S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

30 Aug, 2022

By Iuri Struta

Vodafone Group PLC sold its Hungarian business at a high valuation multiple, highlighting the hidden value in the company's extensive portfolio, analysts said. A set of unique location conditions contributed to the premium.

Vodafone agreed to sell Vodafone Magyarország Mobil Távközlési Zartkoruen Mukodo Részvénytársaság to local player 4iG Nyrt. and the Hungarian government for €1.77 billion. The deal values the assets at an implied enterprise value to EBITDA of 7.7x, according to S&P Global Market Intelligence. Excluding leases — or EBITDA after leases, a preferred valuation method by telco analysts — the multiple rises to 9.1x.

In the past three years, only one deal in emerging Europe had a better multiple than Vodafone's Hungarian business. Poland's ATM SA sale to private equity firm Global Compute Infrastructure LP in 2020 fetched a multiple of 11.0x, largely because data centers are valued higher by the market.

According to J.P. Morgan Cazenove, a U.K.-based unit of J.P. Morgan, the Vodafone transaction offers strong synergies for 4iG, which earlier this year closed on the acquisition of DIGI Hungary for €620 million.

"We believe this is the key driver behind the high exit multiple, and hence this cannot necessarily be directly read across to any other potential future Vodafone asset sales," said JP Morgan analyst Akhil Dattani in a report following the deal announcement. Dattani leads the firm's European telecom research.

The Hungarian government has been seeking to consolidate the domestic telecom sector and may have been willing to pay a premium for Vodafone's unit.

"We believe Vodafone was not actively looking to sell its Hungarian assets, but was approached by 4iG and the Hungarian government, who are keen to build a national champion to compete against Magyar Telekom Távközlési Nyilvánosan Müködö Részvénytársaság," New Street Research analyst James Ratzer said in a note. Magyar Telekom is owned by Deutsche Telekom AG.

"Given the multiple being offered, this was a sensible deal to help unlock value for Vodafone," Ratzer said, adding that the deal highlights "the optionality that is there across the portfolio, and especially to unlock value at a higher multiple to [Vodafone's] own share price."

* Read more details on the sale of Vodafone's Hungarian business.

* Screen for information on more transactions on Capital IQ Pro.

Analysts were not expecting Vodafone's first major deal to come from Hungary, as the company's management has been guiding in recent quarters on a partial selldown of Vantage Towers AG, which is headquartered in Germany and in which Vodafone owns an 80% stake. Vodafone has also been attempting to make deals in key markets like the U.K., Spain and Italy.

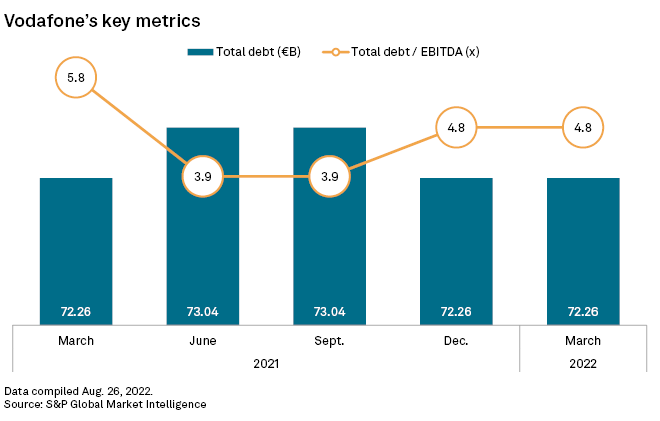

Deals like Hungary's sale help Vodafone reduce its debt. The company ended the March quarter with total debt of €72.26 billion and a total debt to EBITDA ratio of 4.8x.

Looking at net debt — which takes into account offsetting cash balances — the company's net debt to EBITDA ratio will fall from 2.59x to 2.51x after the deal closes, according to New Street analysis. If debt is brought down below 2.50x, this means Vodafone will start returning cash to shareholders, as per management's indications.

Were Vodafone to start exiting other smaller European markets, it would have plenty of choice. In addition to Hungary, it has presence in markets like Portugal, Ireland, Greece, Romania, Albania and the Czech Republic. Together, these businesses generate adjusted EBITDA after leases of about €1.4 billion.