Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

19 Apr, 2021

By Tom Jacobs and Jason Woleben

Catastrophe losses from winter storms that swept through the southern U.S., along with pricing and margin expansion, should top the agendas of property and casualty insurance companies as they report first-quarter earnings.

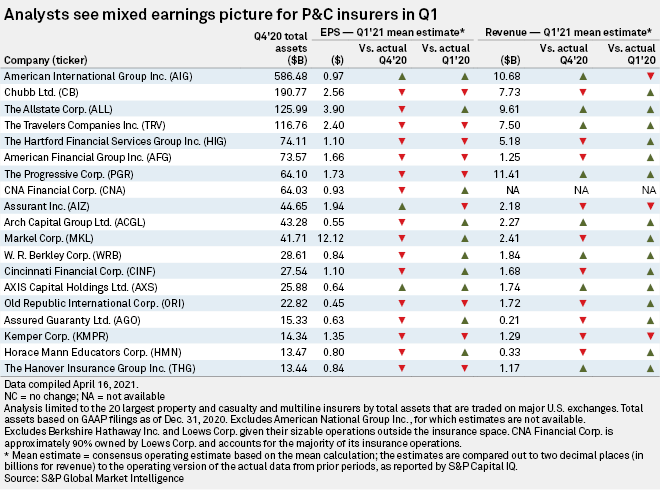

Most of the 19 largest P&C insurers are expected to record year-over-year revenue increases for the period, but nine are expected to log lower EPS, according to an S&P Global Market Intelligence analysis of sell-side forecasts. The analysis was limited to the 19 largest P&C and multiline insurers by total assets that are traded on major U.S. exchanges. Total assets were based on GAAP filings as of Dec. 31, 2020.

Snow, ice and record-low temperatures in February that paralyzed parts of the southern U.S., especially Texas, caused heavy damage and historic losses. Estimates ranged from $10 billion to $20 billion, which would make it the costliest winter storm in U.S. history.

Moody's analyst Michael Dion said personal lines companies that write homeowners policies in the areas impacted by the cold outbreak will likely provide color on those losses. The analyst said the "epic failure of the power grid in Texas" increased the severity of losses for homeowners in that area.

The Allstate Corp. estimated February pretax losses, most of which occurred in Texas, at $577 million, or $456 million after tax. The company said the arctic blast resulted in gross losses of approximately $1.3 billion, with net losses estimated at $567 million pretax, or $448 million after tax, which reflected anticipated reinsurance recoveries partially offset by reinstatement premiums.

Wells Fargo analyst Elyse Greenspan lowered her EPS estimates for seven P&C companies in light of the losses she expects from that cold wave.

Piper Sandler analyst Paul Newsome in a note said none of the first-quarter catastrophe events appear to be "book value" events, but such losses will put a damper on what is "ordinarily a strong quarter seasonally for insurers."

Dion said both analysts and investors could be in for surprises when it comes to catastrophe losses for companies that do not preannounce results.

"I think [they] might be surprised at the level of losses, given what Allstate's already reported, and how that might impact loss mitigation efforts and overall pricing to make up for that risks," he said.

Hard market to continue

Newsome is among the industry analysts who expect the hardening of the pricing market to continue, especially on the commercial side, which should give investors confidence and insurers an expanding margin.

"Given the fact that commercial line prices have been accelerating for a few quarters now, those rate increases are now earning in, and we expect further margin expansion off of what was reported" in the fourth quarter of 2020, he said.

Greenspan said this is the hardest commercial-lines pricing market since the period between 2000 and 2003 when there were nine consecutive quarters of double-digit rate increases. She expects "all of the leading commercial lines insurers" will cite a further firming of the pricing environment in the first quarter.

"We do expect to see rates continue to harden, particularly given the industry is facing additional losses from the ongoing pandemic and elevated cat losses," Greenspan said.

Talking about commercial pricing, Keefe Bruyette and Woods analyst Meyer Shields said first-quarter rate increases are "close to peak levels." Over the remainder of the year, Shields expects to see a plateauing and "very modest deceleration" that will likely be from "slightly smaller increases that should remain above loss trends."

In personal lines, Shields expects insurers to report strong recent underwriting profitability. The analyst also expects to hear about concerns over regulatory pressure and expected lower post-COVID-19 normalized losses to sustain personal auto rate decreases beyond the first quarter.

Greenspan will be listening to the personal lines carriers for any commentary on auto frequency and severity trends, noting that miles driven are returning to normalized levels based on Apple mobility data.