Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

2 Sep, 2021

By Brian Scheid

U.S. job numbers for August could determine when the Federal Reserve will start tightening its pandemic-era, ultra-loose monetary policy.

Economists are already bracing for a potential slowdown in job growth from earlier this summer, according to data firm Econoday. They are expecting the number of new jobs to come in at anywhere between 377,000 and 900,000 for August when the U.S. Labor Department releases its nonfarm payroll on Sept. 3. That would follow employment gains of 943,000 in July and 938,000 in June.

Strong job numbers could compel Fed Chairman Jerome Powell to announce a much-awaited start to tapering $120 billion in monthly securities, according to analysts. That move could happen as early as this month, just after the Sept. 21-22 meeting of the rate-setting Federal Open Market Committee.

"Both June and July were good reports, so if the August one is also strong, I think it moves tapering to the front burner," said Kathy Jones, managing director and chief fixed-income strategist with the Schwab Center for Financial Research. "Conversely, a surprisingly weak report could mean that tapering gets postponed."

The Fed is focusing on jobs as one of the key measures to determine when it will begin to draw down its monthly bond purchases. The bond-buying program, which began in 2020, has supported markets and helped keep longer-term borrowing costs low amid the economic turbulence caused by the pandemic.

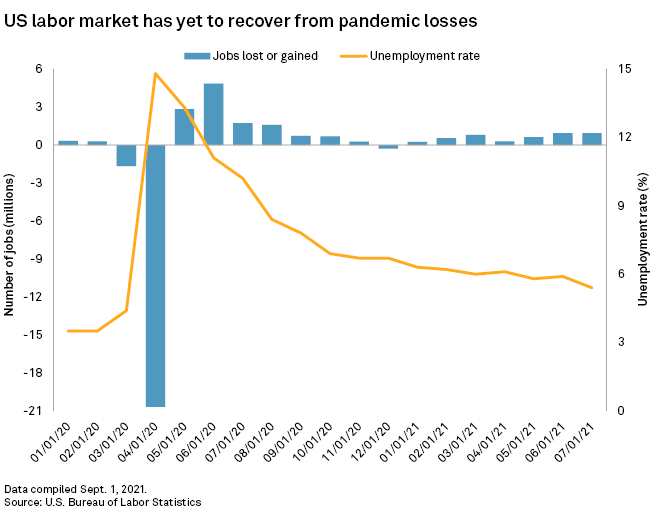

The nearly 1.9 million jobs added in June and July combined outpaced the 1.7 million jobs added during the prior three months, according to the Bureau of Labor Statistics. On average, the U.S. has added 1.1 million jobs per month since losing nearly 22.4 million jobs in March and April 2020. But the average in 2021 alone is 617,000 jobs per month.

Timing the taper

If a million or more jobs were added in August, the Fed may begin to taper asset purchases as soon as October, said Peter Cardillo, chief market economist with Spartan Capital Securities.

Gregory Daco, chief U.S. economist with Oxford Economics, said Powell will likely not announce tapering plans until November, with the central bank beginning to reel in bond purchases in December or January. Daco expects a gain of 675,000 jobs in August but said a surprisingly high number could accelerate the Fed's plans.

"A number closer to 1 million would certainly put more weight toward earlier tapering, but I think [Fed officials] will want to see the potential damage to economic activity and employment in September before making [a] tapering decision," Daco said.

Another estimate from Bank of America Securities puts August job gains at 600,000. The softer number is in line with other economic data that has weakened as the coronavirus delta variant spreads, Bank of America Securities U.S. economists Joseph Song and Stephen Juneau wrote in an Aug. 30 note.

If this forecast proves correct, Powell will not announce a taper plan after the September meeting, and the plan may be pushed back to November, the economists wrote.

"Our jobs forecast if realized is likely to be soft enough to leave the Fed wanting to monitor additional data before tapering," Song and Juneau wrote.

Improving, but turbulent

During an Aug. 27 speech at the Fed's annual economic policy symposium, Powell stressed that labor market conditions were "improving but turbulent" and that job gains have come faster than expected. The country has yet to meet the Fed's employment goals, as inflation, another key measure of economic progress for the Fed, is exceeding the central bank's target.

The core personal consumption expenditures index, which strips out food and energy costs and is the Fed's preferred inflation measure, rose 3.6% year over year in July, well above the Fed's 2% target. This is also the highest jump in 30 years.

But the U.S. unemployment rate in July 2021 was at 5.4%, up from 3.5% in February 2020. The U.S. is still about 5.7 million jobs short of recouping the losses from early 2020, even after adding 16.7 million jobs since April of that year.

Still, the pace of hiring has picked up and has been moving at a historically quick pace, Powell said during the Aug. 27 speech.

"The levels of job openings and quits are at record highs, and employers report that they cannot fill jobs fast enough to meet returning demand," Powell said. "These favorable conditions for job seekers should help the economy cover the considerable remaining ground to reach maximum employment."