S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

23 Sep, 2021

Slowing U.S. economic growth and an expected rise in borrowing costs could leave American companies vulnerable after they gorged on debt during the pandemic.

Recent U.S. jobs and inflation data show signs of a slowdown in economic recovery, which could lead to a drop in corporate revenues. The Federal Reserve is also poised to tighten its ultra-loose monetary policy in the coming months, leading to a possible increase in borrowing costs. The twin threats could erode companies' ability to invest in growth and make interest payments as corporate debt levels climb ever higher, economists and analysts said.

"The record-high corporate debt leverage is a main concern, as much of it has been speculative-grade and it is still a bumpy road to recovery for some sectors," Nicole Serino, associate director of credit markets research at S&P Global Ratings, said in an email.

Corporate debt loads could become "unbearable" for the companies that carry them if the recovery in revenues starts to fizzle, Ratings has warned.

Borrowing to survive

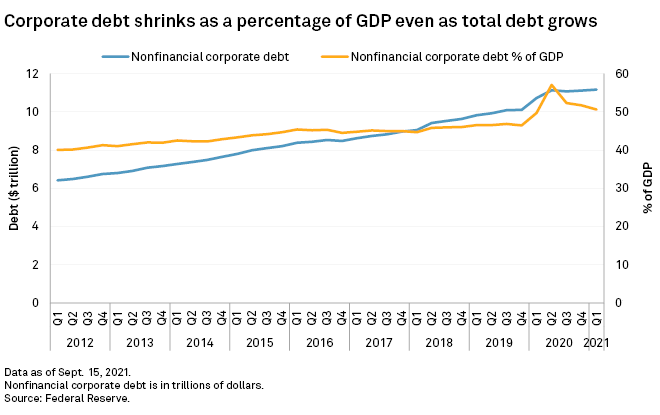

Companies rushed to the bond market in early 2020 to take advantage of low borrowing costs, growing the debt held by nonfinancial corporations to $11.170 trillion, a $1 trillion increase over the course of the pandemic, according to the Federal Reserve. The total shot up to more than 55% of U.S. GDP in 2020 and remains above pre-pandemic levels.

Rated U.S. companies issued $2.122 trillion in bonds during 2020 to make up for the pandemic-induced shortfall in revenues, according to LCD. The record annual total was up 59.7% from the 2019 figure. Companies have continued to issue bonds at historically elevated levels in 2021, reaching $1.417 trillion as of Sept. 15.

That debt buildup left companies well-capitalized, helping grow M&A, capital expenditures and spending on share buybacks and dividends in 2021.

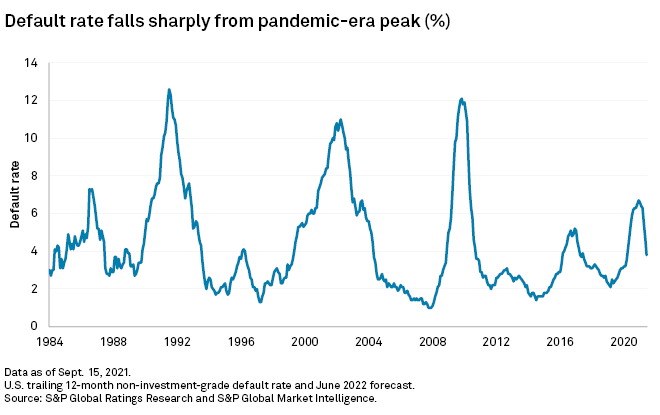

Meanwhile, corporate defaults are reaching new lows. The U.S. trailing-12-month rate of defaults among non-investment-grade-rated companies fell to 3.8% in June from a peak of 6.7% in December 2020. Ratings forecasts the rate will fall to 2.5% by June 2022.

The Federal Reserve's extensive buying of Treasurys has supported corporate bonds as investors have been driven out of the government bond market. But with inflation running hot and the economy recovering, the Fed is planning to taper its $120 billion-a-month asset purchasing program this year, potentially reducing demand for corporate bonds and driving yields higher, increasing the cost of borrowing.

"There is a decent chance that they announce [tapering] as early as November," Tiffany Wilding, U.S. economist at asset management group PIMCO, said in an email.

Debt runs higher, economic growth weakens

The willingness of investors to continue to back companies is not limitless, but for now, they seem unperturbed by the buildup of debt, experts say.

"Clearly there is a point when credit investors will transform into credit vigilantes should corporations become too greedy in [their] use of credit, but we think that is far off in investment grade-land," Frank Rybinski, director of macro strategy at Aegon Asset Management, said in an email.

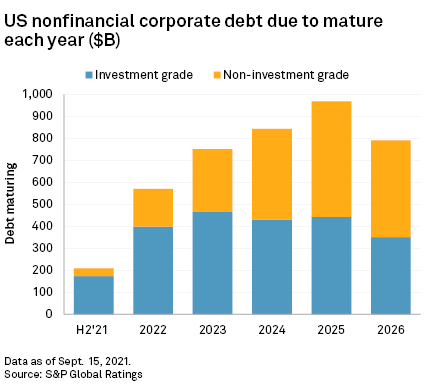

Whereas in 2020 companies issued debt to cover lost revenues, in 2021 they have been taking advantage of low borrowing costs to refinance debt and push back maturities.

|

But by kicking the can down the road, companies risk pushing up the amount of nonfinancial rated debt quickly, from $570.0 billion in 2022 to a peak of $968.5 billion in 2025.

Meanwhile, signs of a slowing recovery are emerging. High inflation and weak jobs data led PIMCO to downgrade its U.S. GDP growth forecast for the third quarter to 3% quarter over quarter from 6.5% previously.

Core consumer price inflation — which excludes food and energy prices — rose 4% year over year in August, eating into household buying power. U.S. job growth also disappointed in August, with just 235,000 jobs added against expectations of 750,000.

A growth scare would pose a significant challenge for the earnings potential of U.S. companies, according to Adam Slater, lead economist at Oxford Economics. And a rise in borrowing rates relating to inflation would make it harder for companies to meet repayments.

"A shift to a higher inflation regime has only a 10%-15% probability, but even a fairly moderate rise in real interest rates could be a problem," Slater wrote in an Aug. 31 research note.

COVID-19 cases are also rising as the delta variant spreads. The Centers for Disease Control and Prevention recorded over 163,000 new daily coronavirus cases Sept. 15, up from less than 10,000 in mid-June.

The scale of the economic slowdown will determine the extent of investors' concerns. If growth slows to the long-term trend, then there will not be a significant repricing of credit, Aegon's Rybinski said.

"If the slowdown is recession-like, then credit risk rises sharply and with it the premium needed to compensate for the increased credit risk," Rybinski said.

LCD is an offering of S&P Global Market Intelligence.