S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

14 Feb, 2022

By Beata Fojcik and Rehan Ahmad

|

Pro-Ukraine activists gather for prayer and a demonstration against Russian aggression in front of the White House. |

Russian banks' access to the global finance system could be restricted in the event the country invades Ukraine, while potential sanctions will also likely disrupt foreign lenders' operations in Russia.

"Such blacklisting could have a devastating impact on the Russian economy," said Caroline Brown, partner at law firm Crowell & Moring who advises on economic sanctions compliance and enforcement. It would affect everyone depending "on transactions through those financial institutions, including Russians and Russian companies," Brown told S&P Global Market Intelligence.

Sanctions would be applied to "three or more" Russian banks and financial institutions, potentially including Sberbank of Russia and VTB Bank PJSC, forcing them to rely on less-established local financial infrastructure and costlier foreign-exchange options. Overseas lenders with a presence in country could also feel the impact of reduced economic activity and a depreciation in the Russian ruble.

Sberbank, VTB, Visa and Mastercard did not respond to requests for comment.

U.S. and European officials are close to finalizing a wide-ranging package of sanctions that would kick in following an invasion of Ukraine, Reuters reported Feb. 11.

'Added blow'

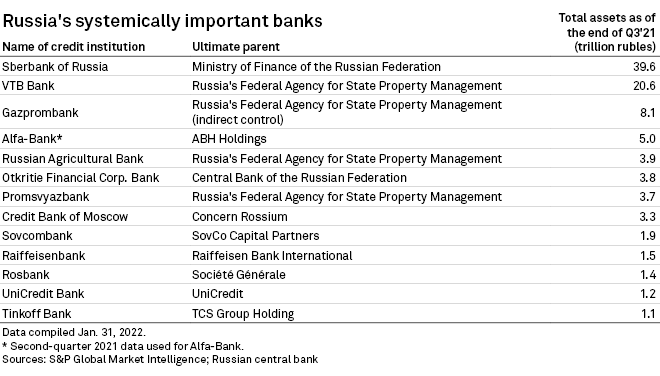

The bill proposed by Senate Democrats would aim to block and prohibit all transactions in certain banks' property in the U.S. The bill states that the sanctions would apply to three or more institutions out of a list of 15. That list of potential targets includes nine of Russia's systemically important banks: Sberbank, VTB Bank, Gazprombank JSC, Credit Bank of Moscow PJSC, JSC Alfa-Bank, JSC Russian Agricultural Bank, PJSC Bank Otkritie Financial Corp., Promsvyazbank PJSC and PJSC Sovcombank.

Many state-owned banks in Russia, including largest lenders Sberbank and VTB, are already subject to Western sanctions imposed after Russia annexed the Crimean Peninsula in 2014 that do not allow them to raise long-term financing abroad. Fresh sanctions would deliver an "added blow" as all dollar transactions with the designated banks would be prohibited, Brown said.

The sanctions would complicate the work of the Russian financial sector and settlements with foreign counterparts, according to Igor Dodonov, an analyst at Russia-based brokerage Finam. There would be higher costs associated with carrying out forex settlements and conversions through countries in Asia and elsewhere, Dodonov said.

The potential disconnection of sanctioned banks from the Visa and Mastercard payment systems would prevent clients of sanctions-hit banks from using those cards abroad, Dodonov said. Russia's National Payment Card System would be able to process domestic transactions, the analyst said.

The prospect of cutting Russian financial institutions off from the Belgium-based Society for Worldwide Interbank Financial Telecommunication, or Swift, messaging system was described as a "key issue" by JPMorgan analysts in a recent report. Such a move would prompt the affected banks to switch to the country's alternative financial messaging services system and serious problems could therefore arise, according to Dodonov.

Disconnecting Russian entirely from Swift is no longer under active consideration, Reuters reported Feb. 11, citing U.S. and EU officials. Concerns had been raised that doing so would mean billions of dollars of outstanding loans European lenders have in Russia would not be repaid, the report said.

Uncertain rebound

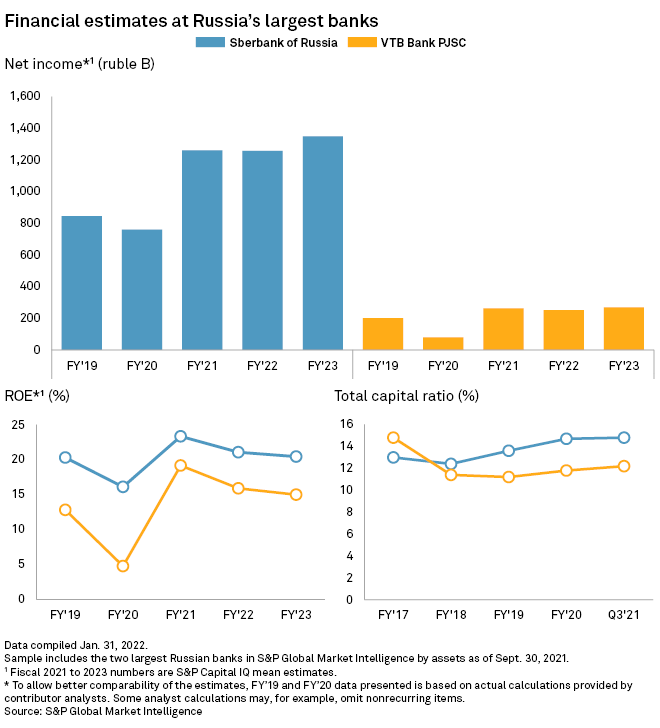

Shares of Sberbank and VTB Bank fell by more than one-third between October 2021 and January as the prospect of sanctions heightened, though they regained some ground in recent weeks.

Both Sberbank and VTB posted strong financial results for the first nine months of 2021, their profits growing more than 75% year over year to 978.1 billion rubles and 293.4% to 256.9 billion rubles, respectively. The S&P Capital IQ consensus mean estimates for the banks' 2021 full-year net profits exceed 1.2 trillion rubles in the case of Sberbank and 260 billion rubles for VTB Bank.

In the event of political risks easing, the two banks would be the first contenders for a significant share-price rebound, Dodonov said.

Western exposure

The earnings of international banks with a presence in the country could be hit by factors including a deterioration in asset quality indicators and a negative impact on capital in the event of a severe depreciation of the ruble, S&P Global Ratings said in its report, even though the exposure of Western banks to Russia is limited overall.

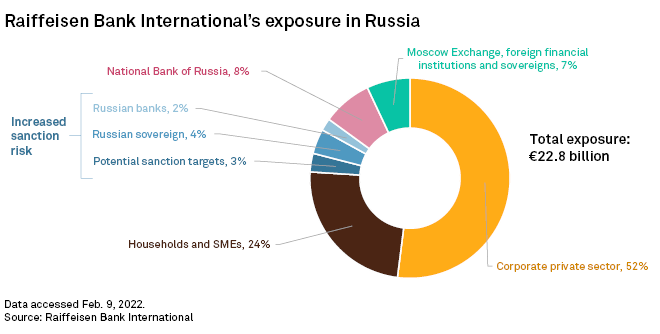

Among the European banks with a Russian presence, Raiffeisen Bank International AG would be most exposed to risk stemming from sanctions tightening, followed by Hungary-based OTP Bank Nyrt., Italy's UniCredit SpA and France's Société Générale SA, according to JPMorgan analysts. The Russian units of RBI, UniCredit and Société Générale are also among Russia's systemically important banks.

RBI declined to comment directly but pointed to its 2021 earnings presentation in which it said that its exposure to Russia and Ukraine was "well within the limits which ensure resilience of the group under all possible scenarios." As of the end of 2021, the Austrian bank's Russia exposure totaled €22.8 billion, of which 9% was subject to increased sanction risks, while provisions for sanctions and geopolitical risk amounted to €150 million, with €46 million added in the fourth quarter.

OTP Bank noted that it is the "most active consolidator" in the central and Eastern European banking markets and aims to strengthen its presence in every country where it is applicable, both organically and via acquisitions. "OTP remains committed to Russia and seeks to continue its business development strategy," a spokesperson for the Hungarian bank said via email.

Société Générale did not respond to a request for comments.

The clearest signal so far of the impact tensions are having on overseas banks came in January, when UniCredit dropped its plans to acquire Moscow-headquartered lender Otkritie. "We did undergo due diligence, but given the geopolitical environment, decided to withdraw from the data room," UniCredit CEO Andrea Orcel said on a Jan. 28 earnings call.

"Russia has gone through waves of sanctions and we have always adjusted our way of operating in a fully compliant manner. We have been present in the country since 2005 and have this experience," a UniCredit spokesperson told Market Intelligence via email.

As of Feb. 11, US$1 was equivalent to 75.93 Russian rubles.