Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

2 Feb, 2022

By Sydney Price and Darakhshan Nazir

With broadband growth slowing, wireless has ascended to become the long-term growth driver for Charter Communications Inc. and Comcast Corp., analysts say.

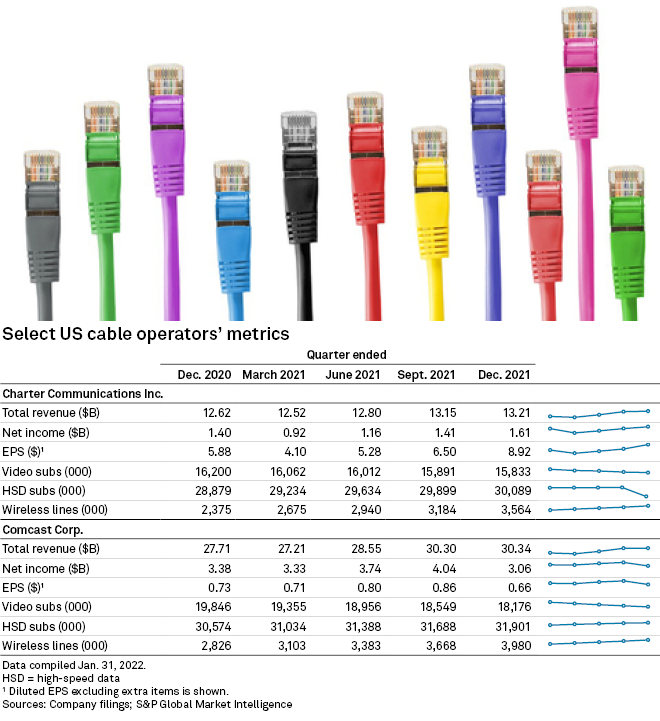

Both cable operators announced record wireless subscriber additions for the fourth quarter of 2021. Charter added 380,000 mobile lines, compared to 315,000 in the same quarter of 2020. Meanwhile, Comcast added 312,000 wireless lines, up from 246,000 in the fourth quarter of 2020.

Both Comcast Xfinity Mobile service and Charter's Spectrum Mobile rely on a mobile virtual network operator agreement with Verizon Communications Inc. that allows the cable companies to use Verizon's network infrastructure. The agreement should lead to lower costs and higher margins for both Comcast and Charter, New Street analysts said.

More than a hobby

"Up to now, investors have treated Cable wireless as something closer to a hobby than a real business," MoffettNathanson analyst and long-time cable bull Craig Moffett said in a research note.

That is all changing as wireless growth surges and broadband growth slackens.

"For sheer size of addressable market, there's nothing close to wireless. The wireless market in the U.S weighs in at roughly $200B, more than twice the size of the home broadband market," Moffett said.

Charter executives have estimated that the company could serve wireless to 50% of its broadband customers, according to New Street Research analyst Jonathan Chaplin. "That would imply 37.5MM wireless subscribers, based on current broadband subs, which is multiples of what is in street models."

That is not to say that wireless revenues are replacing broadband revenues for cable operators by any means. Rather, investors and analysts expect broadband growth rates to decelerate in 2022, while wireless growth will continue to rise.

Charter's total internet customers grew by 190,000 in the fourth quarter, compared to 246,000 in the same quarter of 2020. Charter ended the year with about 1.3 million total broadband customers, down from 2 million in 2020. Comcast gained 212,000 broadband customers in the quarter, down from a gain of 538,000 in the same quarter of 2020.

Broadband drivers

Both Comcast and Charter are hoping to drive future broadband growth by expanding into new markets.

"We will evaluate every opportunity to increase our serviceable passings even more so than we have in the past. We will take advantage of the natural progression of new household and business formation as well as the potential subsidies from the federal, state and local governments to expand into unserved areas," Comcast CEO Brian Roberts said during the company's earnings call.

Charter CFO Jessica Fischer said the company is working to aggressively build out broadband passings to increase market penetration.

"We hope to spend about $1 billion in 2022 on capital expenditures related to our rural construction initiative or our construction within census block groups that are defined as rural ... We may not reach that targeted spend given a number of factors, including pull permitting and equipment and labor availability," Fischer said.

New Street's outlook for cable broadband growth, however, is less positive.

"We don’t anticipate broadband trends improving in 2022 — if anything, they will get worse as competition ramps," New Street's Chaplin wrote in a note, pointing to fiber deployments.