S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

20 Sep, 2023

By Allison Good

A confluence of factors is contributing to underperformance of US-regulated utility stocks in 2023, including expanding risk appetites fueled by dwindling recession fears, high yields on US Treasury notes and increasing concern over wildfire exposure.

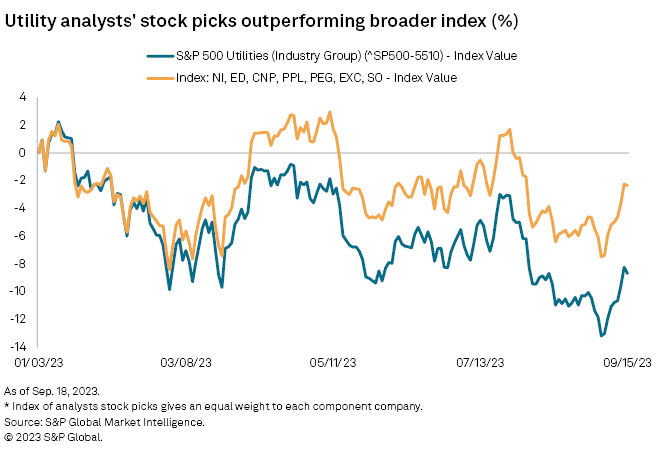

So far in 2023, the S&P 500 Utilities Index has dropped 9% compared to a 16% gain for the S&P 500 Index.

"For utility investors, I think the 'Goldilocks' scenario would be the economy goes to a hard landing and the Fed begins to cut rates, and I think we actually have the opposite right now," Mizuho Managing Director Anthony Crowdell said in an August interview.

BofA Securities analysts blamed utility investor "pullback" on the Treasury 10-year note's 4.3%-plus yield, with most utilities yielding below 4%, as well as compounding wildfire risks in light of lawsuits facing Hawaiian Electric Industries Inc., Xcel Energy Inc. and PacifiCorp.

An Oregon jury in June found PacifiCorp and its Pacific Power division liable for a series of devastating wildfires in September 2020 that the Berkshire Hathaway Energy subsidiary was alleged to have ignited, awarding more than $73 million to 17 homeowners. Xcel Energy is a defendant in a complaint concerning a 2021 Colorado grassland fire that caused two deaths and over $2 billion in property damage, and Hawaiian Electric is grappling with the aftermath of an August fire on Maui that killed 97 and, according to S&P Global Ratings, caused about $5.5 billion in damage.

BofA described investors as increasingly aware of "the consistent existential risk posed by wildfires outflanking any other factor exposure of a given utility equity," adding in the Sept. 6 report that, "Should there be further events, we perceive a risk that the 'new' premium utility will be defined by its exposure to wildfire factors."

Scotiabank disputed the correlation between utilities' equity performance and interest rates, asserting that sector stocks are out of favor because "investors simply see more exciting opportunities elsewhere" despite the industry's "cost-cutting coupled with unmatched visibility into decades of above-average growth."

Scotiabank disputed the correlation between utilities' equity performance and interest rates, asserting that sector stocks are out of favor because "investors simply see more exciting opportunities elsewhere" despite the industry's "cost-cutting coupled with unmatched visibility into decades of above-average growth."

"We recognize that higher interest rates and market optimism about a soft landing and avoiding/postponing/downsizing a recession mean that investors are happy to ignore these sleepy, defensive stocks," Scotiabank analysts wrote Sept. 18.

Without that "flight-to-safety" appeal, the analysts continued, "the catalyst to improve sentiment would have to come from outside of the sector, and frankly, would have to be bad news for the economy and/or market."

Asset sale values decrease

Since Consolidated Edison Inc. completed the $6.8 billion sale of its renewables business to RWE AG in March, subsequent asset sales have not been able to replicate that "robust (11x) multiple that has helped the company drive a share buyback and accompanied a re-rating in shares back to premium levels," according to BofA.

Scotiabank analysts agreed that transactions announced for regulated and unregulated assets by American Electric Power Co. Inc.; Duke Energy Corp.; NiSource Inc.; and, most recently, Dominion Energy Inc.'s $14 billion gas utility divestment have produced "underwhelming outcomes."

Dominion could still offload a minority interest in its planned 2,587-MW Coastal Virginia Offshore Wind project. After Algonquin Power & Utilities Corp. in August announced plans to sell its contracted renewables portfolio, analysts at RBC Capital Markets warned investors the Canadian company may not get a premium.

Eversource Energy remains in a process to announce a buyer for its 50% interest in a joint venture with Ørsted A/S that includes the Sunrise Wind, Revolution Wind and South Fork Offshore Wind projects. But Ørsted recently announced anticipated impairments of up to $2.3 billion on the first two projects as well as Ocean Wind 1. Eversource recorded a $331.0 million after-tax impairment related to its offshore wind business for the second quarter.

Eversource could potentially require $1 billion to $2 billion in incremental equity if no buyer is found, quantified as a 5% stock price downside, Morgan Stanley wrote Sept. 14.

Investor opportunities

BofA Securities named NiSource, PPL Corp. and Exelon Corp. as "compelling opportunities" for investors looking for "the 'unicorns' of pureplay regulated utilities with little regulatory risks at attractive valuations."

Morgan Stanley listed CenterPoint Energy Inc., Southern Co., Public Service Enterprise Group Inc. and Con Edison as utilities that will "hold their value" as a result of earnings stability and balance sheet strength.

Mizuho Securities USA agreed that Southern and Con Edison are premium stocks amid sector-wide underperformance during a "higher-for-longer rate environment."

"We note that while some utilities have stayed away from equity issuances, [Con Edison] has been a consistent issuer and now trades at the third-highest [price to earnings ratio] multiple in the group," Mizuho wrote. "We have seen in recent years just how difficult it is to fix a balance sheet, as evidenced by the significant restructuring [Dominion] and PPL have had to undergo."

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.