Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

5 Dec, 2024

By Cathal McElroy and David Hayes

| The Oct. 29 floods in Spain's Valencia region killed more than 220 people and caused over €10 billion of damage. Source: David Ramos/Getty Images News via Getty Images Europe. |

The Spanish banking sector faces more urgent action to address the impacts of climate change than previously thought following the devastating floods that ripped through Valencia in late October.

The southeastern Spanish region was hit by a catastrophic deluge on Oct. 29 after a year's worth of rain fell in one day. The floods killed more than 220 people

Spain's central bank warned in the wake of the tragedy that climate risks are materializing faster than expected and that banks should adapt their strategies and modelling to reflect this.

"Spain is one of the most exposed countries in Europe in terms of climate risk," Maria Parra, vice president, European financial institutions ratings at Morningstar DBRS, said in an interview. "The problem with this event was severity, which means that climate change is here."

Among 43 European countries, Spain has the joint fifth-highest physical risk exposure from climate change, according to S&P Global Market Intelligence and Sustainable1 data.

The country's physical risk exposure is expected to increase significantly by 2050 whether the net-zero greenhouse gas emission goals of the 2015 Paris Agreement on climate change are met or not, the data shows. While a low-risk scenario in which the goals are achieved and global average temperatures rise by 1.3 to 2.4 degrees Celsius by 2100 would lead to a less extreme rise in Spain's physical risk score than a high-risk one in which temperatures rise by 3.3 to 5.7 degrees, it would remain among the eight most exposed countries in the region in either event.

The European Central Bank's inaugural climate stress test in 2021 found that more than 60% of bank loans in Spain, Greece and Portugal are exposed to high physical risk, defined as more than 1% probability of a firm suffering from the effects of a wildfire or a river or coastal flood in a year. The average percentage of bank loans exposed to high physical risk among the 1,600 euro-area banks assessed was about 20%.

Extreme weather

The Valencia floods were the latest in a series of extreme weather events in Spain in recent years.

Parts of Spain experienced their worst-ever drought in 2023 after the driest first four months of a year ever recorded. The extreme dry spell followed the country's worst-ever recorded year for wildfires in 2022 when more than 300,000 hectares of land were affected, according to data provider Statista.

"Fires have been a very big problem in Spain for quite a while," said Javier Beldarrain, equity research analyst at Spanish capital markets firm Bestinver Securities. "They haven't had any impact on growth, but perhaps there is some kind of tail impact that we haven't seen just yet."

The sudden emergence of climate risks ahead of projections means banks should now concentrate on measuring accelerating physical risks and addressing the transition risks of shifting to a lower carbon economy, said Angel Estrada, the Spanish central bank's head of financial stability, according to a Nov. 5 report by Reuters.

Nonperforming loans

The Valencia floods are likely to cause a temporary increase in Spanish banks' nonperforming loan (NPL) ratios in the coming quarters, said Parra. Spanish lenders have about €20 billion of exposure to the region,

The Valencia Chamber of Commerce forecast that between 25% and 40% of the small retail businesses hit by the floods will not reopen. Bankinter SA and Grupo Cooperativo Cajamar have the largest exposures to SMEs in the Valencia region, at about 30% of their loan books based on year-end 2023 data, according to the Morningstar DBRS report.

The floods affected "close to over 100" CaixaBank branches and forced the closure of six, CEO Gonzalo Gortázar said during the bank's Nov. 19 investor day presentation. The bank expects to see an increase in NPLs and cost of risk as well as a hike in operating expenses due to the floods, according to Gortázar.

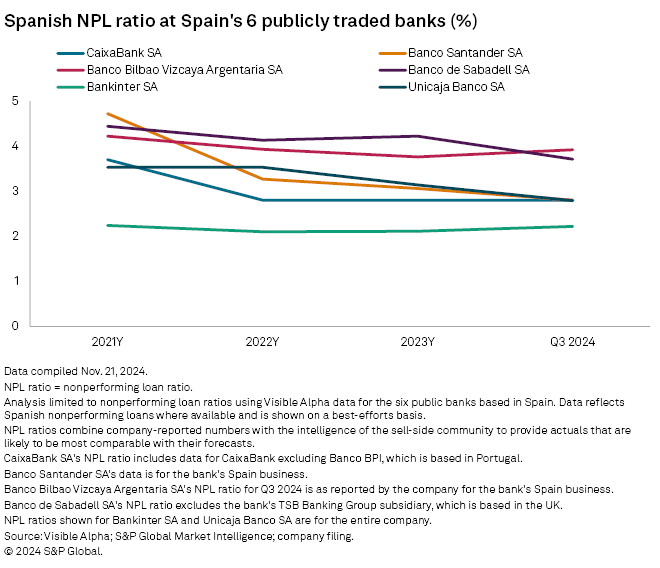

Still, the challenges posed by the Valencia floods come during a period of strength for Spanish banks. The domestic NPL ratios at Spain's largest lenders have mostly fallen in recent years even as the COVID-19 pandemic, a surge in inflation and a rapid rise in interest rates pressured borrowers, Visible Alpha data shows.

The banks have also enjoyed massive boosts to revenues and profits from higher rates, which has further strengthened their balance sheets.

Emergency disaster relief provided by the Spanish government should also reduce the impact on the banks. Two government aid packages worth a total of €14.37 billion include measures such as direct cash compensation, guarantees on loans covered by prospective insurance payouts, and tax and loan payment holidays.

The government assistance will make estimating the financial impact of the disaster on Spanish banks' loan books difficult, according to Nuria Álvarez, bank and insurance analyst at Spanish financial services firm Renta 4 Banco.

"This could change the view of the evolution of the loan portfolios," Alvarez said in an interview.

The real threat

Over the long term, EU banks will almost certainly face additional capital requirements to account for the escalating climate risk attached to their loan books. Both the European Central Bank and the European Banking Authority have recently proposed using the systemic risk buffer that allows EU member state authorities to impose additional capital requirements on banks to include protection against climate risks.

The financial impact of such a move would likely far outweigh any risks banks face from climate-related disasters, according to Álvarez. "The regulatory risk faced by banks is really more important than the climate catastrophe risk."

BBVA said in an emailed statement to Market Intelligence that it is making progress in integrating climate and environmental risk into its capital and provisioning drivers in line with the expectations set out by the European Central Bank.

"In any case, it must be said that one-off events do not change our integration strategy in the management of these risks," BBVA said.

CaixaBank is also employing a framework to monitor the impact of climate risk on credit risk, though at present it sees "no need to incorporate any changes to loan underwriting conditions, provisioning and capital considerations" based on recent extreme weather events, Stefan Rodia Garcia Petit Catoir, the bank's climate risk director, said in an email.

Santander is "working on many fronts to develop and complete our operational model for climate risk management," a spokesperson said in an email. While recent events have not changed the bank's approach to climate risk, "they have highlighted the importance and relevance of proper management of this type of risk," according to the spokesperson.