Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

23 Aug, 2023

By Karin Rives

| North Carolina Treasurer Dale Folwell, though a critic of BlackRock Inc., said it would cost the state too much to cancel the asset manager's contracts. Source: North Carolina Department of State Treasurer |

This article is the second in a two-part series on a multistate effort to eliminate environmental, social and governance considerations from public investments.

North Carolina Treasurer Dale Folwell won accolades from fellow environmental, social and governance opponents in December 2022 when Folwell called on BlackRock Inc. CEO Larry Fink to resign, saying the asset manager was "using its market power to coerce the world's companies to transition to carbon net-zero by 2050."

During an Aug. 9 interview on FOX News, Folwell said BlackRock has held North Carolina's retirement systems "under siege for over five years" and politicized the money because of the firm's ESG investment policies.

The state's business with BlackRock, however, has been undisturbed even though North Carolina joined 11 other states with newly enacted anti-ESG laws in 2023. In several other Republican states, boycott lists targeting specific investment firms have yet to translate into actual changes.

The reason, pension officials say, is that large Wall Street firms often offer lower fees and reliable returns, which is good for state business.

Replacing BlackRock with a firm that does not include ESG risks in its vocabulary would cost state taxpayers $8.4 million a year "in perpetuity" because of higher fees, North Carolina Deputy Treasurer Frank Lester said in an interview.

So Folwell decided to retain BlackRock as manager of North Carolina's $114 billion pension fund.

"My responsibility is to challenge assumptions and then ask the next question, 'Then what? What are the transition manager fees?'" Folwell said in an interview. "I think that the legislature and the voters in North Carolina are very happy that we applied common sense to this entire topic."

ESG alive in Texas

Texas' highly publicized bank boycott list has not resulted in notable changes for the state's largest pension system, the $185 billion Teacher Retirement System of Texas (TRS).

In August 2022, Texas Comptroller Glenn Hegar published a list naming BlackRock among financial companies banned for allegedly boycotting the state's large oil and natural gas industry. BlackRock had been among firms that had sought to allay the state's concerns by pointing to their vast investments in Texas fossil fuel projects.

Even so, BlackRock remains among external managers of TRS funds, and the pension system has not shied away from talking ESG.

ESG "factors influence the performance of TRS' investments," the current TRS policy statement says. "In making investment decisions, the investment division will consider ESG factors that are material to long-term returns and levels of risk" as long as investments are made "prudently and in accordance with fiduciary and ethical standards."

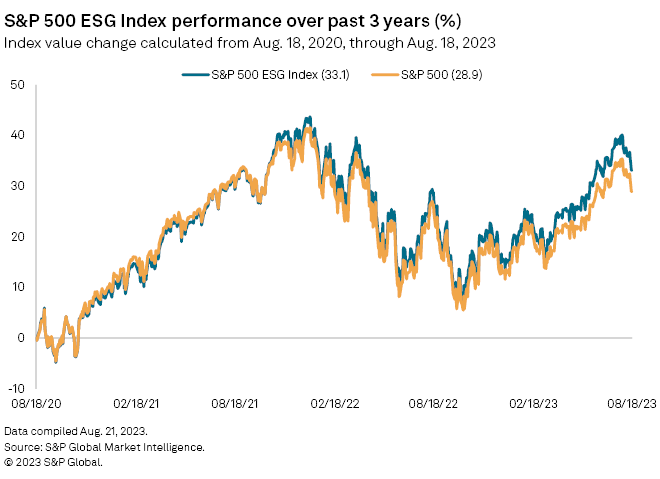

Inflation, rising interest rates and recession fears have weighed on both ESG and the broader sustainable funds market in 2023, as they have on the market as a whole. However, the S&P 500 ESG index, which includes the world's best-performing companies, continues to outperform the S&P 500.

Most states have been retaining the firms that manage their pension assets, according to an Aug. 8 white paper that law firm Ropes & Gray sent to its corporate clients.

"Despite forceful messaging from state political leaders that managers who consider ESG are practicing 'woke capitalism' that goes against the best interests of plan participants and beneficiaries, state pension plan fiduciaries may construe these new requirements narrowly in order to avoid having to remove their investment managers on the basis of ESG," the firm wrote.

West Virginia Treasurer Riley Moore is a member of the state's Investment Management Board, which is responsible for West Virginia public pensions. Moore in July 2022 published a list of firms barred from state contracts due to alleged "boycotts of fossil fuel companies," but that policy was never extended to West Virginia's pension systems.

Moore "understood early on that we have a duty to our plans," Craig Slaughter, the board's executive director, said in an interview. "Pension money belongs to a select group of people. It's not state money, and it's not appropriate to use that money to perpetuate state policy goals."

Two of the companies on the treasurer's list, JPMorgan Chase & Co. and BlackRock, still have multiyear contracts with the Investment Management Board. So does Franklin Resources Inc., also known as Franklin Templeton and a member of the Net Zero Asset Managers initiative, which Moore has criticized as "woke radicals."

Florida pension fund untouched

Florida officials have made more consequential policy decisions about ESG investments and their engagement with Wall Street than any other state. Their December 2022 decision to cancel BlackRock's management of $1.43 billion in state long-term securities and $600 million in short-term overnight investments exceeded what any other state has done to date.

State legislators then passed the most far-reaching anti-ESG initiatives to date, known as H.B. 3. Enacted in May, the bill expanded a previous policy for the state's $189 billion pension system to any fund in which local and state agencies invest.

Among other things, the new legislation requires investment managers to certify annually that they are only considering pecuniary factors free of any "social, political or ideological interests" when investing the state's money.

Still, "the Florida Retirement System continues to have investments that are managed through BlackRock-related entities," Paul Groom, deputy executive director with the Florida State Board of Administration (SBA), confirmed in an email. "All of the SBA's investment activities are based on obtaining the best risk-adjusted returns for the beneficiaries of the [system]."

During the first half of the year, BlackRock's business grew by $190 billion, including $109 billion in new business from clients in the US, a spokesperson for the firm said in an email.

BlackRock was among the first large Wall Street firms to begin communicating openly about how it uses ESG as part of its risk assessments. It then became a prime target for conservatives who believe the firm is using its market clout to steer investments toward political goals, and for environmentalists who point to the company's continued investments in fossil fuel industries.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.