S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

7 Oct, 2022

By Allison Good

|

Provisions in the new U.S. climate package could alter how large utilities finance construction of renewables, though the tax equity market is expected to live on. |

U.S. utilities are already moving to take advantage of the new benefits of transferring clean energy extended investment tax credits and new production tax credits contained in the recent federal climate package. But experts expect the traditional tax equity market for financing renewable projects will remain robust.

Until recently, developers of large-scale wind and solar installations could only monetize tax credits received from the U.S. government by selling them to large financial firms and other companies with significant tax liabilities, creating partnerships that owned projects.

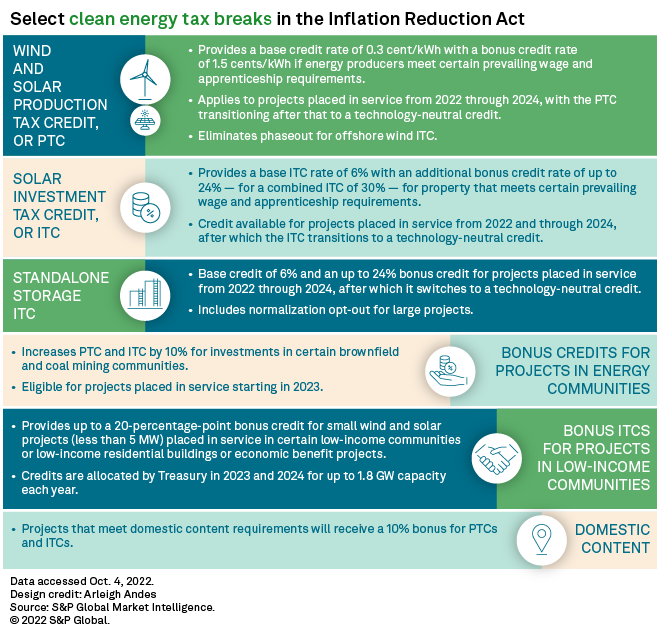

But the U.S. Inflation Reduction Act allows developers to convert tax credits into cash payments themselves by selling the credits to corporate entities unaffiliated with their projects, opening the door for direct ownership and potentially creating extra income from unused credits.

Most of the interest in that new option, also known as transferability, is coming from regulated utilities, according to Matt Shanahan, managing director at investment bank Marathon Capital LLC.

Now that utilities have a financial mechanism that does not require third-party management of tax credits, "they're thinking, 'I could own these assets, put them in my rate base and then sell the credits every year,'" he said in an interview. "They couldn't do that with a tax equity partnership because the partnership owned the assets. They'd still get cost recovery, but not direct ownership."

Switching regimes

Alliant Energy Corp. subsidiary Wisconsin Power and Light Co. is among the first utilities planning to swap tax equity partnerships for full ownership. In a Sept. 15 filing, the utility notified the Public Service Commission of Wisconsin that it "terminated" planned tax equity financing for 12 solar projects. The utility will also request approval to dissolve a tax equity partnership formed in June for the 50-MW Bear Creek Solar Project that began operating in August, and the 50-MW North Rock Solar Plant and 150-MW Wood County Solar Project (Saratoga) installations under construction.

"We see the potential for the company to add up to [approximately] $1.3B of additional capital opportunities to its forecast" and "materially offset" external equity needs, analysts at BMO Capital Markets told clients Sept. 27.

"Previously, the company was flowing back the value of the [production tax credits, or PTCs] immediately to customers independent of whether they had enough taxable income to utilize the tax credits," BMO continued. "Any unutilized PTCs were hung up on the company's balance sheet as a deferred tax asset subject to the generation of sufficient taxable income."

During a Sept. 29 investor conference, NextEra Energy Inc. President, Chairman and CEO John Ketchum said subsidiary NextEra Energy Partners could also create new capital by switching to the transfer option.

"Tax equity structures basically monetize the depreciation from the fifth year, so now we have an opportunity to maybe go buy out tax equity, create a bunch of cash and then go transfer the tax credits that we would have monetized through the tax equity structure," he explained.

Avangrid Inc., meanwhile, anticipates earning about $100 million a year from transferring tax credits, CEO Pedro Azagra Blázquez told shareholders Sept. 22.

Tax equity advantages

Some bankers and tax professionals still expect tax equity to dominate as the most cost-effective vehicle for building renewables because they can generate cash in ways that transferring credits cannot.

"Developers will still routinely choose tax equity versus transferability because … of the ability to allocate depreciation reductions, which in turn can generate an actual capital infusion into their projects," Brett Weal, a principal in project finance adviser CohnReznick LLP's renewable energy practice, noted in an interview.

Selling tax credits in a transfer market would be less lucrative because the purchase price would not be deductible and investors would want a discount for not realizing the credits' full tax benefit.

"It won't be dollar-for-dollar," Keith Martin, a renewable energy tax expert and co-head of projects at Norton Rose Fulbright, said in an interview. "Nobody knows until the tax credits start to trade what the discount will be."

Another advantage of the tax equity structure is that a partnership contains a project's complete package of site control, interconnection agreements, revenue contracts and other parts that make "construction and completion of the asset largely turn-key," creating value beyond the costs of the individual assets, CohnReznick partner Joel Cohn said in an interview.

Higher interest rates also favor tax equity partnerships, according to Arevon Energy Inc. director of finance Daniel Murphy.

"You're really trading sort of a fixed rate on tax equity to deal with more variability in the debt market" by opting for transferability, Murphy said during a Sept. 29 webinar hosted by the American Council on Renewable Energy, or ACORE. "If you did this analysis a month or two ago you're clearly switching to a lower cost of capital. Here, it's tightening against debt and tax equity so the tradeoff isn't as beneficial."

Relieving stress

A June 2021 survey by ACORE found that 46% of investors and 35% of project developers reported a decrease or significant decrease in the availability of tax equity during the previous year.

Norton Rose Fulbright's Martin and others expect the transferability option will give tax equity financiers more headroom to manage the projects they have already committed to.

"The expectation was that without these transferability and direct pay options, the market would come under increasing stress because it is a $20 billion a year market and two additional types of projects are crowding into it" — carbon capture and "gigantic" offshore wind projects that require more than $1 billion each in tax equity, Martin noted.

Raymond Wood, head of global natural resources at Bank of America Corp., agreed that introducing an alternative to tax equity could help banks be more efficient.

"With higher demand for these bigger projects and the lead times coming in [for monetizing tax credits], we're all going to have to get more creative about the timing of the commitments and including taxpayers directly for a piece of it and have that fit in with the partnership structure," he said during the ACORE event.

Meanwhile, large financial institutions like JPMorgan Chase & Co. could still benefit from tax credit transfers by participating in whatever market arises for them.

"Some projects just won't be suitable for traditional tax equity … so the transferability suddenly opens the channel for alternative monetization of those credits and we certainly want to be a participant in that space," Rubiao Song, managing director and head of energy investments at JP Morgan, said during the webinar.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.