S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

21 Jan, 2022

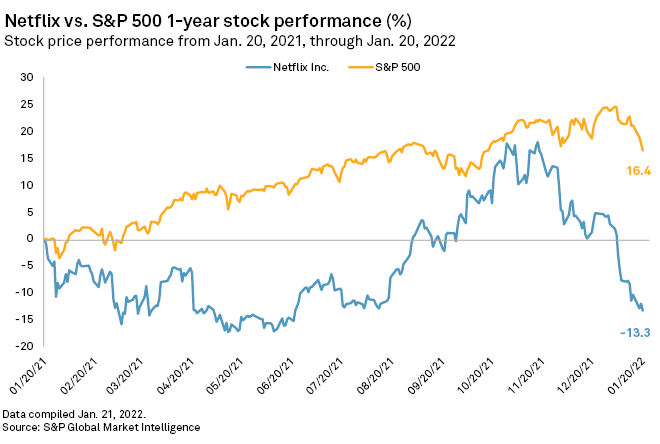

After several quarters of ambivalence on the part of investors, Netflix Inc. stock cratered following the company's fourth-quarter 2021 earnings release.

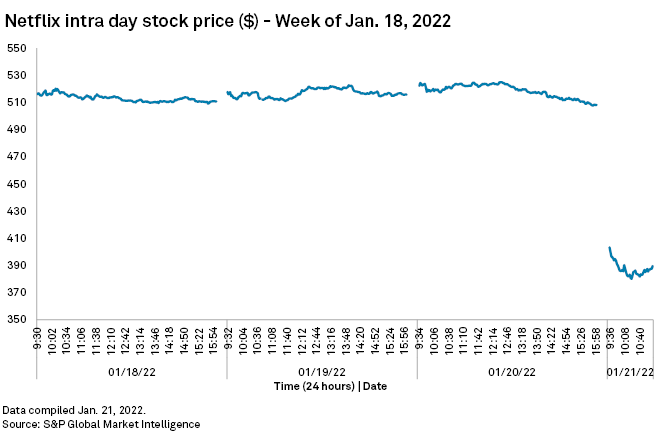

The company after market close Jan. 20 reported paid net membership additions that marginally missed prior guidance, and it drastically hemmed expectations for the first quarter of 2022. Netflix opened the trading day with a 25% drop in its share price as investors embraced the bear case and dumped the stock.

"We think Netflix can deliver sustainable profit growth as long as it is able to continue raising subscription prices, but we question the company's valuation. Ultimately, we think that Netflix will evolve into a slow growth, highly profitable company, and our price target reflects that fact," Wedbush Securities analyst Michael Pachter said in a Jan. 21 note on the company's earnings results.

Pachter reiterated an "underperform" rating and a $342 price target on the ticker. The stock was trading around $380 per share the morning of Jan. 21, compared to a Jan. 20 close at $508.25 and a one-year high of $700.99, according to S&P Global Market Intelligence.

Netflix executives on an earnings webcast following the report were defensive of the earnings miss.

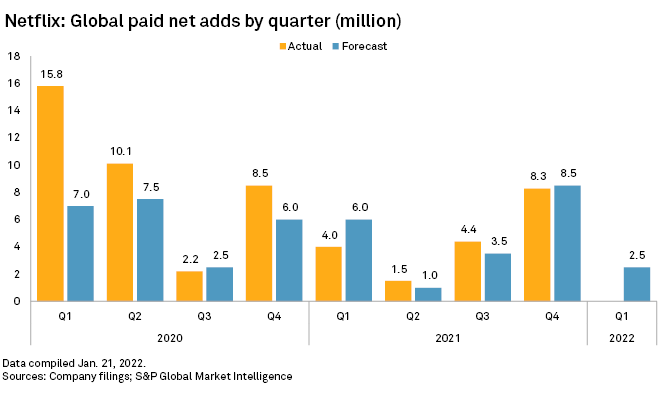

After Fidelity Management & Research portfolio manager Nidhi Gupta asked what led to the company's underperformance, co-CEO Reed Hastings retorted, "Nidhi, 8.3 million versus 8.5 million, I mean ..."

"In fairness, Nidhi said it was a little shy," CFO Spencer Neumann interjected. "Overall, the business was healthy. Retention was strong. Churn was down. Viewing was up. But on the margin, we just — we didn't grow [subscriber] acquisition quite as fast as we would have liked to see, and on our large subscriber base, a small change in acquisition can have a pretty big flow-through in paid net adds."

While the company's 200,000 miss on paid net member additions was marginal compared to its total membership base of 221.8 million, analysts flagged the company's guidance as cause for more concern.

Netflix expects first-quarter paid net members to grow by 2.5 million, a figure Gupta said was below expectations. Paid net member additions in the first quarter of 2021 totaled 4.0 million, and in 2020 at the start of the pandemic, it totaled 15.8 million.

"It's definitely frustrating for us," Hastings said of the slowing growth. "Streaming TV is such a better experience than the old linear TV. In some ways, we think to ourselves we should be higher than pay TV, a combination of lower pricing and better experience."

Hastings said the guidance number is not "sandbagged," meaning the company did not put up an artificially small number to stage a first-quarter beat. The CEO was at a loss to explain the pressure on growth and went so far as to admit that perhaps the potential for the streaming market is not as robust as his team previously believed.

"We try to be really rigorous of thinking about the long term. It's possible that we'll get there, but slower than we thought," Hastings said.

The Wall Street consensus for first-quarter paid net additions was 5.8 million going into the earnings report, analysts said in notes following the earnings report.

The "significant miss" on that metric calls Netflix's growth trajectory into question, Truist Securities analyst Matthew Thornton said. The company has been managing a "pull-forward" effect from the pandemic period when an unprecedented number of consumers signed up for its platform while quarantined, which executives said put downward pressure on membership gains through 2021. But the company keeps getting further from that pull-forward effect and member additions are "getting worse, not better," Thornton said.

He downgraded Netflix to "hold" from "buy" and dropped his price target for the stock to $470.

"There's a number of potential explanations with COVID, but then we worry about hanging too much on that," Hastings said. "There's more competition than there's ever been. But we've had Hulu and Amazon for 14 years. So it doesn't feel like any qualitative change there."

One potential factor impacting the company's growth trajectory is pricing. Netflix, in the week before its earnings results, announced an increase in subscription prices in the U.S. and Canada, and chief product officer Greg Peters said the effect of those increases would be felt throughout the quarter. A Netflix subscription is materially more expensive than competitors like Walt Disney Co.'s Disney+ and Comcast Corp.'s Hulu.

Not all analysts gave up their positive outlook on Netflix following the earnings. For example, Jefferies Equity Research analyst Andrew Uerkwitz acknowledged the in-line fourth-quarter 2021 results and the miss on guidance, but still maintained his "buy" rating and $737 price target on the company.

Pivotal Research Group Principal and Entertainment/Interactive Subscription Services Analyst Jeffrey Wlodarczak, another self-avowed medium- to long-term bull on the stock, wrote in a Jan. 20 note, "NFLX offers consumers an increasingly compelling entertainment experience on virtually any device, [without] commercials at a still relatively low cost." Wlodarczak has a $550 target price.