Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

25 Apr, 2022

By Sydney Price

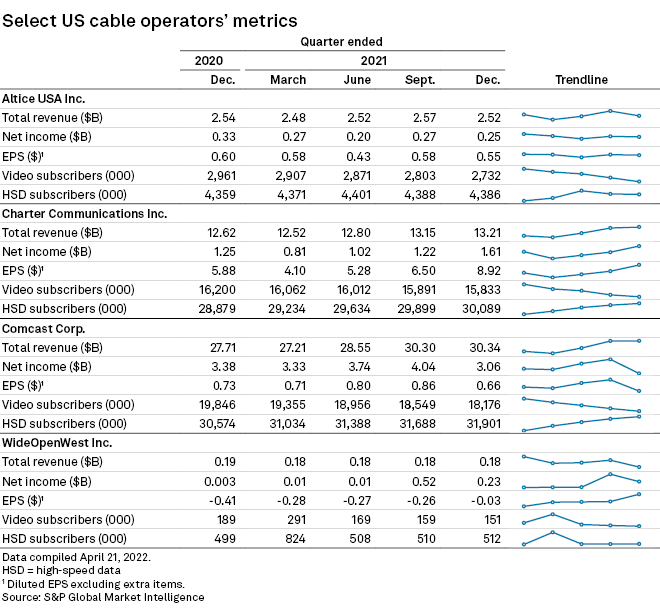

When earnings presentations from cable operators begin next week, analysts will have their eyes on mobile and broadband metrics.

Though broadband continues to be the heart of the cable business, wireless additions have driven growth for cable operators for several quarters, and analysts are not expecting the subscriber gains to stop just yet.

Both Xfinity Mobile by Comcast Corp. and Spectrum Mobile by Charter Communications Inc. launched unlimited plans for under $30 per month in 2021, helping the companies report record wireless subscriber additions for the fourth quarter of 2021. Charter added 380,000 mobile lines, compared to 315,000 in the same quarter of 2020. Meanwhile, Comcast added 312,000 wireless lines, up from 246,000 in the fourth quarter of 2020.

Heavy advertising from both companies likely contributed to high subscription numbers in previous quarters and will likely help keep numbers high over the upcoming quarters, said Jeff Moore, principal at Wave7 research, a wireless research company.

"Comcast and Charter have worked very aggressively to make price point known through advertising campaigns, so we are expecting very big numbers in subscriptions for the first quarter," Moore said.

Another cable operator, privately held Cox Communications Inc., is also set to enter the wireless playing field. Cox, which serves 20 U.S. markets, began offering mobile phone and wireless services under its Cox Wireless brand in four states in 2011 through a mobile virtual network operator agreement with Sprint. In 2012, Cox decommissioned its wireless offerings. The company was set to relaunch mobile services in 2021, but a court battle with current Sprint owner T-Mobile US Inc. over the company's new MVNO agreement with Verizon Communications Inc. led to delays. A March 2022 court decision has finally given Cox freedom to pursue wireless options again.

Moore is optimistic about Cox's plans to reenter the mobile space, even after the legal hurdles. Moore said he believes Cox will do "just fine" in keeping up with Xfinity Mobile and Spectrum Mobile when Cox's mobile services eventually launch.

Broadband

Broadband dependency has grown as Americans opt-out of cable video services for online-streaming options. The number of U.S. homes with a broadband subscription that do not have a traditional video service topped 50 million at the end of 2021, according to estimates from Kagan, a media research group within S&P Global Market Intelligence.

However, cable broadband adds will continue lagging pre-pandemic growth, according to New Street Research analysts.

New Street said the broadband market is in a good position overall, but cable cannot keep up with rising competition from fiber and fixed wireless offerings from Verizon, AT&T Inc. and T-Mobile.

"Over the last twelve months, cable continued to take share in the fixed broadband market, though at a slower pace than before," wrote New Street analyst Jonathan Chaplin in a note. "If we layer in fixed wireless broadband, cable lost share of the overall broadband market in 4Q21. The last two quarters may be the first time cable hasn’t taken share in well over a decade."

Notably, Altice has a more fiber-focused strategy than its cable competitors. On Feb. 16, Altice announced plans to accelerate its fiber network rollout strategy so that it reaches 6.5 million total passings by the end of 2025. The plan calls for more than doubling the passings in its Optimum territory in the New York tri-state area to 2.5 million, up from 1.2 million as of Dec. 31, 2021.

WideOpenWest potential sale

Analysts may also hope for any updates on potential interest in cable operator WideOpenWest Inc. Citing sources close to WOW, Bloomberg News reported this month the company is exploring "strategic options," including a possible sale. Shares jumped over 12% after the April 7 Bloomberg article.

WOW has shown an interest in M&A of late, having completed a sale of some of its Midwestern markets to Astound Broadband LLC and Breezeline in 2021.

"WideOpenWest has a recent track record of finding buyers for systems with two big deals last year. So we know they are open to it, and with reduced size and scale perhaps primed for further sales," said Ian Olgeirson, an analyst with Kagan. Olgeirson declined to speculate on potential buyers.

Before the newest sales speculation, Raymond James analysts Frank G. Louthan IV and Rob Palmisano maintained their "strong buy" rating for WideOpenWest.

"We believe the outlook is fundamentally improved for WOW following its recently completed deals to divest legacy markets," the analysts wrote in a February note.

Comcast and Altice are set to report first-quarter earnings April 28, Charter will report April 29, and WideOpenWest has not yet announced a date for its earnings presentation or release.