S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

24 Aug, 2021

By Vanya Damyanova and Francis Garrido

Unloved for the better part of the last decade, bank shares are among the top performers in the European stock markets in 2021, as a COVID-19 rebound, higher earnings expectations and the return of dividends bolster the sector.

European bank stock rallies since the global financial crisis have always been followed by periods of decline. But with valuations still at a steep discount to those of U.S. lenders, as well as strong momentum in the sector and positive macroeconomic indicators, this bull run could yet continue, analysts said.

When the COVID-19 pandemic hit in early 2020, bank stocks were sold off "in anticipation of a 2008-type fallout with massive asset write-downs," said Johann Scholtz, equity analyst at Morningstar. This was "a great overreaction" and ignored the fact that banks had much more capital and much better asset quality when COVID-19 hit than at the start of the global financial crisis.

"Once it dawned on investors that banks will largely survive the pandemic, a recovery was always on the cards," Scholtz said in an email.

European bank stocks have been on a rebound since the fourth quarter of 2020, further aided by positive vaccine news and the outcome of the U.S. presidential election. As the yield curve started to steepen amid hopes of an economic recovery, international investors began rotating their portfolios out of "high-flying tech and other growth stocks, where cash flows are far in the future, to banks and other value stocks, where cash flows are much closer to the present," Scholtz said.

The market was also reassured by improving asset quality and declining impairments for this year, which drove consensus earnings upgrades, said Marc Halperin, co-head of European equities, and Aymeric Gastaldi, equity fund manager, at Edmond de Rothschild Asset Management.

Indeed, the first- and second-quarter results of many European banks exceeded analyst forecasts. Year-to-date, the sector has been one of the leaders by 2022 earnings upgrades and share price development, according to a July 16 Credit Suisse research note.

The key driver was better asset quality "as government support has made the economic outlook and loan losses much better than expected," said Jon Peace, an equity analyst at Credit Suisse.

Value play

European lenders still trade at roughly half the price-to-book value, or PBV, of their peers across the Atlantic as U.S. institutions are expected to maintain their dominance of the global banking market established in the wake of the 2008 crisis.

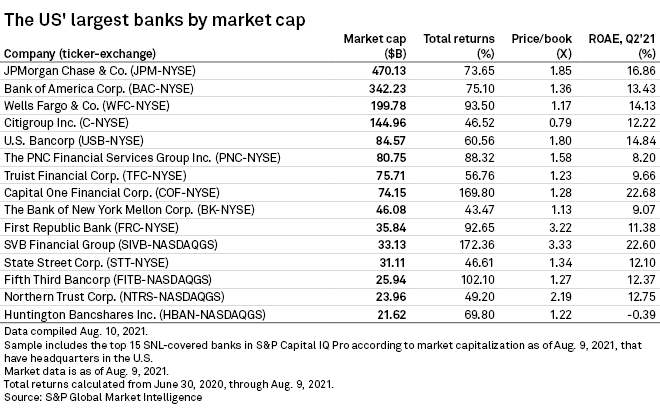

Only five of the top 15 European banks by market capitalization currently have a PBV of 1.0x or above, compared to 14 of the top 15 U.S. counterparts, Market Intelligence data shows. The average return on equity of the top 15 U.S. banks was about 12.8%, compared to 11.8% for European institutions.

U.S. banks have also enjoyed a purple patch on the public markets, with the S&P 500 Bank index

The average PBV of European banks of 0.67x is in line with the 7% ROE outlook for the sector, but still below the 10% level equity investors typically expect, ABN AMRO fixed income strategist Tom Kinmonth wrote in a July 1 note.

"On top of that, banks have showed an unexpected ability to absorb the COVID-19 crisis, demonstrating the robustness of their business and the quality of their balance sheets after 10 years of restructuring. This could potentially encourage the market to apply higher valuation multiples to the sector at the exit of the crisis," the pair said in an email.

Promising dividend yields and buybacks will draw attention to the sector in the near term as many banks prepare to pay out 2019 and 2020 distributions they held back at the request of regulators. Now both the Bank of England and the European Central Bank have lifted dividend restrictions, the total yield for European banks over the next 12 months could reach 6.7% on average, Berenberg analysts said in an Aug. 18 note.

Well-capitalized banks with a strong risk focus, such as Nordea Bank Abp, ING, NatWest Group PLC, UBS Group AG, Barclays PLC and UniCredit SpA, are among Berenberg's top picks. UBS analysts have recommended investors choose banks with attractive valuations but also adequate provision levels and high capital ratios.

However, the Aug. 18 stock slump following the publication of minutes from the U.S. Federal Open Market Committee's July meeting was a reminder that the sector remains vulnerable to a wide range of factors. Downside risks still linger, as the rise in delta-variant infections could jeopardize the economic recovery and asset quality issues may still materialize.

"If withdrawal of stimulus support packages leads to a material increase in loan defaults, the sector will de-rate," Morningstar's Scholtz said.