Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

27 Jun, 2022

| Drought across the western United States is a significant challenge for keeping the lights on during the summer, especially as solar plants power down at sunset. |

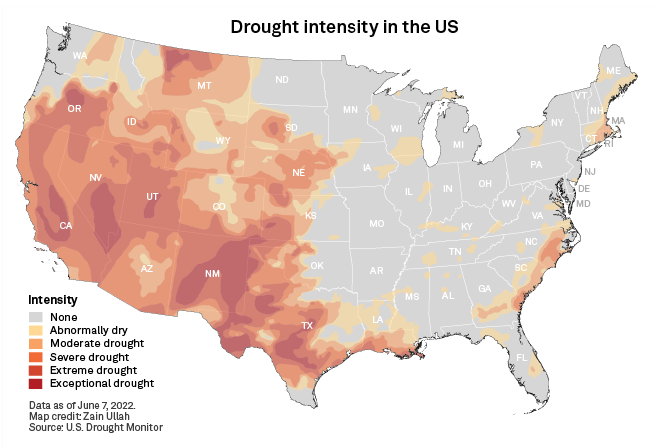

Wide swaths of the United States are being strained by drought as summer begins, heightening anxieties over hydroelectric operations and possible power outages, especially in the severely dehydrated Southwest.

The southwestern "megadrought" is among an unprecedented series of threats to keeping the lights on and buildings cool in coming months across much of North America, according to grid reliability officials. The potential challenges range from ongoing drought conditions, intensifying heat waves and catastrophic wildfires to pandemic- and policy-induced supply chain disruptions, Russia-related cyberattacks and equipment failures at emerging zero-emission and conventional fossil fuel assets.

Together, these often interrelated risks point to the nightmare scenarios that power system operators across North America are on high alert to contain this summer. That effort got off to a stumbling start as extreme weather popped up across the U.S. in mid-June, knocking out power for hundreds of thousands of households, mainly in Ohio and Wisconsin.

This summer's vast grid vulnerabilities highlight the need for technological, regulatory and market advances to support the new technologies being integrated into the grid, innovators and reliability experts said.

"We need to be considerate of how much carbon emissions are tied to our generation fleets, but we also need to be considerate of the reliability of the grid," said James Hanson, a senior engineer at the Western Electricity Coordinating Council, or WECC, an organization that ensures the operation of a reliable electric grid across the Western U.S. and Canada.

The delicate balance is playing out across the broader West this summer, where the biggest concern is the combination of "persistent drought and the potential for extreme heat," added Mark Olson, manager of reliability assessments at the North American Electric Reliability Corp.

That one-two punch can reverberate throughout the region's renewable energy-rich power generation portfolios and growing demand for electricity, supercharged by air-conditioning use. Widespread early melting of snowpack in the Sierra Nevada and Rocky Mountain ranges this year and anticipated above-average temperatures could cut deep into hydro output as summer progresses.

"These projections can mean there is a higher risk of electricity shortfalls in the evening periods when solar [photovoltaic, or PV] output is diminished and electricity demand is still high," Olson said in an email.

Stressful sunsets

That could lead to stressful sunsets, especially for the California ISO, the state's primary transmission grid operator. While the world's fifth-largest economy was nearly entirely powered by renewable energy resources at times this spring, and had enormous solar oversupplies in the middle of the day, the setting sun creates a precarious transition.

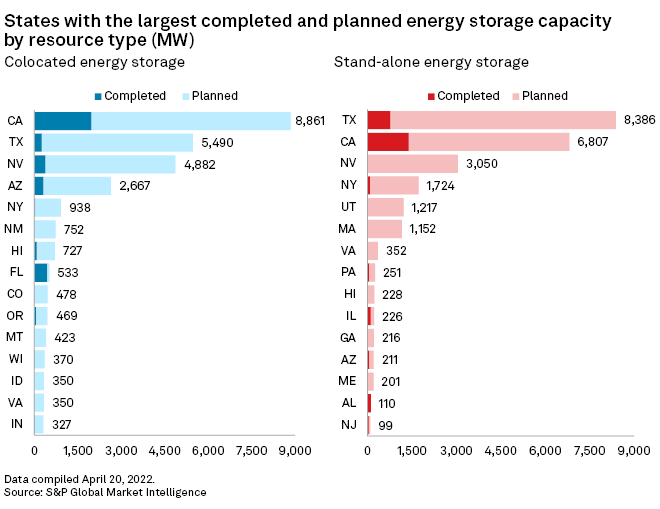

More than 15,450 MW of CAISO-connected solar farm capacity and more than 12,370 MW of distributed PV power down at twilight, requiring that other resources ramp up to meet demand for electricity. With in-state hydro decimated by drought, California is poised to call on new battery storage stations, natural gas-fired generation, conservation and hydro imports from the more drought-resistant Pacific Northwest.

California's hydro generation could come in at less than half of average this summer, driving up production from gas-fired resources and related carbon-dioxide emissions, according to a recent analysis from the U.S. Energy Information Administration.

Other areas of the Western Interconnection — spanning all or part of 14 states, two Canadian provinces and northern Baja Mexico — are in similar situations, though on smaller scales than California. Meanwhile, solar capacity is fast-accumulating in other parts of the country as well, most notably in Texas, the Midwest and across the PJM Interconnection LLC market, the nation's largest regional transmission organization covering states from the mid-Atlantic to the Great Lakes.

Go-to peak resources to counterbalance solar's decline at sunset are not always reliable, however. Some recent trouble spots include the breakdown of AES Corp.'s 10-MW/40-MWh Dorman Battery Storage Project in Chandler, Ariz., in April, as well as prolonged outages at Vistra Corp.'s 400-MW/1,600-MWh Moss Landing Energy Storage Facility on California's Monterey Bay and Calpine Corp.'s 648-MW gas-fired Russell City Energy Center in the San Francisco Bay area.

Read More: Battery blazes, breakdowns underscore 'growing pains' for energy storage

While the latter two plants are scheduled to return to full service this summer, a far bigger issue could be last summer's deadly rupture at a critical juncture of a gas pipeline system operated by Kinder Morgan Inc. subsidiary El Paso Natural Gas Company LLC. The incident has led to a 20% flow reduction in the Golden State "that has not been remediated yet," according to Amanda Sargent, senior resource adequacy expert at WECC.

That could lead to "a curtailment of natural gas supplies during periods of peak demand this summer," Sargent said in late May at a two-day meeting on this summer's reliability risks.

| A new battery station next to a gas plant in Texas. Such peak power assets do not always operate as they should. |

Wanted: Market entry of aggregated resources

In areas where rising temperatures expose energy deficits this summer, conservation and "emergency imports" will be essential for avoiding "operator-initiated load interruption," said NERC's Olson. "System operators will be paying close attention to weather, grid conditions, and demand and resource forecasts for energy shortfall risks."

Last year, California showed how helpful conservation can be when such efforts helped the state to narrowly avoid a second consecutive summer of rolling blackouts after the raging Bootleg Fire in southern Oregon blocked a major transmission corridor carrying Columbia River hydropower to the Los Angeles Basin.

Some market participants see much greater opportunity for end-use consumers to contribute to broader U.S. grid reliability.

"The United States is potentially in for a world of hurt this summer," said Cisco DeVries, CEO of OhmConnect Inc., an Oakland, Calif.-based company that pays households to cut their power use when the grid is stressed and then bids those demand-side savings into wholesale power markets. "But I hope that, by what we do this summer, we can avoid blackouts or at least minimize them [and] also set us up to avoid this kind of crisis issue every summer."

OhmConnect is collaborating with tech giant Google LLC, solar and energy storage installer SunPower Corp., and heating, ventilating and air conditioning supplier Carrier Global Corp. to orchestrate significant volumes of residential demand reductions in California, Texas, New York and beyond.

That would align with the Federal Energy Regulatory Commission's Order 2222. But implementation has been lagging, especially in the Midcontinent ISO's domain in the Central U.S. and Canadian province of Manitoba, where clean energy trade groups recently expressed deep frustration over MISO's proposed delay of necessary tariff revisions until October 2029. Gregg Dixon, CEO of distributed energy resource software developer Voltus Inc., is calling for a tariff that enables "the democratic market entry" of coordinated conservation, small-scale generators, storage and other aggregated assets — sometimes referred to as virtual power plants — in wholesale markets.

FERC could unlock "thousands of megawatts" of resources in MISO this summer by eliminating a rule that allows states to opt-out of demand response, Dixon said. But he fears such progress toward harnessing the greater potential for small-scale assets to support the broader grid may only occur "when tragedy strikes."

Not just 'a California issue'

Grid reliability officials are also concerned about unexpected drops of solar generation following minor disturbances on the grid, such as occurred in 2021 in California and Texas. The events were linked to older power electronics, known as inverters, that caused short but significant reductions of solar generation.

A joint NERC-WECC report released in April flagged four separate incidents in California, involving the sudden temporary loss of roughly 550 MW to 910 MW of large-scale solar and distributed generation.

|

equipped with power electronics prone to drop offline during minor disturbances. Source: SunPower Corp. |

"We have a lot of legacy equipment right now in the West, which is why we're dealing with so much momentary cessation still," said WECC's Hanson. "Other resources have to pick up and cover that generation that's lost."

Some inverters lack the capability to ride through minor grid hiccups, threatening to turn them into bigger problems and prompting NERC to push for nationwide standards to address repeated output losses.

"You can't just say that it's a California issue," said Hanson. "Because wherever you operate, you're going to have inverter-based resources in the near future, so these are real problems for the entire interconnection."

CAISO has developed performance requirements to keep the problem in check, although resources that came online prior to the rules only have to comply when changes are made to the facilities, according to grid operator spokesperson Anne Gonzales.

"The ISO does agree that national standards would be beneficial, rather than each transmission service provider addressing these concerns through their individual tariffs and interconnection agreements," Gonzales said in an email.

As more inverter-based resources enter operations, there is confidence in newer, smarter inverters. But better transparency is needed about which plants are still using less sophisticated legacy inverters, added Curtis Holland, staff reliability specialist at WECC.

"If it's going to happen, we want to know that it's going to happen and we want to model that it's going to happen so that when it does happen it's not going to be a surprise that several hundred megawatts tripped off," Holland said.

Summer relief

Overall, CAISO is not concerned about reliability challenges associated with ever larger volumes of renewables.

"Extreme heat events, especially those lasting several days and across a wide area, can make the grid more vulnerable to supply shortages. And we are monitoring the low hydro conditions," Gonzales said. "But resources, especially significant amounts of storage, have been added to the system, grid operators have been managing growing amounts of renewables for the past several years, and we've refined and improved our policies to make the market more reactive to high demand days."

Still, California in recent years has been forced to extend the lives of several older gas-fired power plants to support grid reliability, and Gov. Gavin Newsom in May pitched a $5.2 billion "strategic reliability reserve" that could offer contracts to keep them open longer. Prolonging the life of the Diablo Canyon nuclear plant is also suddenly on the table. The state's largest single source of electricity, owned by PG&E Corp. operating arm Pacific Gas and Electric Co., is scheduled to be retired in two phases in 2024 and 2025. But a $6 billion federal credit program to support struggling nuclear plants has piqued the interest of Newsom and the utility.

Delays affecting the online dates of contracted renewable energy and storage resources are contributing to such considerations. If coordination of conventional resource retirements and clean energy additions remains choppy around the West, "then you're running into control problems [and] potentially rolling blackouts like we did have in California [in August 2020] ... as the solar dropped off," said Holland of WECC.

Some summer relief in the West could come through the expansion of the CAISO-operated real-time Western Energy Imbalance Market, or WEIM. In May, the market added the Bonneville Power Administration, whose network of 31 federal hydro dams is not nearly as heavily impacted by drought as hydro facilities in California and other parts of the Southwest. CAISO is also working with stakeholders in the West to expand the WEIM with day-ahead market transactions.

Further market integration, perhaps culminating in the formation of one or more organized regional transmission organizations in the region, would help fight reliability challenges by ensuring members "get the right changes in the right spots," Holland said.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.