S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

9 Feb, 2021

By Rebecca Isjwara, Xiuxi Zhu, and Francis Garrido

Southeast Asia, where the technology startup scene thrives on economic growth and a chronic need to boost financial inclusion, is fertile ground for acquisitions for listed blank-check companies in 2021, analysts say.

"Recently there has been momentum and appetite building in APAC, particularly in Southeast Asia, where tech-focused startups and unicorns — and their investors — view SPACs as a more efficient monetization or 'exit' option when compared to conventional IPOs," said Mark Uhrynuk, corporate and securities partner at Mayer Brown.

"While the capital markets in China offer fundraising options to domestic startups there, companies from Southeast Asia, generally speaking, have fewer options. Accordingly, they may be more open to the SPAC alternative for fundraising," he said.

With quite a few Southeast Asian unicorns — many of which are technology companies looking to go public — SPAC sponsors have had plenty of target options, experts said.

PT. Tokopedia, an e-commerce giant in Indonesia, told S&P Global Market Intelligence that it is accelerating its listing plans since the pandemic has catalyzed its business growth. It is considering SPAC as "a potential option," having appointed Morgan Stanley and Citi as advisers. The firm's spokesperson did not provide further details.

Indonesia-based tech company Traveloka is also considering a SPAC as possible stock-market listing option, according to a December 2020 Reuters report. President of the online travel app, Henry Hendrawan, said the company had been "approached by a few" SPACs.

SPAC vs. IPO

The SPAC route is appealing to companies looking for a faster exit and less pre-IPO scrutiny, said Bruce Pang, head of macro and strategy at China Renaissance Securities (Hong Kong).

"SPAC might be one of the popular listing options for startups and IPO-ready unicorns in high-growth sectors such as tech, healthcare and fintech, giving a faster, more flexible and lower-cost way to raise funds with shorter listing timelines than a traditional IPO," Pang said.

Valuation is another factor when a firm decides if SPAC is the way to go forward.

"In sectors where there are not too many comparable firms or where there's a lot of uncertainty about valuations, about how big the markets are ... those sectors would benefit a lot through listing via SPAC compared with an IPO," said Vidhan Goyal, chair professor of finance at the Hong Kong University of Science and Technology.

Experts added that startups find it easier to be valued through a SPAC listing versus a traditional IPO because the valuation is determined by private negotiations between the sponsor and the target.

Asia is the next hotspot

Asia is looking to see more SPAC activity, both from Asia-headquartered SPACs listing in U.S. or Asian exchanges as well as SPACs acquiring target firms in Asia, or so-called de-SPAC-ing, according to Marcia Ellis, global chair of the private equity group at Morrison & Foerster.

"The 220 SPACs listed last year [in the U.S.] are looking around for targets. This year is definitely the year in which those de-SPAC-ing transactions have to happen. But we are also seeing more and more SPACs listed with at least 80 SPACs listed in just in January," she said.

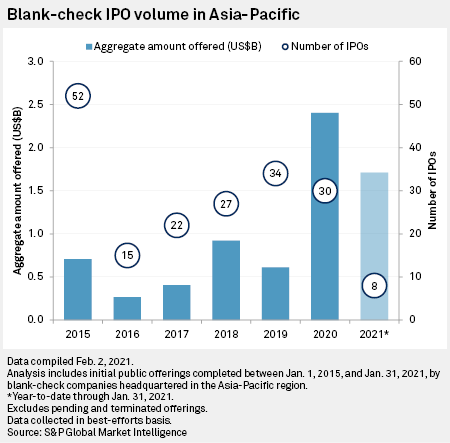

According to S&P Global Market Intelligence data, Asia-Pacific-headquartered SPACs raised $2.4 billion in 2020, a significant increase from 2019's $613 million. That number is on an upward trend in 2021. As of Jan. 31, eight SPACs have already raised $1.71 billion.

Although most SPACs are listed in the U.S., many funds that listed those firms are from Asia and of considerable size.

Last year, CITIC Group Corp.'s CITIC Capital Acquisition Corp. floated a US$276 million SPAC on the New York Stock Exchange seeking companies in the energy efficiency, clean technology and sustainability sectors. Richard Li, son of Hong Kong tycoon Li Ka-shing, has also partnered with billionaire Peter Thiel to establish a US$595 million SPAC in December and another US$299 million on Jan. 28. A SoftBank Group Corp.-backed SPAC also closed its IPO on Jan. 13, raising US$603.8 million in proceeds.

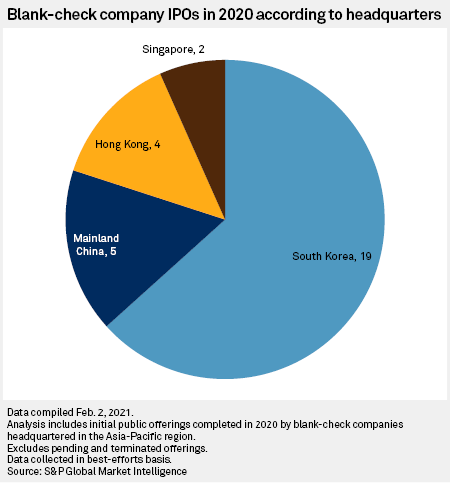

According to S&P Global Market Intelligence data, 19 South Korean SPACs were listed in 2020, compared with five from China, four in Hong Kong and two in Singapore.

"South Korea is one of the few Asian countries with a framework and regulations around SPAC listing and, in fact, the first SPAC IPO in South Korea happened way back in 2010," said Anish Ailawadi, senior director of investment banking at Acuity Knowledge Partners.

"So while Asia is seeing a lot of interest around SPACs, it's a home run for U.S. exchanges given lack of established SPAC rules on Asian stock exchanges barring South Korea and Malaysia."