Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

19 May, 2023

Gas utility operators are exploring new ways of producing low-carbon hydrogen and preparing to use the alternative fuel across their business lines, according to a review of quarterly earnings conference calls.

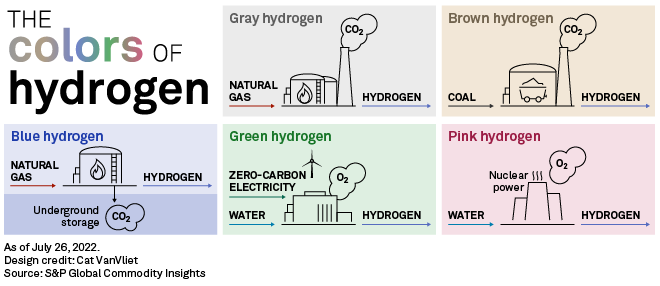

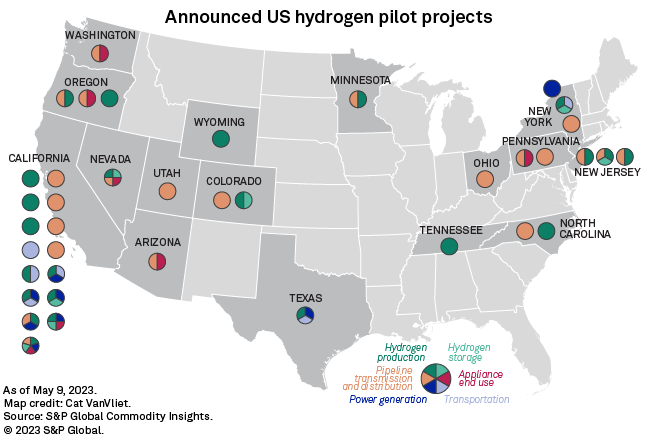

Hydrogen production has been an important component of many gas utilities' hydrogen pilot projects. However, many of the 39 demonstration projects identified by S&P Global Commodity Insights rely on more established methods of producing hydrogen, including electrolysis and steam methane reforming paired with carbon capture.

During the first-quarter earnings reporting period, some gas utilities announced plans to pilot novel methods of generating hydrogen from fossil fuels.

Meanwhile, government backing for hydrogen continued to create opportunities for utility operators to integrate the fuel into regulated gas distribution businesses as well as nonregulated segments, executives said.

Turning fossil fuels into clean hydrogen

Northwest Natural Holding Co. is preparing to start a project with Modern Hydrogen Inc. — previously known as Modern Electron Inc. — to pilot hydrogen and solid carbon production from natural gas through methane pyrolysis, sometimes called turquoise hydrogen. Northwest Natural is also evaluating another turquoise hydrogen technology under a nondisclosure agreement, Chief Marketing Officer and Senior Vice President for Operations Kim Rush said during a May 4 conference call.

Rush called the technology a "really a good fit for existing buildings." It would capture flue gas and also create liquid carbon that can be used in secondary markets such as concrete production.

Black Hills Corp. received a grant from the Wyoming Energy Authority to study producing hydrogen from the state's Powder River Basin coal reserves, the company announced May 1. Black Hills will partner with Babcock & Wilcox Enterprises Inc. to test its BrightLoop chemical looping technology at scale, using coal from the Wyodak Mine in Campbell County, Wyo., as a feedstock.

The technology uses an oxidation reduction chemical process to produce low-carbon hydrogen and a nearly pure CO2 product stream. In the first phase of the project, the partners will conduct a feasibility analysis, including a conceptual design and estimate for a semi-commercial scale hydrogen plant. The grant will cover $598,000 of the first phase's estimated $900,000 cost, Black Hills told Commodity Insights.

If the partners determine the project is feasible and cost-effective, they will construct the facility at Black Hills' Neil Simpson Complex in Gillette, Wyo., where an 80-MW coal plant is slated for conversion to combust natural gas.

Black Hills previously completed a study, also partly funded by the Wyoming Energy Authority, to assess the feasibility of generating blue and green hydrogen for use in the 132-MW gas-fired Cheyenne Prairie Gas CC Plant. Black Hills and its partners are not planning to advance to the second phase of the project — piloting a 35% hydrogen blend in the plant's turbines — until they identify more funding or hydrogen becomes more available and cost-effective, the company told Commodity Insights.

Positioning hydrogen for export

AltaGas Ltd. continues to evaluate developing "fuels of the future" on land acquired in 2021 near its Ferndale liquefied petroleum gas export terminal in Washington state, Randy Toone, president of the company's midstream unit, said during an April 26 conference call.

In July 2021, the company said it would explore energy transition-related development projects, including hydrogen facilities, in a bid to diversify its export offerings to Asia. At the time, AltaGas did not have immediate plans to invest substantially in those projects.

Asked if the federal Inflation Reduction Act had positive implications for developing the site, Toone said the law provided some benefits that AltaGas is exploring. The law includes a hydrogen production tax credit and enhanced carbon capture incentives.

Within the gas utilities segment, investments to modernize distribution systems and reduce pipeline emissions have positioned the assets to carry fuels of the future, AltaGas President and CEO Randy Crawford said.

Hydrogen hubs drive participation

Sempra, which has long been active in the hydrogen space through its gas utilities, is also exploring opportunities in its Sempra Infrastructure Partners LP subsidiary, which encompasses a portfolio of North American liquefied natural gas, gas pipeline and renewable energy assets.

Sempra Infrastructure is participating in three applications to develop US Department of Energy-funded hydrogen hubs, Sempra Infrastructure CEO Justin Bird said during a May 4 conference call. Those included the HyVelocity Hub on the Texas and Louisiana Gulf Coast; the HALO Hydrogen Hub spanning Louisiana, Arkansas and Oklahoma; and the Horizons Clean Hydrogen Hub (HCH2) at the Port of Corpus Christi in Texas. HCH2 recently merged with the Trans Permian H2Hub.

"We are looking for opportunities to support hydrogen as one of the many clean molecules that we think will fuel the future," Bird said.

Chesapeake Utilities Corp. announced it had joined a coalition developing a hub spanning Delaware, Philadelphia and southern New Jersey. Chesapeake has been piloting hydrogen blending at its Florida combined heat and power plant since 2021 but has previously been more focused on developing renewable natural gas in its Delmarva Peninsula gas distribution territories.

"We believe the Delaware-based hub offers many opportunities for Chesapeake to expand our hydrogen capabilities and identify multiple end-use applications," Chesapeake President and CEO Jeff Householder said during a May 4 conference call.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.