S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

30 Dec, 2021

By Allison Good

As North American utilities and power providers race to meet their net-zero carbon emissions targets, sustainable debt financing experts anticipate environmental, social and governance-linked issuances for the sector will continue to soar in 2022, particularly given the flexibility built in to certain structures and rising demand for private placements.

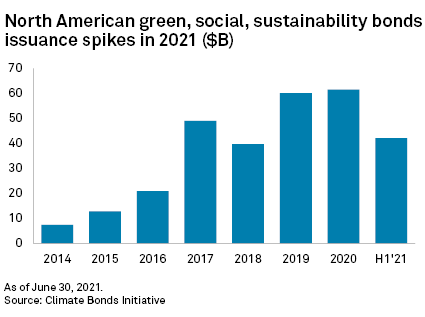

North American companies issued a record $42.1 billion of green, social and sustainability bonds during the first half of 2021, according to the Climate Bonds Initiative, which expects those investments to reach $1 trillion per year globally for the first time ever by the end of 2022. Institutions such as Barclays PLC have also carved out part of their business to focus exclusively on sustainable and impact banking.

Robert White, Natixis SA executive director of green and sustainable financing, said banks are doing big business issuing green bonds, which are earmarked for a specific use of proceeds, as well as sustainability-linked bonds, whose frameworks are tied to a set of key performance indicators, or KPIs, but come with no restrictions on how the proceeds can be used.

"There's a lot of liquidity for these types of structures," White said in an interview, even though North American investors still pay higher prices for green bonds on the primary market. "We do see the 'greenium' compressing a little bit. It's compressed a lot more in Europe as the market matures there, but we still see a ... slightly bigger one here in [the] U.S., particularly for inaugural issuances."

Natixis recently served as a co-framework structuring adviser for

But green bonds are not necessarily the right vehicle for companies such as NRG Energy Inc., White explained, which are buying existing assets as opposed to building the infrastructure. If a company is looking for additional capital to cover thermal generation retirement costs or diversifying into other business segments such as retail, sustainability-linked bonds "work incredibly well," White added.

In 2020, NRG became the first North American company to tie its ESG targets to sustainability-linked bond frameworks when it issued $900 million in senior notes connected to an associated sustainability performance target in line with the United Nations' sustainable development goals. The bonds were a part of a $3.83 billion round of securities offerings to finance NRG's acquisition of retail provider Direct Energy LP

Other energy companies such as Edison International and Enbridge Inc. have adopted similar financing strategies, with Edison planning capital investments of about $16 billion over the next three years, much of which is expected to follow the new financing rules.

In 2017, Avangrid Inc. became the first North American power provider to issue a green bond under guidelines "inspired" by the ICMA's green bond principles. Southern Co. and the National Rural Utilities Cooperative Finance Corp. have selected the ICMA's green bond standards for their sustainable debt blueprints.

Michael Ferguson, S&P Global Ratings director of sustainable finance, agreed that the North American power sector is "ripe for disruption" when it comes to sustainable financing since utilities are "prodigious and natural debt issuers."

"There's not an obvious pricing advantage right now with green bonds, but there ... arguably is with sustainability-linked bonds based on how you structure the financing because you can give yourself a benefit or heavy penalty if you don't perform in line with the targets," Ferguson said in an interview. "I think 2022 could be a pretty significant year."

In November, green bonds reached a new frontier when Canada's Bruce Power LP announced the world's first issuance for nuclear power to help phase out coal-fired electricity in Ontario. The C$500 million in bonds were offered through private placement, which is also gaining traction.

"There are given sponsors that have become comfortable with certain bank groups and have maintained a reasonable amount of business within them, but there are always people banging on the door," Jim Kaiser, Natixis managing director and head of North America infrastructure finance, said in an interview.

Privately backed power providers, which do not face the same kind of pressure from investors as public companies do when it comes to decarbonization, are also focusing more on sustainable financing, according to Latham & Watkins LLP attorney David Miller. Those institutions could initiate a paradigm shift in how private capital conceptualizes its strategy.

"You'll start seeing more and more companies ... lay the foundation of their capitalization in green-based products," Miller said in an interview. "That's going to be a bit of a sea change."

Still, issuing ESG-linked debt may not be the right fit for all utilities since they require rigorous research and reporting.

"The question is whether by slapping a sticker on it saying this is a green bond or a [sustainability-linked bond], does that get any beneficial pricing impact?" Miller said. "Does going to the extra expense and effort of getting a second-party opinion, designing KPIs, designing projects to be deemed green ... is that juice worth the squeeze? I think that's yet to be determined."

Power sector shareholders have not universally welcomed green financing, either.

For sustainability-linked bonds, some investors are skeptical of the so-called coupon step-up, which penalizes the issuer if it fails to reach its target. Others have raised concerns over labeling inconsistencies, the potential for greenwashing and the lack of ambition in the targets of sustainability-linked bonds being issued.

Asset manager Nuveen LLC recently warned in a note to clients that "the credibility and robustness of these deals remain highly variable," pointing to several recent bonds in which it contended the KPIs were "gamed to make them relatively easy to achieve" and calling for targets and reporting frameworks to become more science-based and aspirational.

Theme

Location

Segment