S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

7 Sep, 2021

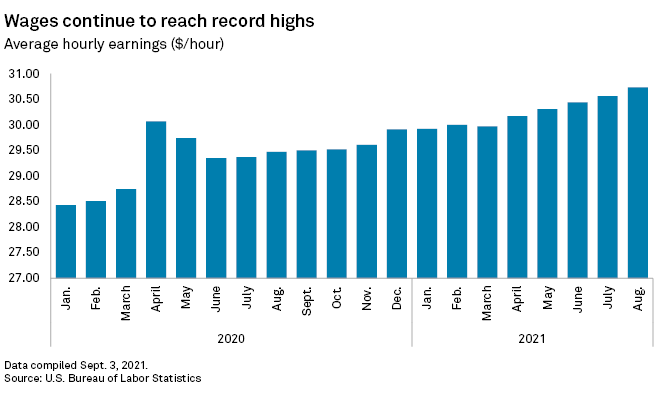

Wages continue to rise in the U.S. as businesses struggle to lure workers back into a stagnant workforce, the latest jobs data shows.

Average hourly earnings rose to $30.73 in August, an all-time high and a 4.3% jump in the last 12 months, according to the Labor Department's Sept. 3 jobs report. Wages have now risen for five straight months. Meanwhile, the labor force participation rate, or the proportion of people who are either working or looking for work, was 61.7% in August, roughly where it has been since April. The participation rate fell as low as 60.2% in April 2020 and previously had not fallen below 62.7% since at least 2011.

Economists have pinned the decline in labor market participation on a number of factors, including health concerns amid the pandemic, lack of childcare options and expanded unemployment benefits. While some workers may get back on the job as their extra benefits run out, health and childcare concerns could continue to keep people away from work and pressure employers to offer higher pay and other incentives, economists say.

"Labor force participation has been somewhat slow to come back, especially relative to the robust labor demand we are seeing, and as a result, there has been some upward pressure on wages as employers compete to attract the workers who are in the labor force," Michael Pugliese, an economist with Wells Fargo Securities, said in an interview.

Risks remain that the participation rate may continue to stagnate, said Lydia Boussour, lead U.S. economist with Oxford Economics.

"While we expect the recovery in the labor force participation rate to pick up in the fall as labor supply constraints gradually ease, there is a risk that the rapid spread of the Delta coronavirus variant delays the return of some individuals into the workforce," Boussour wrote in a Sept. 3 note.

The unemployment rate fell to 5.2% in August, down nearly a full percentage point in four months, but job growth slowed to 235,000, the lowest number of jobs created in a month since January, according to the Labor Department. Total U.S. employment remains nearly 5.5 million jobs below pre-pandemic levels.

The weakness in job creation, however, may be a one-off, driven by rising delta variant infections and workers quitting low-paying jobs, said Aneta Markowska, chief economist with Jefferies.

"Both of these headwinds are likely to be short-lived, given the likely influx of labor supply in early September, and the projected peak in COVID cases in late [September]," Markowska wrote in a Sept. 3 note.

Low-wage jobs

Labor market weaknesses were concentrated in low-wage, high-contact sectors including leisure and hospitality, which created no jobs in August.

There were about 11.3 million jobs at U.S. restaurants and bars in August, up 1.4 million from August 2020, but down 41,500 from July 2021.

"The flat payrolls in the leisure and hospitality sector are the clearest sign the latest COVID wave is weighing on both demand for high-contact discretionary services and the supply of workers willing to perform them," Sarah House, a senior economist at Wells Fargo, said in an interview.

The jobs number was below analyst expectations and signals that the Federal Reserve will not begin to taper its monthly $120 billion in securities purchases until at least late this year.

The racial employment divide, a priority for Fed Chairman Jerome Powell, worsened in August. The unemployment rate for Black or African American workers climbed from 8.2% in July to 8.8% in August, while the rate for white workers dropped from 4.8% to 4.5%.