Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

2 Jun, 2021

By Jiayue Huang

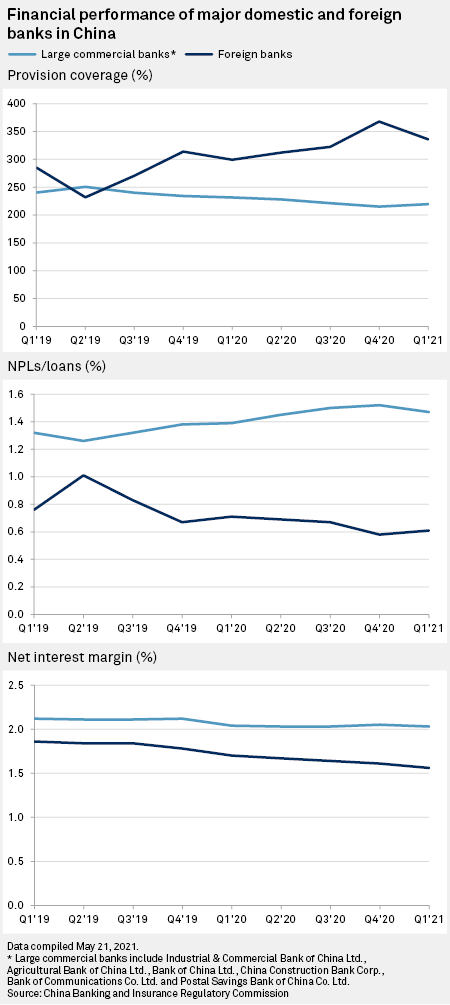

While net interest margins are trending lower for most banks in China amid Beijing's accommodative monetary policies, foreign lenders have seen their returns on lending and other interest-earning assets fall more sharply than domestic institutions. As of March 31, the gap between the NIMs of foreign banks and the nation's six largest state-backed commercial banks, for instance, widened to 47 basis points from 26 bps two years ago, according to the China Banking and Insurance Regulatory Commission, or CBIRC.

In addition, the combined net profit of 41 foreign lenders in China fell to 6.0 billion yuan as of the end of the first quarter, from 7.6 billion yuan a year ago, according to the CBIRC. It was equivalent to 0.98% of the net profit of all banks in China, down from 1.27% a year ago. That contrasts with the large commercial banks, which reported a 2.76% year-over-year increase in combined net profit, with their share of the sector's total earnings edging higher to 51.57% from 51.37%.

"The gap reflects the structural trend that foreign banks are not as competitive and efficient as large [Chinese] commercial banks. [But China's] market is still attractive given the potential size and the net interest margin may still be higher than [their] home markets," said Gary Ng, a Hong Kong-based economist at investment bank Natixis.

"The onshore presence [in China] is important for client relationship and offshore or cross-border financing, which may be even more relevant for foreign banks at the current stage," Ng added.

Despite chronic comparative disadvantages partly due to the dominance and scale of local players as well as the emergence of financial technology platforms, many foreign lenders continue expanding in China organically or through acquisitions. Experts say even a small slice of China's banking sector could help foreign lenders as many of their key markets, such as the U.S. and Europe, had been struggling to grow even before the pandemic.

Among the latest deals, Singapore's DBS Group Holdings Ltd. acquired 13% of Shenzhen Rural Commercial Bank Co. Ltd. in April. HSBC Holdings PLC, Standard Chartered PLC and Citigroup Inc. also said they would beef up their wealth management operations in China, targeting the growing middle class.

HSBC, for example, added 100 wealth planners in mainland China in the first quarter out of the 600 planned new hires across Asia. The bank said its trade loans in Asia grew by $3 billion in the first quarter, mainly driven by mainland China and Hong Kong.

Structural issues

One of the reasons why foreign banks in China are less profitable than domestic peers is their persistently high funding cost, a key component of the NIM.

Foreign banks' retail networks in China are much smaller than the local players, which are able to lean on low-cost deposits as their major funding source. Sourcing wholesale funding from the interbank market, which is priced with reference to interbank rates that are usually higher than deposit rates, or attracting more deposits by offering higher-than-market interest rates are adding pressure to the already thinning NIMs for foreign institutions in China.

Cao Zhu, a Shenzhen-based analyst at brokerage Guotai Junan added that China's removal of restrictions on bond market and money market interest rates in recent years has contributed to the faster decline of NIMs for foreign banks and other lenders with a smaller deposit base.

"The interest rate fluctuates in a greater range as it liberalizes, which also makes it more costly for banks to absorb deposits and borrow from the financial market. However, usually lenders with more branches are less affected as they have more deposits in hand and higher capacity to attract clients," Zhu said.

The overnight Shanghai interbank offered rate, or Shibor, rose to 2.187% as of June 1, from 0.899% at the beginning of 2021, according to China Foreign Exchange Trade System and Nation Interbank Funding Center.

Risk aversion

Relatively conservative provisioning for bad loans is another reason why foreign banks in China are less profitable.

Foreign banks' loan loss provision coverage ratio, which also accounts for unexpected losses beyond loan loss provisions that are buffers against nonperforming loans, has been consistently higher than domestic lenders and the regulatory minimum for almost two years. Such a policy has been limiting the banks' growth of net interest income, according to Xiong Jinwu, associate professor at the China University of Political Science and Law.

As of March 31, the coverage ratio for foreign banks stood at 335.98%, up from 285.1% for the same quarter in 2019. It was higher than 219.56% reported by the six largest state-owned banks in the first quarter.

"It shows that foreign banks are more cautious in terms of risk management. However, they will need to find a balance between setting aside enough provisions and profitability," said Xiong.

Ng, however, added that the higher provision coverage ratio for foreign banks reflects the limited tools available to them to dispose of nonperforming loans. Unlike domestic lenders, only a handful of foreign banks are allowed to securitize bad loans as a way to clear the troubled debt from their books.

Fees, relationships

However, what NIMs do not capture is the performance of fee-based business, such as mutual funds and stock broking, which have shown improvement for some of the foreign banks in recent years.

HSBC's net fee income from mainland China, for example, grew 38.9% year-over-year to $120 million in the first quarter of 2021, while interest income only went up roughly 0.75% to $401 million during the same period. Interest income accounts for roughly 45.6% of HSBC's income in China.

Morningstar senior equity analyst Michael Wu also said foreign banks will focus on cross-border deals to differentiate themselves from local banks since they have branches overseas. This aspect could have increasing importance in the future as more Chinese companies may seek overseas listings or acquisitions.

"Comparing to Chinese counterparties, foreign banks generally have a larger global presence with stronger connection in international capital flows. Such advantages would allow foreign banks to play a vital role in China's financing opening by facilitating two-way capital flows, such as bringing foreign investors to China and the other way round," Ng said.

Morningstar's Wu added that even Chinese banks are target clients for foreign banks. "Singaporean banks, for example, might lend Singapore dollars to the Chinese banks," he said.

Apart from institutions, high-net-worth clients may also be the target since they are more likely to have demand for cross-border services and wealth management, in which foreign banks have more experience. "It can be competitive, but the overall pie is growing at a quite solid pace," Wu said.

As of June 2, US$1 was equivalent to 6.38 yuan.