S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

21 Apr, 2022

By Allison Good

High inflation and rising interest rates are not dragging utility stocks, but ballooning customer bills and rising renewable project costs could eventually impact balance sheets in the sector.

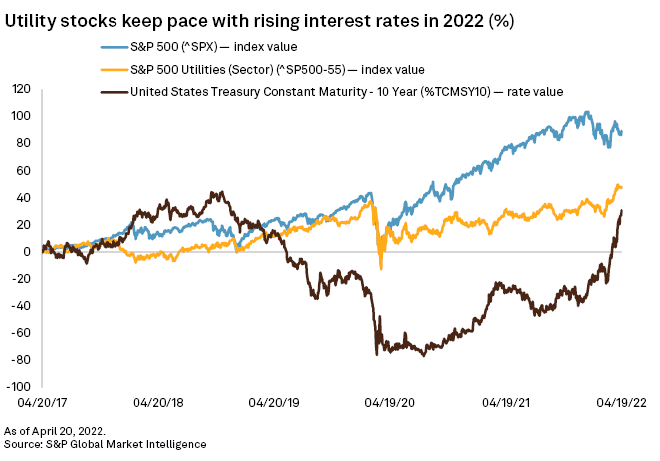

Although utility stocks have typically declined when interest rates rise, that is not happening in the current cycle. The S&P 500 Utilities index has logged a 3% gain so far in April compared to the S&P 500's 3% drop as of April 20.

Shahriar Pourreza, Guggenheim Securities LLC senior managing director, said some characteristics once seen as defensive are starting to shift from a slow-and-steady model of growth, with utilities becoming a higher-growth sector that is just as stable amid "extremely pronounced" interest in the industry.

"What's happening is the sector may go through a period where it completely deconsolidates from interest rate moves," Pourreza said in an interview. "You could even make an argument that the sector could be positively correlated to interest rates."

"I've covered utilities since 2001 ... and I've never seen the space this fundamentally strong," Pourreza continued. "You take a group that used to be a 4%-6% [EPS] grower ... and now you're in a period where you could see growth rates tick up to 6%-8%."

Analysts at Scotiabank said in an April 19 note to clients that NextEra Energy Inc., American Electric Power Co. Inc. and WEC Energy Group Inc. could see even more equity value upside.

Analysts also warned of potential downsides ahead when it comes to rate filings, operations and maintenance budgets, and rising commodity prices that could be exacerbated should a global recession occur.

Spotlight on inflation

Scotiabank, as well as analysts at Wells Fargo Securities and Barclays, emphasized that soaring commodity and labor costs will make customer affordability a front-and-center issue for utilities and regulators.

For gas utilities, "commodity was 30% of bills on average, and so if gas prices double, it's now 60%, which is essentially a 30% increase for customer bills," Eric Beaumont, Barclays power and utility research director, said in an interview.

Consolidated Edison Inc., for example, has been under pressure. Wholesale power and gas prices contributed to high bills over the winter as Con Edison's New York City utility filed requests with state regulators, seeking rate increases of $1.2 billion for electric and $502.7 million for gas to fund investments in energy efficiency, renewables, electric vehicles and clean heat. The New York Public Service Commission recently approved a request by Con Edison subsidiary Orange and Rockland Utilities Inc. to increase gas and electric rates through 2024, but Orange and Rockland agreed to eliminate funding for senior management wage increases from October 2020 to 2022 to mitigate customer bill impacts.

The impact of rising gas prices on customer bills is the "huge overriding theme for everyone," CreditSights bond analyst Andrew DeVries said in an interview. But Barclays' Beaumont said tension will not emerge in rate cases until the second half of 2023.

"Historically, the first rate case cycle after you see commodity inflation increases is not a big concern for disallowances," Beaumont said. "It tends to be the second and third rate case cycles because that's when people have started to complain and regulators start to push back more."

Utilities have long enjoyed an environment in which low fuel costs and interest rates helped offset increased revenue requirements, leaving monthly bills relatively low, but the reverse will make it more difficult for regulators to balance ratepayer and shareholder interests. S&P Global Ratings analysts said March 8 that "persistent rate case filings can lead to regulatory fatigue" and heighten regulatory risk.

Additionally, Scotiabank expects operations and maintenance budgets to be a larger year-over-year "headwind for many companies than investors might expect," due to inflation, particularly utilities experiencing "stronger-than-expected demand trends."

KeyBanc Securities' Sophie Karp, on the other hand, expects the impact of rising interest rates on utilities to be more muted since the second quarter of 2020 set a record for sector debt issuances as utilities girded for pandemic-driven lockdowns.

"Everyone locked in extremely long-duration debt with a low cost of capital, so the cost of debt won't go higher in the medium term," Karp said.

Rising renewables prices

That does not mean balance sheets will remain completely insulated from near-term inflation impacts.

Contract prices for wind and solar power in North America rose by nearly 10% in the first quarter of 2022, due in part to rising input and labor costs, according to a LevelTen Energy Inc. report. Multiple European executives declared the trend of ever-falling offshore wind costs to now be over.

Given those challenges, Wells Fargo wrote Feb. 28, losing bids for offshore wind lease acreage for areas off the coast of New York and New Jersey was "a winning strategy" for utility holding companies like Avangrid Inc. and Public Service Enterprise Group Inc. that bowed out of the auction, which was the nation's highest-grossing competitive offshore energy lease sale in history.

Companies that won acreage will be vulnerable to inflation due to the "fairly dramatic escalation in cost estimates," Paul Fremont, Mizuho Securities USA LLC managing director, said in an interview.

Project delays and cancellations could be driven more by supply chain logjams than inflation, particularly as the U.S. Commerce Department investigates whether solar manufacturers moved production to Southeast Asia to dodge tariffs on imports from China. That development might lead to new tariffs on a wider range of imported components.

NextEra recently canceled the 30-MW Chinook Solar Project in New Hampshire after determining it was "not economically feasible," reportedly citing costs associated with integrating Chinook to the larger power grid as one factor.

Companies in similar positions are likely to follow suit instead of simply increasing their capital budgets, according to Barclays' Beaumont.

"If they can all spend the amount they said they were going to spend, it likely means they get a little bit less work done, which doesn't shift rate base growth, but it does mean that ... reliability or other metrics may be a little slow," Beaumont said.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.