Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

25 Apr, 2022

By RJ Dumaual and Jason Woleben

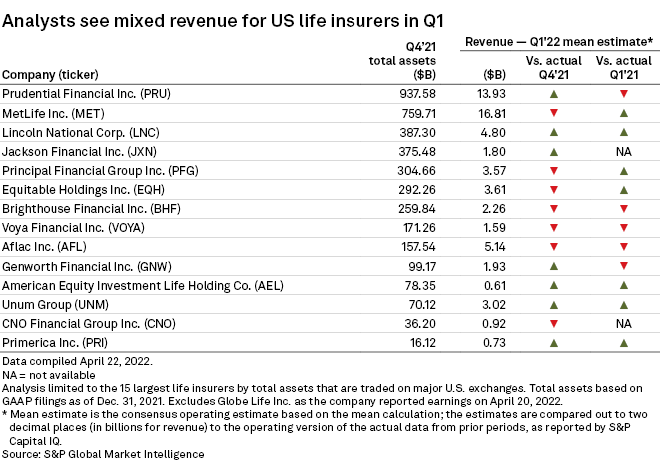

A significant number of the largest U.S.-listed life insurers are expected to see earnings slide both year over year and sequentially in the first quarter, according to an S&P Global Market Intelligence analysis.

Earnings set to fall

All but three of the life insurance companies included in this analysis are expected to log EPS declines from the fourth quarter of 2021. A majority are also anticipated to record drops from the first quarter of last year. The EPS of the two largest life insurers by total assets, Prudential Financial Inc. and MetLife Inc., are expected to decline compared to both periods.

With 10-year Treasury rates rising above 2.75%, Keefe Bruyette & Woods analyst Ryan Krueger anticipates some continued headwinds from new money rates trailing existing roll-off yields, but the spread between the two has meaningfully narrowed.

Krueger estimated that ongoing EPS headwinds are likely down to 1% to 2% annually for many companies, with more nuanced cash flow impacts to legacy liabilities, such as variable annuities.

Revenue expectations slightly better

Half of the largest life insurers are expected to log revenue growth on a sequential basis, while the revenues of seven are forecast to rise year over year.

Of the life insurers scheduled to report this week, Aflac Inc. is projected to record revenue declines on sequential and annual bases, and Principal Financial Group Inc.'s revenue is expected to rise compared to the first quarter of 2021 but fall sequentially.

Piper Sandler analyst John Barnidge will be looking for commentary on Aflac's benefit ratio in the U.S. and Japan, as well as color about U.S. distribution, specifically regarding newer dental and vision, group life, and pet insurance additions.

Barnidge will be watching Principal Financial for insights on revenue growth versus expense growth and the impact of COVID-19.