Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

5 Jan, 2023

|

An offshore wind farm near Redcar, England. As costs and power prices surge, dynamics in offshore wind auctions are changing. |

Offshore wind developers preparing to bid in the many seabed lease sales and subsidy auctions taking place in 2023 in both Europe and the U.S. will be doing so in a new era of volatility and uncertainty.

The price environment for renewables has been bolstered by the energy crisis, with structural energy shortages propping up long-term forward power price curves, especially in Europe. On the other hand, spiraling prices for wind turbines and labor, as well as the higher cost of borrowing for project finance, are set to make projects more expensive to deliver.

Higher expected wholesale market earnings are already leading more developers to take higher levels of merchant exposure on projects, but are equally being targeted by governments through windfall taxes and revenue clawback policies.

"The current market situation with high price volatility and increasing uncertainty certainly has an impact on the offshore industry, with larger contributors to the supply chain put under pressure," said Ricardo Rocha, technical director for offshore wind at German developer BayWa r.e. AG.

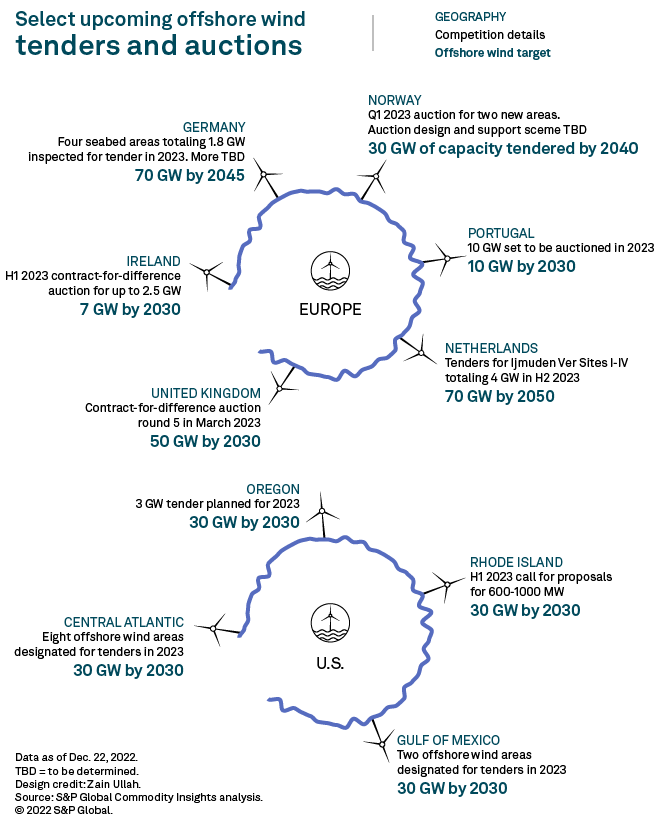

Governments in the U.S., the U.K., Germany and Norway will open new offshore wind competitions in 2023 to help ramp up capacity, and developers will need to weigh higher costs against an upbeat market backdrop in their bidding.

"There are quite a few contradictory pressures," said Alon Carmel, energy transition expert at PA Consulting, adding that the recent California offshore wind seabed lease round, which ended in December 2022, was a bellwether for what may be to come.

The round attracted fewer bidders than expected, and seabed lease payments were lower than in past U.S. rounds. California-specific uncertainties around remuneration were combined with wider macroeconomic risks, Carmel said, resulting in less exuberant bidding. Technical challenges also played a role, with California's deep waters requiring the use of floating turbines, which have much less of a track record than traditional fixed-bottom machines.

Strategic bidding to continue

Still, developers keen to gain a foothold in new offshore wind markets are likely to maintain the aggressive pricing that drew record bids for February's New York Bight offshore wind auction. During a 2021 seabed lease round in the U.K., successful bidders paid hundreds of millions for the right to develop new capacity.

Upcoming auctions are likely to see a spectrum of risk appetite given the uncertain climate.

"It is a prisoner's dilemma to the extent that if some bidders start to bid more conservatively to protect themselves against those risks, that might disadvantage them," Carmel said.

"There's still a significant number of investors who are seeking to establish themselves — you'll still have some element of strategic bidding. But I would hope that the vast majority of bidders would carefully weigh up these different factors," Carmel said.

Companies with strong balance sheets will continue to bid aggressively despite inflationary pressures, according to Henrik Stamer, founding partner and managing director at Naver Energy, a technical advisory firm working across the offshore wind development process.

"Companies that are wealthy and have the cash, they see it as a competitive advantage," Stamer said. "They feel secure that they can bid, win at almost any price and still make a good business out of it. And if not, they are following their [renewables] strategy."

For new entrants into the sector or smaller players, inflationary pressures are making it more difficult to get a foothold. Even securing meetings with sales teams at wind turbine manufacturers is difficult for developers with smaller project pipelines, with demand for equipment outpacing supply and turbine-makers being more selective, Stamer said.

US auctions ramping up

The next U.S. offshore wind auction will take place in waters off Texas and Louisiana in the Gulf of Mexico, according to Adam Wilson, renewable energy analyst at S&P Global Commodity Insights. While the waters are well known after decades of geological surveying from oil and gas activities, wind resources are comparatively weak, Wilson said.

The Central Atlantic region will be more appealing because routes to market and state regulatory commitments are clearer, Wilson said. The U.S. Bureau of Ocean Energy Management has selected eight potential wind energy areas off Delaware, Maryland, North Carolina and Virginia.

Oregon is also planning a 3-GW auction. With its deep waters, it will require the more costly floating wind technology. "But Oregon has some of the best wind resources in the country," Wilson said.

The U.S. is targeting 30 GW of offshore wind capacity by 2030.

While the supply chain has a mammoth challenge ahead, investments are already flowing and the Inflation Reduction Act is expected to support the supply chain for offshore wind, with investments in vessels also eligible for incentives, Wilson said.

Supply chain squeeze looms over Europe's goals

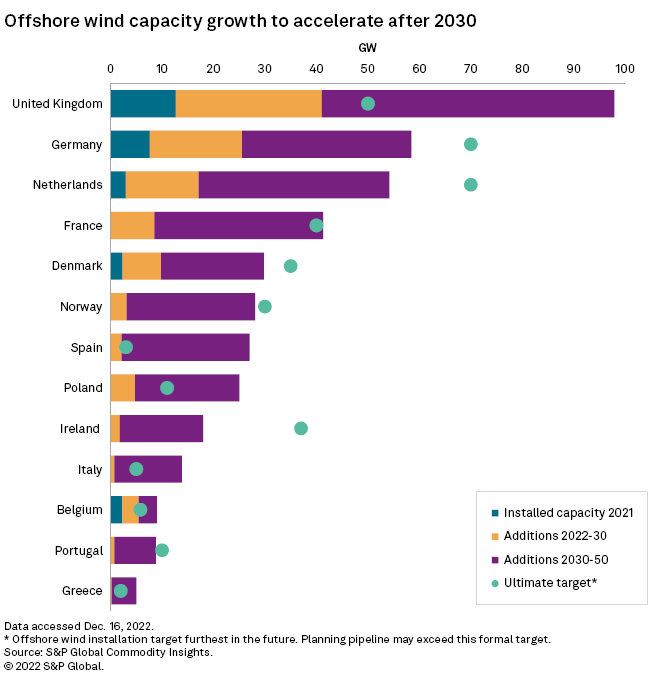

European nations are targeting 140 GW of offshore wind by 2030, according to a December 2022 analysis by Commodity Insights, with the European Union aiming for 300 GW by 2050. However, the supply chain is not designed to deliver on those ambitions, Commodity Insights analysts wrote.

"Global and regional competition ... will push costs up and could become a barrier for growth," the analysts said.

"What can be done? We — the developers — need to develop a supply chain for our projects," Rocha said, for instance by providing incentives and visibility for crucial development partners in steel, shipping or construction.

To that end, Rocha pointed to regulatory support. "This includes visibility for permitting processes, access rights for the projects and grid capacity," Rocha said.

WindEurope, the trade association representing Europe's wind sector, said auctions need to be index-linked to cover potential cost increases between the time when projects are awarded in an auction round and when a wind farm is commissioned.

The high rate of inflation would otherwise trip up turbine-makers in delivering equipment at the agreed price, WindEurope spokesperson Christoph Zipf said in an email, adding that not all European countries have index-linked their auctions.

A growing number of auctions offer no payment at all, Commodity Insights analysts pointed out, with zero-subsidy competitions now in effect in the Netherlands, Germany and Denmark, and more markets likely to switch to this model.

"While beneficial to governments, such auctions introduce a 'winner's curse' risk to the industry and pressure the supply chain just as it is scaling up to deliver the 2030 ambition," the analysts wrote.

Stamer sees a mismatch between high-level ambition and regulatory support in easing bottlenecks on permitting, infrastructure and skills. "I'm worried that a lot of policymakers, investors and decision-makers are going to end up with less offshore wind capacity than they expected," Stamer said.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.