S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

29 Mar, 2022

By Vanya Damyanova and Cheska Lozano

Global investment banking revenues are set for a hard landing as companies shelve M&A and IPO plans on Ukraine war fears and hawkish central bank policies.

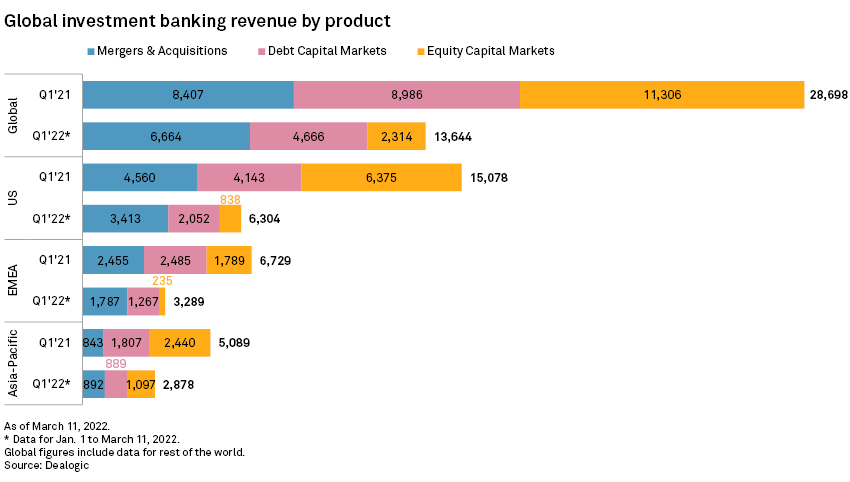

Tightening financial conditions and widespread uncertainty about the ongoing conflict in Ukraine have created a perfect storm that is slowing down client activity. The trend is on track to impact investment banks' underwriting and deal advisory revenues in the first half of 2022 and possibly beyond. Year-to-date, M&A, debt and equity capital market transaction volumes have dropped to their lowest levels in five years, S&P Global Market Intelligence data shows.

"So far, it seems like the industry got the worst of everything," Eric Li, research director at financial services analytics company Coalition Greenwich, said in an interview, noting that revenues across all business areas, including debt capital markets, equity capital markets and advisory services, have declined. "There are no silver linings for any of the areas," said Li.

War worsens outlook

Global investment banking revenues hit a two-decade high of $127.5 billion in 2020 and climbed further to $159.4 billion in 2021. The results for both years were the strongest on record since 2000, according to financial market data provider Refinitiv. In the early part of this year, revenues have shrunk by more than one-third, Dealogic data shows.

With central bank rate hikes on the horizon, a revenue normalization from the pandemic-fueled boom of the past two years is not surprising, Li said. Yet the war in Ukraine could significantly weaken revenues in 2022, especially if the conflict drags on, he said.

Before the Ukraine war started, Coalition Greenwich estimated that global banking revenue would drop 10% to 25% year over year in 2022, citing the negative impact of rate hikes on economic growth. Li said it's "very possible" global banking revenue could now fall as much as 50% in the most distressed scenario as war persists.

Market jitters hit IPO, M&A numbers

Companies are likely to hold off on new debt or equity issuance until the uncertainty triggered by the war has eased, which could hurt banks' underwriting revenues in the meantime, said Maria Rivas, senior vice president of global financial institutions at DBRS Morningstar. Both M&A and IPO transaction numbers have trended down on a weekly basis since early March, Market Intelligence data shows.

"Implied volatility right now is so elevated, and that's making markets really jittery. It's very difficult to price effectively against this backdrop," Garrett Melson, a portfolio strategist with Natixis Investment Managers Solutions, said in an interview. Both debt and equity issuance has slowed since the start of 2022, with weekly outflows from European equities hitting all-time highs in recent weeks, Melson said.

Equity capital markets is expected to be the worst-performing investment banking area in 2022 given the difficult prior-year comparison and the slowdown in activity anticipated this year, Li said. Last year was the best year for IPOs globally since 1980, according to Refinitiv.

The outlook for M&A advisory revenues is uncertain even though there is a strong pipeline of announced deals as it is unclear how many transactions will actually close while the war continues, Li said. "This sort of thing deters many people from making very big decisions, like closing multibillion transactions."

Better 2nd half

Deal-making and primary market issuance can regain some lost ground in 2022 if market sentiment improves and worries about the war, rate hikes and commodity price inflation lessen, Melson said.

Markets are overpricing the expected rate hikes in particular, and some of the jitters will likely ease in the back half of the year when there is more clarity "on just what the tightening cycle looks like from global central banks," Melson said.

The U.S. Federal Reserve announced its first rate increase in two years on March 16 and plans six more hikes by the end of 2022. The Bank of England raised its key interest rate in early February, while the European Central Bank is still weighing options for a rate hike this year.

Banks also expect an improvement as the year goes on. The drop in investment banking revenues at Deutsche Bank AG in early 2022 reflects "more of a delay than ... a falling away of activity," CEO James von Moltke said at a conference in March. "Our sense is, you will see activity come back ... as people adjust to a changed environment," von Moltke said.

Absorbable hit

The big European and U.S. financial institutions have strong capital and liquidity positions and are well placed to absorb a decline in investment banking revenues, said Peter Nerby and Olivier Panis, senior vice presidents at Moody's Investors Service.

Business mix varies across the top global investment banks, and direct exposure to Russian investment banking operations is negligible, according to Dealogic data. The volatility also presents opportunities for growth in alternative business lines, such as securities sales and trading, Rivas said.

Even so, banks are tight-lipped on their revenue outlooks. Von Moltke, UBS Group AG CEO Ralph Hamers and Credit Suisse Group AG CEO Thomas Gottstein all declined to comment at conferences and investor days on expectations for first-quarter investment banking revenues.

BNP Paribas SA, Société Générale, Bank of America Corp., The Goldman Sachs Group Inc. and HSBC Holdings PLC also declined to comment when contacted by S&P Global Market Intelligence. JPMorgan Chase & Co., Morgan Stanley and Citigroup Inc. did not respond to requests for comment.

The progression of investment banking activity in 2022 will become clearer when the major institutions start reporting first-quarter earnings in the second half of April. "We need to wait and see what the banks report in the first quarter and continue watching carefully how things develop," said Rivas.