S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

9 Sep, 2022

By Anser Haider

The video game industry is facing declining growth this year due to a lack of new hit games and ongoing hardware shortages.

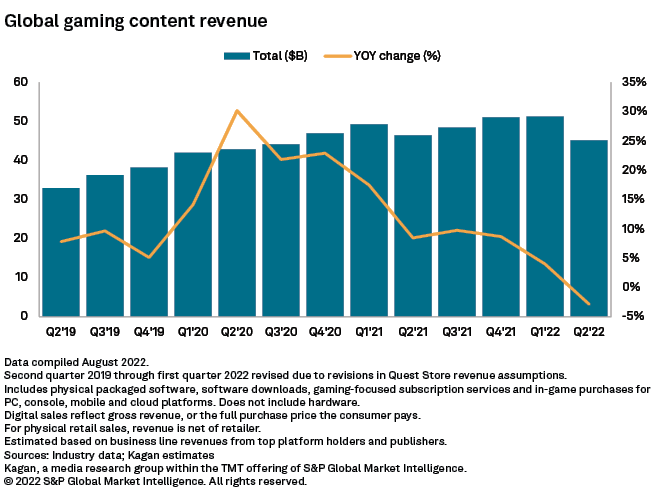

Second-quarter global video game software and services revenue fell 2.9% year over year to about $45.10 billion, according to estimates by Kagan, a media research group within S&P Global Market Intelligence.

"It's unclear whether this softness in gaming revenue growth is because the software is underperforming or the hardware isn't there, but we're definitely seeing some hollowing out of demand," said Kagan analyst Neil Barbour on the latest episode of "MediaTalk," a podcast by S&P Global Market Intelligence.

The gaming industry saw two years of strained development conditions amid the pandemic, with work-from-home policies severely slowing the pipeline for potential hit games coming to the market.

"Q2 was fairly barren as far as new, hit title releases go," Barbour said. "While there seems to be some strength in Q4 as some big-name titles come to the market, the question is, will vendors be able to supply new hardware to gamers that will get them really excited about buying these new titles?"

Both Microsoft Corp. and Sony Group Corp. have been grappling with lingering supply chain issues that are impacting the production of their respective Xbox Series X and PlayStation 5 game consoles. The constraints saw global game console shipments fall 12.3% year over year to 9.2 million units in the second quarter, according to Kagan estimates.

While both companies have taken steps to ramp up production in the coming months, the devices continue to be hard to find on store shelves.

"We haven't really seen hardware coming to market in a big way yet that you might expect if Sony and Microsoft were able to deliver on promises of increased production," Barbour said.

Mobile gaming revenue took a hit in the second quarter as well, falling 0.5% year over year to $28.13 billion, according to Kagan estimates. The decline stems from a regulatory overhang in China, the world's biggest market for mobile games.

"China withholds how many games can be released by assigning licenses to new titles, so that limits growth potential," Barbour said. "They also monitor and limit the amount of time that children can play a game, and that limits how much engagement and revenue can flow through the system."

The strict regulation will likely push more game publishers to extend their mobile gaming aspirations outside the Chinese market, Barbour said.

Despite the various hurdles impacting growth, there are still reasons for optimism.

"I think there's potential, particularly in the fourth quarter, to sort of win back some of the losses that are happening right now in the market, but a lot of things have to go the market's way, not the least of which are inflationary pressures and other macroeconomic strains," Barbour said.