S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

26 May, 2021

By Brian Scheid

| Lower-income workers are demanding higher wages amid a very tight labor market. |

A wage revolution may be underway.

Lower-income workers have greater bargaining power than before the pandemic, according to economists interpreting new data. Employers are facing an unusually tight labor market and struggling to fill a record-high number of open positions. Companies are offering more pay to lure people, while prospective employees are demanding higher wages to get back to work.

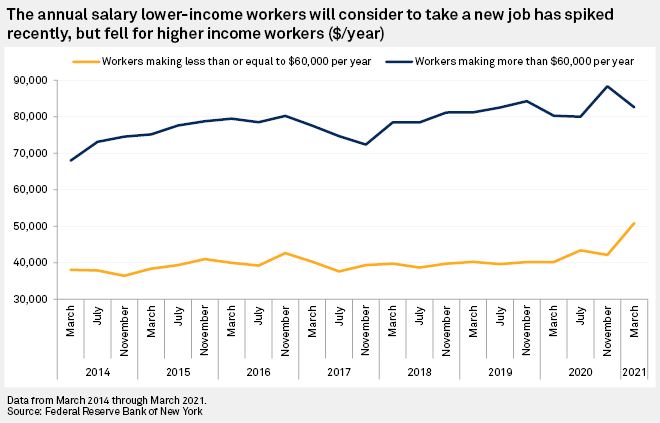

The reservation wage — the minimum required for a worker to take a new job — jumped 21% from November 2020 to March 2021 for workers making $60,000 or less per year, according to the Federal Reserve Bank of New York's latest survey of consumer expectations released on May 10. Meanwhile, the reservation wage for workers making more than $60,000 fell by 7% over the same time.

Economists said the data may just be an aberration of an economy early in its post-pandemic recovery, but lower-income workers seem to have strengthened their wage bargaining power.

The labor supply constraints facing employers nationwide will likely abate in the coming months as fear of contracting the virus recedes, childcare options expand and increased unemployment benefits expire, said Shannon Seery, an economist for Wells Fargo's Corporate and Investment Bank.

But the pandemic's effect on wages may not be temporary.

"In some ways, the tide is already turning in the direction of higher wages," Seery said in an interview.

The increase in the reservation wage

Oren Klachkin, lead U.S. economist with Oxford Economics, said a lack of qualified, willing and available labor to take on these open positions has increased negotiating power for lower-income job applicants.

"Also potentially playing a role here is that businesses weren't anticipating such a rapid turnaround in economic conditions, and they are now forced to offer higher wages, which is feeding through into higher reservation prices," Klachkin said.

Higher minimum pay

The data, which shows that lower-income workers are demanding increasingly higher salaries, are also reflected in recent announcements from numerous companies including McDonald's Corp., Bank of America Corp., Under Armour Inc. and Chipotle Mexican Grill Inc. to raise the minimum pay rate as they struggle to fill open positions.

"We are committed to doing the right thing, and at the center of our commitment is ensuring our teammates feel valued and appreciated," Patrik Frisk, Under Armour's president and CEO, said in a May 19 announcement of the company's plan to boost the minimum pay rate to $15 per hour.

Dec Mullarkey, a managing director with SLC Management, the institutional asset management arm of Sun Life Financial, said the drivers of these wage hikes were the increase in digital commerce and demand amidst the reopening economy.

"But the need for greater equality, something that was amplified during the pandemic, is also forcing companies to rethink their social role," Mullarkey said.

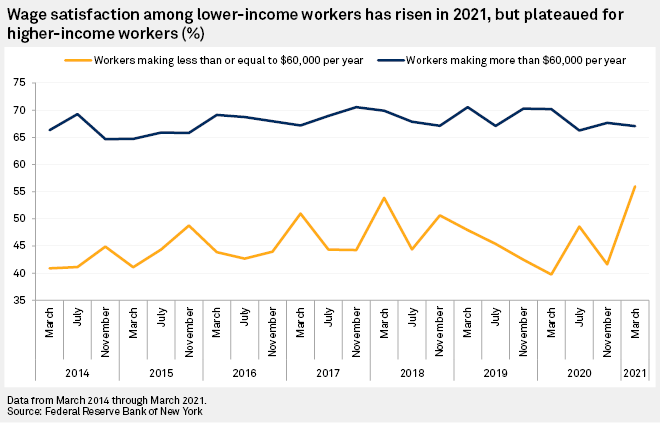

Wage satisfaction for lower-income workers rose from November to March as it declined for workers making above $60,000 per year.

The rise in the reservation wage and income satisfaction for lower-income workers make indicate that many of these people are "pretty content" with their current situation, as some of them may have transitioned into more favorable working conditions at home, said James Knightley, chief international economist with ING.

"To go to a new working environment, which could involve having to go and commute to work again, they want to be compensated for that in the form of higher pay," Knightley said. "Either way, in a tight labor market where companies are having to compete for workers it underscores the point that employers will have to pay up to attract staff."

This could increase costs and boost risks of inflation going higher for longer, Knightley said.

In a May 13 note, economists with Goldman Sachs said labor constraints will likely keep labor markets tight and push wage growth above 3% in the near term. This momentum is unlikely to last and will disappear by this fall, they noted.

Federal minimum wage

But economists interviewed this week said the impact of the run-up in the reservation wage for lower-income workers may have a more lasting effect and could impact Congress through the ongoing fight over raising the federal minimum wage to $15 per hour.

"As the market pushes wages higher, more employers are already paying more employees above any given potential minimum wage threshold," said Aaron Sojourner, a labor economist and associate professor at the University of Minnesota's Carlson School of Management, in an interview. "This often softens their opposition to a minimum wage at that level because it's not as binding on them but they believe it may raise the costs of their low-wage competitors."

The changes underway may ultimately blunt the argument of the negative impact a higher minimum wage will have on businesses and the overall economy, said Gus Faucher, chief economist with the PNC Financial Services Group, in an interview.

"It could be easier for the federal government to increase the minimum wage if businesses are already raising pay on their own, because in that case there might be less opposition since the minimum wage may be less binding," Faucher said.

Mullarkey with SLC Management said increased social pressures will like also continue to be a catalyst for higher wages.

"Activism from their own employees, customers, and ESG investors are forcing companies to be more deliberate in contributing to a more equitable social order," he said. "The awareness around this issue was heightened during lockdown and looks likely to be sustained."