanon, a senior research analyst covering workforce collaboration and communication platforms at 451 Research.

"Zoom's growth early last year was overhyped, and now, all the talk about its growth slowing is also overhyped," Castanon said. "I still have a lot of confidence in the company's future and think it will continue to grow and expand steadily, even if it is not as significantly as it was in the early days of the pandemic."

Zoom's shares were down more than 28% year-to-date through Nov. 22, while the NASDAQ was up 23%. After Zoom reported earnings after market close Nov. 22, Zoom's stock plunged another 15% on Nov. 23, closing at $206.64.

Competition for users

Castanon thinks that the momentum Zoom experienced during the pandemic lit a fire under its larger, deeper-pocketed competitors — including Microsoft Corp., Cisco Systems Inc. and Alphabet Inc. — who accelerated the expansion of their own conferencing platforms, like Microsoft Teams and Cisco Webex.

The market is now crowded with very well-established alternatives, and Zoom is feeling the impact.

Zoom reported about 512,000 customers with more than 10 employees at the end of the quarter ended Oct. 31, up 1.4% quarter over quarter. By comparison, the October 2020 quarter saw 17.2% sequential growth.

Similarly, customers contributing more than $100,000 of trailing 12 months revenue are growing at an increasingly slower rate, up 10.1% sequentially in the October period.

Moving beyond videoconferencing

Although Zoom's claim to fame was its videoconferencing platform, the company is looking to expand its presence into other businesses as it seeks to reaccelerate growth.

One increasingly lucrative business segment that Zoom is eyeing is contact center software, which uses artificial intelligence to help companies interact with customers. The company struck a $14.7 billion all-stock deal to acquire cloud contact center company Five9 Inc. earlier in 2021, but the deal fell through in September.

Zoom now plans to launch its own solution in the space — Zoom Video Engagement Center — in early 2022. A spokesperson for the company declined to comment on the new service.

Keith Snyder, an analyst at independent investment research firm CFRA, said this is an extremely attractive market for Zoom, as it synergizes well with the company's existing range of products, but entry may not be a cakewalk.

"I think they're very excited about their new call center solution that they're developing, but it's one thing to develop a product, and it's another thing to break into a market like the call center market with absolutely no start and no beachhead," Snyder said.

Born free

Another area that Zoom is now exploring is advertising. Earlier in November, the company announced that it would roll out a pilot program to show ads to users on its free tier of service.

Snyder noted that the free service made Zoom the poster child of the pandemic but "absolutely crushed" the company's margins, as it had to invest very heavily in third-party infrastructure to host the service.

"Ads could certainly help soften the blow of the userbase that still remains on the free service, but I think this is more of a stop-gap measure than a sustainable business strategy," Snyder said. "Some users may opt to leave the service to avoid the ads, but that wouldn't be the end of the world, as they're non-paying customers."

Joe McCormack, an analyst at research firm Third Bridge, said the free-to-use tier is predominantly used by consumers and small businesses who cannot afford the product's monthly premium fee.

"While it could be expected these users' engagement levels fade as the socially distant aspects of COVID-19 continue to subside, they still represent one-third of Zoom's overall users, and as such, advertising is an easy passive way to continue to monetize them while they remain on the platform, regardless of whether they pay a subscription or not," McCormack said.

451 Research is part of S&P Global Market Intelligence.