S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

10 Mar, 2022

By David Feliba and Cheska Lozano

Financial institutions in Latin American markets have little to no exposure to Russian firms and financial institutions, dodging direct impact from the country's invasion of Ukraine and economic sanctions.

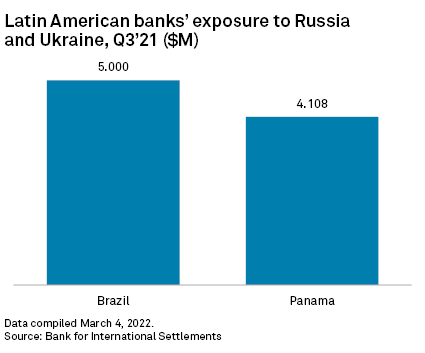

Banks in Brazil have $5 million in outstanding loans to Russian firms, and none to companies in Ukraine, data compiled by S&P Market Intelligence from the Bank of International Settlements show. Considering Brazil's industry loan book of roughly $900 billion, exposure to Russia is virtually null despite some commercial ties in agriculture.

There has been “no reported situation to the organization that indicates any cause of concern" from Brazilian banks, Brazilian banking association Febraban said in response to e-mail questions.

Banks in Chile and Mexico have recorded no exposure to the countries. In Panama, exposure from local lenders to Russia and Ukraine totals $4 million, a fraction of the country's more than $55 billion banking system.

Banking systems across the Americas are likely to emerge relatively unscathed from the war. Latin American financial institutions have a total of less than $10 million in exposure to Russian and Ukrainian loans. The U.S. has more than $16 billion in lending to Russia and Ukraine, and while the figure is significantly higher, it is also unlikely to have a big fallout given the $2.5 trillion size of the U.S.'s commercial and industrial loan portfolio, data from BIS and the U.S. Federal Reserve show.

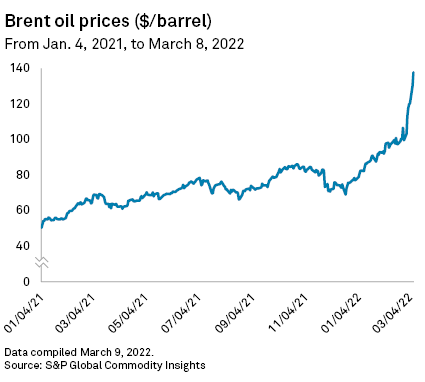

"Direct exposure to Russia and Ukraine in Latin America's banking systems is minimal, and we do not expect any rating impact," S&P Global Ratings said in a recent report. However, unintended indirect effects on credit may arise. "We do see potential risks from second-round effects arising from higher oil prices, increasing inflation, and weaker economic growth, which in turn could pressure bank asset quality and profitability."

Oil prices have spiked dramatically over the past few days as prospects of sanctions on Russian oil and gas exports pressed energy prices higher. The price of Brent reached $137.64 on March 8, up from levels of $90 to $95 before the conflict began in late February.

Although the ratings agency argued that higher rates and global disruption in markets could put pressure on banks' funding, Latin American institutions rely little on riskier, volatile market sources. Deposits are their primary funding sources, which are considered much more stable and sticky than capital markets.

The New Development Bank, established by Brazil, Russia, India, China and South Africa (BRICS) with the objective of financing infrastructure and sustainable development projects in emerging markets, announced on March 3 that it has "put new transactions in Russia on hold" in light of uncertainties and restrictions.

Data compiled by S&P Market Intelligence also shows that no Latin American bank in the aforementioned countries has a physical footprint in Russia or Ukraine.