S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

30 Dec, 2022

By Garrett Hering and Susan Dlin

| The 190-MW/380-MWh Cunningham Battery Storage Project in Hunt County, Texas, is on track for completion in 2023, part of a planned U.S. development boom. Source: ACCIONA Energía |

U.S. utilities and independent power producers plan to add unprecedented volumes of battery storage to the nation's electric grid by mid-decade, driven by ambitious clean energy targets, reliability needs, a more competitive cost of technology and lucrative federal tax incentives.

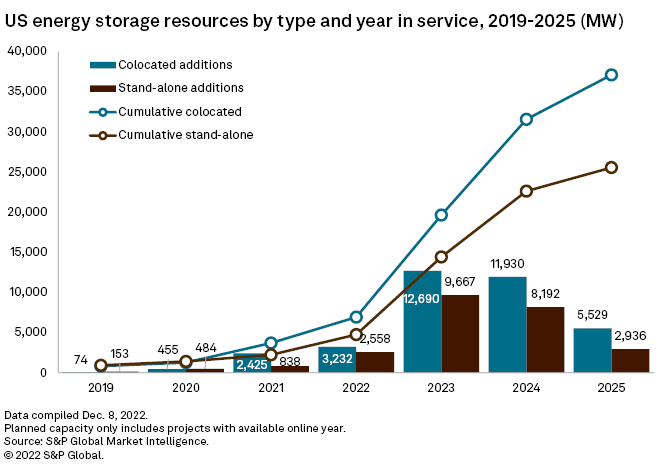

Roughly 57 GW of large-scale energy storage resources are planned for connection to the U.S. grid between 2022 and 2025, largely in Texas, California and the broader Southwest, according to S&P Global Market Intelligence data. That is almost 10 times more nonhydroelectric storage capacity than was on the grid at the end of 2021.

Passage of the Inflation Reduction Act in August created new and expanded support for energy storage manufacturing and installations, especially for lithium-ion batteries that provide up to four hours of discharge to help meet peak power needs. But widespread delays related to battery shortages, transmission interconnection bottlenecks and other obstacles have illustrated that the energy storage industry can only scale up so fast.

"Frankly, the thing we ask ourselves is, how much growth is too much growth?" Geoff Brown, CEO of battery storage system integrator Powin Energy Corp., said in a recent interview. "There's a functional limit to how much you can really effectively take on."

With 2022 sales anticipated to reach nearly $1 billion, the privately held, Oregon-headquartered company plans for annual growth of at least 50%-100% in the years ahead, combining both U.S. and international projects.

"Over the next three years, I think we're in a perpetual short," said Brandon Keefe, CEO of Houston-based developer Plus Power, which is offering its near-term excess battery cell orders to fellow developers short on supplies. "Those who already went out and procured supply are going to have successful projects and those who don't [have batteries] are going to have issues."

The energy storage industry's battery supply crunch has been exacerbated by strong demand from automakers, which are investing heavily in electric vehicles and new U.S. battery plants largely for their EVs. Although some automakers are exploring stationary energy storage and battery upstarts plan to build dedicated domestic cell factories for the energy storage industry, developers are likely to remain reliant on imports in a fiercely competitive global market for some time.

'Storage is part of the solar story'

As of Dec. 8, the U.S. storage industry as a whole had added 3,770 MW of large-scale batteries in 2022, about 53% of which was in the form of stand-alone capacity, Market Intelligence data shows. Another roughly 2,000 MW was still planned for completion by Dec. 31, mostly batteries co-located with solar farms. If the industry manages to bring those planned storage stations online by the end of December, the resulting nearly 5,790 MW would equal 77% growth in 2022. If the industry connects just half of those still planned projects, that would still be a 46% year-over-year rise.

While down significantly from the overly ambitious 10,000 MW of new storage capacity previously planned for 2022, such strong double-digit growth rates are more in line with what many in the industry consider healthy. During a breakout year in 2021, large-scale U.S. battery capacity additions totaled more than 3,200 MW, exceeding 200% annual growth, according to Market Intelligence data. But several battery systems experienced plant troubles in 2021 and 2022, and grid operators are still learning how to best integrate energy storage into markets.

Fluence Energy Inc., a Virginia-headquartered global energy storage technology and services specialist launched in 2018 by AES Corp. and Siemens AG, expects the U.S. market to grow at a pace of "around 40% to 50% per year," Julian Nebreda, the company's president and CEO, said Dec. 13 on its fourth-quarter 2022 earnings call.

Fluence boosted its revenues 76% in its 2022 fiscal year to $1.2 billion, the company announced Dec. 12, beating the S&P Capital IQ consensus estimate. For 2023, Fluence expects revenues of between $1.4 billion and $1.7 billion, with adjusted gross profit of $60 million to $100 million.

During the Dec. 13 call, Nebreda highlighted the impact of a new investment tax credit for standalone storage, which was passed as part of the Inflation Reduction Act and takes effect in 2023. "We expect [it] will incentivize more projects to move forward and to greenlight other projects that were not economic for our customers," Nebreda said.

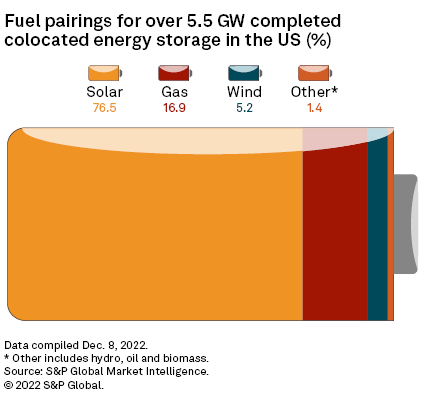

The climate law also incentivizes energy storage projects paired with solar projects or retired fossil fuel plants. As of Dec. 8, over 5,500 MW of completed battery power storage capacity in the U.S. was colocated with other power plants. More than three quarters of that capacity was located at solar farms.

"Storage is part of the solar story," said Powin's Brown. "They are joint technologies that are necessary to achieve the common goal of reducing overall carbon emissions."

Shorter duration remains near-term focus

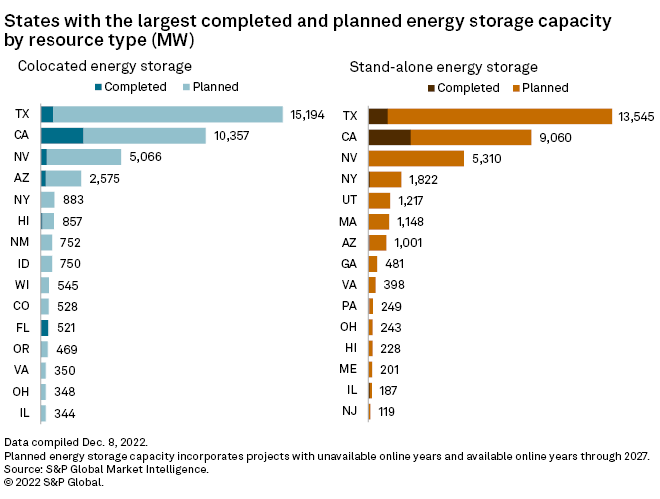

The largest U.S. solar markets, California and Texas, are also the largest energy storage markets. Significant volumes of batteries are planned across the sunbelt states of the Desert Southwest, as well.

In December, Energy Vault Holdings Inc. announced a contract to deploy a 220-MW/440-MWh battery system in Nevada in 2023 for NV Energy Inc., a utility affiliate of Berkshire Hathaway Energy. Energy Vault has secured contracts to provide two-hour battery systems in Texas and California, and in Australia.

The company, which is seeking to commercialize a unique longer-duration gravity-based energy storage technology, in 2022 expanded its business with conventional lithium-ion batteries. Passage of the Inflation Reduction Act is accelerating demand especially for shorter-duration projects, according to Energy Vault CEO and co-founder Robert Piconi.

"Right now, what we see is really an intensity around the two- to four-hour market," Piconi said in an interview. "There's no pivot here," he said, pointing to Energy Vault's own continued focus on longer duration. That includes the company's gravity-based approach and an "ultra-long duration" green hydrogen storage project with a "large Western utility" that will soon be disclosed, Piconi added.

But as the shorter-duration market surges in real time, Energy Vault is seeking to take advantage, leveraging its energy management software platform designed for all durations.

"The long-duration market is not as near term as some people thought, and even us," Piconi said. But as solar and wind energy resources become a higher percentage on the power mix, "because of the intermittency, that instability, longer duration will become more and more important."

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.