S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

18 May, 2021

By Anna Akins and Sarah James

A grand experiment by U.S. wireless carriers to make and distribute video content appears to be coming to an end, as AT&T Inc. joins Verizon Communications Inc. in preparing to shed its media business.

While the timing of AT&T's May 17 announcement that it planned to combine its WarnerMedia assets with Discovery Inc. to form a new, stand-alone entity surprised Wall Street, analysts said the move underscores the difficulty for U.S. companies to compete effectively in both the wireless and streaming markets, each of which requires significant investments to stay ahead of rivals.

The WarnerMedia announcement comes less than three years after AT&T paid $85 billion for entertainment conglomerate Time Warner in a transaction that significantly added to its debt. Now, under terms of the deal to spin out those assets and merge them with Discovery, AT&T is set to receive $43 billion in a combination of cash, debt and WarnerMedia's retention of certain debt. AT&T shareholders will own 71% of the new entity while Discovery shareholders will own 29%, AT&T said.

"It's a pretty big change of direction on a pretty quick turnaround timeframe," said Rich Karpinski, an analyst at 451 Research who analyzes mobile operators' strategies. "That said, I think it makes sense."

Karpinski pointed to Verizon's similar announcement earlier this month that it would sell off the AOL Inc. and Yahoo! brands under its Verizon Media Business as further indication of the challenges telcos face in achieving success in both the wireless and content realms.

"To that end, [AT&T's decision is not] surprising directionally, but maybe timing-wise," Karpinski said.

Speaking on a May 17 call with analysts, AT&T CEO John Stankey said the deal with Discovery will provide the new media company with the necessary capital to keep pace with the acceleration toward direct-to-consumer entertainment while AT&T focuses on expanding its broadband footprint nationwide.

"By doing this deal now, WarnerMedia will be in a position to self-fund its growth, and AT&T will have the flexibility to invest and address the growing long-term demand for connectivity and be the leading best-capitalized broadband connectivity provider in the country through 5G and fiber," Stankey said.

It will also give AT&T more flexibility on its balance sheet to pay for the rollout of 5G services. Earlier this year, AT&T spent $23.41 billion in the Federal Communications Commission's C-Band spectrum auction, more than its typical annual capital expenditures.

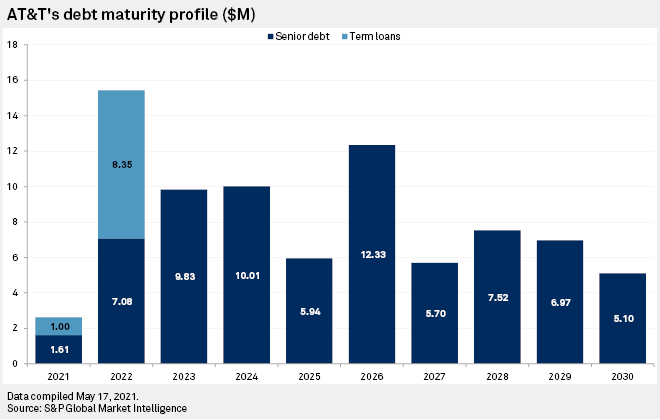

While the spectrum was considered essential for AT&T's long-term 5G ambitions, it set the company back on its efforts to pay down debt. AT&T ended the first quarter of 2021 with net debt totaling $197.71 billion, up from $173.22 billion at the end of 2020. Hefty loans and maturities totaling more than $15 billion are due as soon as 2022, according to S&P Global Market Intelligence data.

AT&T's proceeds from the sale of its WarnerMedia unit will place the company in a stronger position to be more competitive in the race to 5G, said Alex Besen, founder and CEO of the mobile data consulting firm The Besen Group LLC.

"AT&T was not successful with [its] media business," Besen said. "Selling it and investing the funds into their 5G infrastructure and fixed wireless assets, I think that will be a better play for them."