Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

5 Jan, 2021

|

| The Anholt wind farm in Denmark. Ambitious new targets for offshore wind deployment will be a boon to turbine suppliers, but bottlenecks such as a shortage of large installation vessels will need to be ironed out. |

A year of coronavirus-related disruption and corporate restructurings in 2020 has changed the landscape for wind turbine manufacturing.

The pandemic has been challenging for a sector heavily reliant on functioning international supply chains, but manufacturers were able to largely shake off the disruption of the initial lockdowns earlier in the year. More recently, ramped-up renewables targets and green recovery plans across Europe have brightened the long-term outlook.

"Onshore [wind] has maybe lost a little bit of volume, but offshore has lost very little progress," with contractors increasing spending on safety measures to ensure delivery of the valuable offshore contracts, said Andy Strowbridge, associate director at advisory firm BVG Associates.

Siemens Gamesa Renewable Energy SA experienced supply chain turbulence and cost overruns in 2020 and, after a profit warning in the spring, cut ties with CEO Markus Tacke, with Andreas Nauen replacing him. Earlier in the year, the manufacturer snapped up rival Senvion SA's intellectual property and European wind farm servicing business. In September 2020, the group was moved under the umbrella of newly spun out Siemens Energy AG.

Siemens Gamesa also took the lead in the race for scale in the offshore turbine segment in 2020, announcing a 14-MW machine that will become available by 2023. Until that turbine is rolled out, General Electric Co.'s GE Renewable Energy unit will be the leader in terms of scale in the offshore space, with first delivery of its 12-MW Haliade-X turbine set to begin this year.

MHI Vestas Offshore Wind A/S could make the next move now that the company is a full subsidiary of Vestas Wind Systems A/S, which bought out partner Mitsubishi Heavy Industries Ltd.'s share of their joint venture in 2020. Former CEO Philippe Kavafyan was replaced at the helm by Vestas veteran Johnny Thomsen.

Under new ownership, the company will be able to move faster toward a new supersized offshore machine, according to Strowbridge. "I wonder if the JV between Vestas and MHI slowed down the decision-making. With a single owner, there is more clarity," he said.

In the onshore segment, German manufacturer Enercon GmbH is busy with its own restructuring effort to turn the fledgling business around, which includes a new onshore turbine design. "The new product looks utterly different. It will be interesting whether they will be able to deliver on the transformation of the company. If not, they will likely be the last consolidation that will be available on the market," Strowbridge said.

Big targets

While competition in the turbine-making space is stiff, the market is also likely to be big enough for all. In Europe, a new target of 300 GW of offshore wind capacity by 2050 will require a real effort from the suppliers to deliver, industry group WindEurope said. Onshore, the sector is facing the growing task of repowering wind farms: removing the first turbines installed in the 1990s and early 2000s and replacing them with new machines.

"European countries decided that COVID-19 could be a great opportunity to accelerate decarbonizing the economy. So the European Green Deal is there as a multiyear package and is real and is driving demand," Nordex SE CEO Jose Luis Blanco said during the company's third-quarter earnings call in November 2020.

2020 also unleashed momentum around green hydrogen, powered by the European Commission's 40-GW electrolyzer capacity goal for the end of this decade. "This year has been peak hype in offshore wind and hydrogen in terms of policymakers realizing that there is a solution here that can be scaled," Strowbridge said in an interview Dec. 10, 2020.

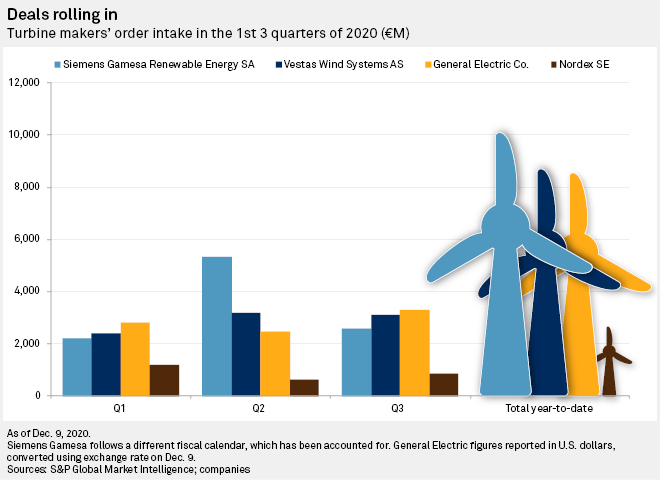

|

On the back of that hype, Vestas late in 2020 became an anchor investor in a new energy transition fund focused on power-to-X — referring to technologies that convert electricity into other energy carriers, such as hydrogen — as part of a €500 million deal to buy a 25% stake in Copenhagen Infrastructure Partners K/S, a Danish fund manager.

New market leader in 2025

U.S. and European manufacturers are set to have an edge over competition from China, according to consultancy Wood Mackenzie. Global operational scale, onshore and offshore presence, large balance sheets, closer proximity to the largest asset owners and financial strength will prove to be advantageous for leading Western turbine-makers and will help to consolidate global market share outside of China, the company said in a Dec. 3, 2020, report.

Vestas, Siemens Gamesa and GE are set to increase their global market share from 43% in 2019 to 60% by 2029, Wood Mackenzie added.

Vestas, now sitting in top spot in the global rankings, will be faced with strong competition over the coming years due to Siemens Gamesa's aggressive expansion in the offshore segment. "[Siemens Gamesa] will secure the global number one ranking by 2025 and retain that position through the end of the decade," Shashi Barla, principal analyst at Wood Mackenzie, said in a statement.

Against the backdrop of rising renewables targets globally, the eight largest turbine-makers are set to more than double their cumulative installations in gigawatt terms by the end of the decade. Vestas and Siemens Gamesa each will have reached 200 GW, and GE will be just shy of that target, Wood Mackenzie predicted.

Buy cheap, buy twice

Some supply chain challenges in Europe are expected to remain as capacity targets are hiked. Shipping vessels capable of lifting and installing the largest offshore turbines are in short supply. The offshore wind sector was expecting the delivery of the Orion installation vessel by DEME Group in May 2020, but the ship was severely damaged during a final crane load test in the port of Rostock, Germany.

DEME has booked alternative vessels for the first couple of jobs, including the Moray East wind farm off the coast of Scotland, developed by Engie SA and EDP Renováveis SA. Crane-maker Liebherr, which had hoped to gain a foothold in the offshore renewables segment, said work to repair the vessel would wrap up at some point this year.

While the logistical disruption from this incident may be short lived, it is likely to further concentrate minds in the search for contractors in the ancillary wind supply chain. "It has for sure created a massive focus on choice of various suppliers in the [offshore wind supply] chain," Frederik Colban-Andersen, managing director for offshore renewables at shipping company Clarksons Platou, said in an email. "As such it's good, there is focus on quality and that buying cheap is not necessary the best. Buy cheap, buy twice."