Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

25 Mar, 2021

|

Texas faces a financial crisis among retail electric providers as Dallas and other |

As Texas energy regulators and legislators battle over divisive pleas to undo billions of dollars in sky-high, allegedly inflated electricity prices charged during February's devastating winter storm, another competitive retail electric provider has called it quits.

In a March 24 letter to the Public Utility Commission of Texas, Energy Monger LLC President and CEO Drew Gormley surrendered the company's certificate to supply retail electricity after halting services days earlier. The startup "does not plan on serving any customers in the near future," Gormley said. The CEO blamed regulators and the Electric Reliability Council Of Texas Inc., the state's primary wholesale grid operator, for allowing the storm to snowball into a "financial disaster."

Plagued by prices that soared to $9,000/MWh in the real-time market and $24,000/MWh for ancillary services, Energy Monger owed wholesale suppliers $8.5 million in outstanding payments, over which it faced an ouster from ERCOT markets.

In the wake of the Arctic blast that triggered blackouts for millions of residents and almost completely toppled the Texas power system, the state's competitive electricity market has become a target for criticism. ERCOT has revoked the rights of several small retail electric providers unable to make their payments, including Griddy Energy LLC, Entrust Energy Inc., Power of Texas Holdings Inc. and VOLT Electricity Provider LP. Some companies are hanging on through bankruptcy protection while others are fleeing Texas or entering liquidation.

But amid the still unfolding crisis, there is also opportunity — not only for Texas retail electric affiliates of U.S. power giants such as Vistra Corp., NRG Energy Inc. and NextEra Energy Inc., all of which lined up to catch a possible mass exodus of retail customers from smaller retail electric companies exiting the market — but also for innovative providers.

Expanding in crisis

Rhythm Ops LLC, for instance, which launched 100% renewable energy retail services only a month before the February storm, has emerged stronger than before. The privately held, Houston-based company backed by undisclosed institutional investors gobbled up roughly 50,000 new residential and business customers from Entrust Energy and Power Co. of Texas Holdings. Rhythm also took on additional customers from Griddy, which was exposed to skyrocketing wholesale prices during the deep freeze.

With its rivals "dropping like flies," Rhythm is "doubling down on competition ... on our thesis and the business case and the reason why we started this," CEO and co-founder P.J. Popovic said in an interview.

| Vestas technician Francisco Anderson at the top of a wind turbine in Texas. Several retail electric providers in the state offer 100% renewable energy plans. Source: Robert Daemmrich Photography Inc./Corbis via Getty Images |

Texas retail and wholesale power markets have suffered from "sloppiness around risk management" and an inability to control "what I would call a casino underneath," Popovic said.

"I would argue that some of the incorrect pricing of the risk was rewarded, and when the event in February happened, it really exposed gaps that already existed in the business," the CEO added. "Properly hedged companies may have lost money ... but they would have survived."

Rhythm purchases "affordable renewable energy" and hedges its wholesale market risks with a variety of commodity products, including swaps, options and weather hedges, according to the CEO. "We take the risk, and we hedge that risk," Popovic said.

'Not too late' for repricing

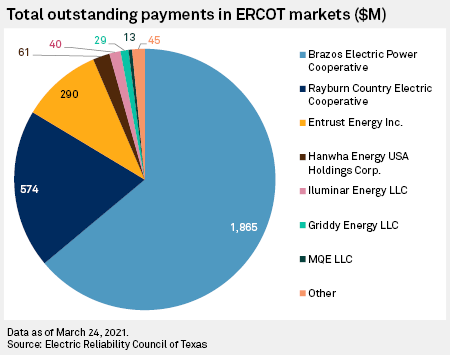

As of March 24, more than a month after the storm sent prices soaring, 14 retail electric providers and cooperatives remain $2.9 billion behind on their ERCOT invoices.

Some hard-hit retail companies and co-ops have landed in bankruptcy court. Brazos Electric Power Cooperative Inc., Griddy and Just Energy Group Inc. are all trying to restructure, while Brilliant Energy LLC went straight into Chapter 7 liquidation.

Their calls for repricing a $16 billion error flagged by ERCOT's independent market monitor so far have gone unheeded.

"The harm in failing to correct the pricing errors ... will be felt in Texas, on the licensed entities that provide electricity, and on the Texas businesses and residents that they serve," Catherine Webking, an attorney for the Texas Energy Association for Marketers, said March 22 in a renewed request for the PUC to force ERCOT to reprice real-time transactions during a 32-hour window during the storm.

"It is not too late to make these corrections," Webking said, arguing that neither the PUC, nor the governor nor the Legislature are bound by a 30-day deadline to order repricing that some parties opposed to the action have cited. "If corrections are not made immediately, Texas commercial customers will continue to be faced with invoices that could cripple their businesses, and municipal and cooperative retail electric utilities will continue to bear a substantial financial burden that ultimately must be recovered from their end-use customers."