S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

13 Sep, 2021

By Sean Sullivan and Susan Dlin

This story about pipeline and storage asset trends in 2020 is the firsts of a two-part outlook on U.S. natural gas pipelines. The second part, which covers project development over the next five years, can be found here.

The total value of U.S. interstate natural gas transportation and storage assets reported to the Federal Energy Regulatory Commission crept up in 2020, but year-over-year growth lost momentum, continuing a trend that showed up in 2019 after an active year in 2018.

Slowing growth could partly reflect the growing opposition to new natural gas infrastructure among environmental advocates and some regulators and policymakers.

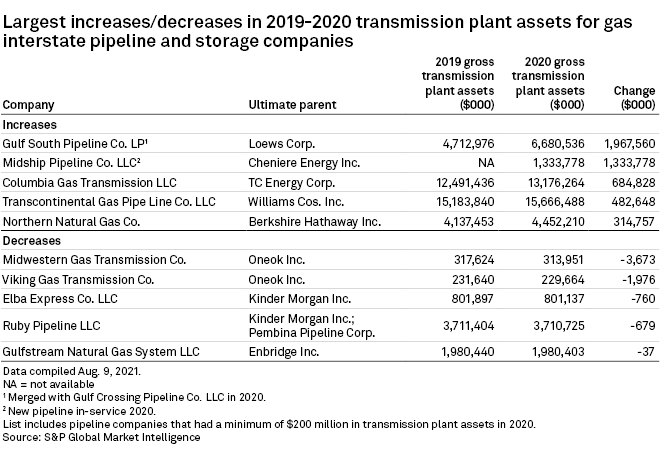

The total value of gross gas transmission plant assets — a term that covers pipelines and supporting infrastructure — hit almost $187.9 billion in 2020, according to an analysis of FERC Form 2 data by S&P Global Market Intelligence. This was an increase from almost $180.0 billion in 2019 and about $170.4 billion in 2018. Growth in total asset value from the preceding year was 4.4% in 2020, compared to 5.6% in 2019 and 12.2% in 2018. Form 2 collects financial and operational information for a calendar year from interstate gas pipelines under FERC jurisdiction.

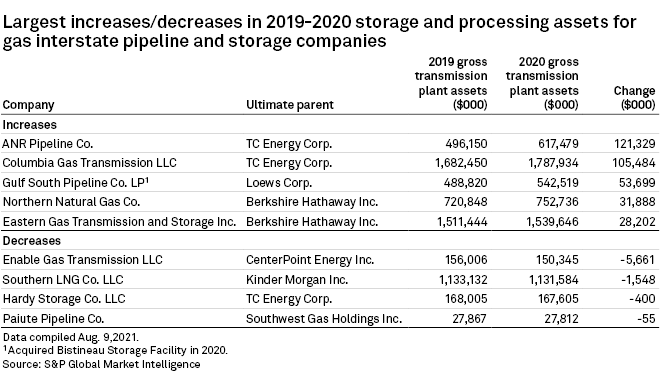

The total value of storage plant assets inched up to almost $18.8 billion in 2020, increasing from $18.2 billion in 2019 and $17.1 billion in 2018.

Pipelines push forward in tough market

As the world fell under the grip of the COVID-19 pandemic in 2020, some pipeline projects were affected by the crisis. But more were affected by legal challenges from environmental groups, landowners and other opponents of fossil fuel use and industrial development.

Still, acquisitions and new projects continued to add to the number of reported assets. North American pipeline companies expect to add nearly 33 Bcf/d of gas transportation capacity from 2020 through 2025, according to a January report from the INGAA Foundation, the research arm of pipeline trade group Interstate Natural Gas Association of America.

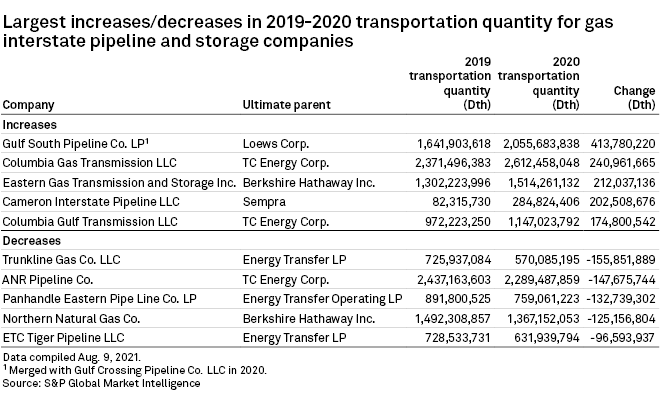

Gulf South Pipeline Co. LP saw the largest gain in gross transmission plant assets, rising to $6.7 billion in 2020 from $4.7 billion in 2019. The biggest part of the increase for Gulf South, a subsidiary of Loews Corp.'s Boardwalk Pipeline Partners LP, was the result of its acquisition of Gulf Crossing Pipeline Co., another wholly owned subsidiary of Boardwalk Pipeline Partners. With the increase in assets, Gulf South reported that it transported about 2,055 Bcf of gas in 2020, up 25% from 2019.

Boardwalk spokesperson Jillian Kirkconnell said in an Aug. 31 email that the company is bullish on its pipeline assets even as the world begins to look at lower-carbon fuels to help mitigate climate change.

"To date, we have not seen a reduction in our deliveries to electric generation plants," Kirkconnell said. "Instead, we have seen an increase in load in 2020 compared to 2019. Natural gas can complement the move to other forms of renewables like wind and solar by helping with intermittency issues."

Cheniere Energy Inc.'s Midship Pipeline Co. LLC became an interstate gas pipeline operator in 2020. It received federal authorization in April 2020 to put in service most of the 199-mile, 1.4-Bcf/d Midship pipeline, which the company reported as a gross value of about $1.3 billion. Midship did not report pipeline assets in 2019.

Reductions in asset value are minor

Oneok Inc. pipeline companies saw the biggest decreases in gross transmission assets among the surveyed pipelines from 2019 to 2020, but even these changes were not material. Midwestern Gas Transmission Co. assets dipped by almost $3.7 million to land at a total of about $314.0 million. Viking Gas Transmission Co. assets slipped by almost $2.0 million to about $229.7 million. A Oneok spokesperson said the changes will not affect rates or revenues for Midwestern and Viking, and Midwestern will see a gross plant increase in 2021.

Oneok said its pipeline assets and market positions would give it the ability to launch alternative energy projects. "We have a business group actively evaluating opportunities such as the further electrification of compression assets; potential carbon capture, use and storage (CCUS) opportunities; sourcing renewable energy for operations; and other longer-term opportunities such as hydrogen blending, transportation and storage," the Oneok spokesperson wrote in an email, adding that the company will continue to focus on its midstream business.

For gas storage and processing assets, TC Energy Corp.'s ANR Pipeline Co. and Columbia Gas Transmission LLC picked up the largest increases in gross value from 2019 to 2020, going up by $121.3 million and $105.5 million, respectively. Enable Gas Transmission LLC assets slipped the most, with a decrease of about $5.7 million.