Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

24 Aug, 2022

By Adnan Munawar and Gaurang Dholakia

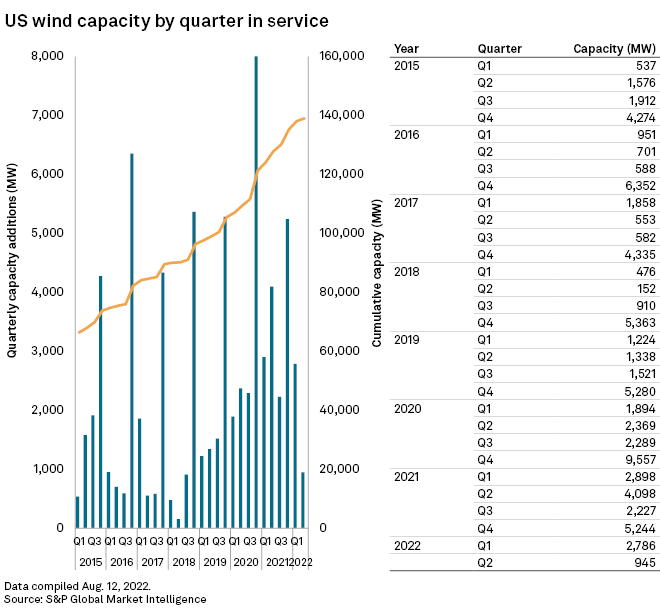

Wind developers connected 945 MW of new capacity to U.S. grids from April to June, a 77% decrease from the 4,098 MW of wind capacity that came online during the same period of 2021, according to S&P Global Market Intelligence data.

The second-quarter 2022 total is the lowest level for U.S. wind additions since the third quarter of 2018, when developers installed 910 MW of projects. The total also represents a 66% decline from the first quarter of 2022, when the U.S. added 2,786 MW of wind power capacity.

The decline in additions occurred as the U.S. wind industry was waiting to see if Congress would reinstate production tax credits for new onshore wind farms, with wind equipment manufacturers experiencing delays in orders amid policy uncertainty, supply chain disruptions and rising prices.

On Aug. 16, U.S. President Joe Biden signed the Inflation Reduction Act, a comprehensive energy and climate law that allocates nearly $370 billion in federal spending to decarbonization efforts over the next decade. The legislation includes an extension of federal tax credits for clean energy projects. It would also lift an effective 10-year ban on offshore wind leasing in much of the U.S. Southeast.

As of the end of the second quarter, the U.S. had a cumulative wind power capacity of 139,025 MW, Market Intelligence data shows.

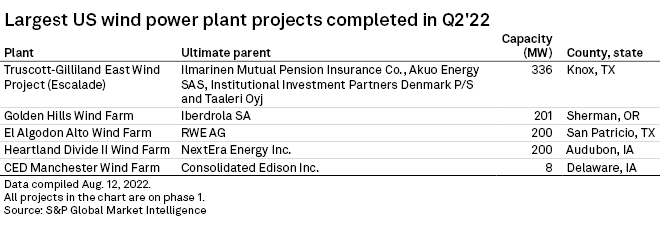

The largest plant was added to the Electric Reliability Council of Texas Inc. grid: The 336-MW Truscott-Gilliland East Wind Project in Knox County, Texas. The facility is jointly owned by a group of international investors comprising Ilmarinen Mutual Pension Insurance Co. of Finland, Paris-headquartered Akuo Energy, Danish asset manager Institutional Investment Partners Denmark P/S and Finland-headquartered Taaleri Oyj.

Also in the ERCOT market, RWE Renewables GmbH completed the 200-MW El Algodon Alto Wind Farm in San Patricio County. RWE Renewables, a U.S.-focused developer, is a unit of Germany-headquartered RWE AG.

Avangrid Renewables LLC, a unit of Spanish utility Iberdrola SA, achieved operations at the 201.3-MW Golden Hills Wind Farm in Sherman County, Ore. The project holds a power contract with Puget Sound Energy Inc. Elsewhere, U.S. renewables giant NextEra Energy Inc. completed the 200-MW Heartland Divide II Wind Farm in Audubon County, Iowa.

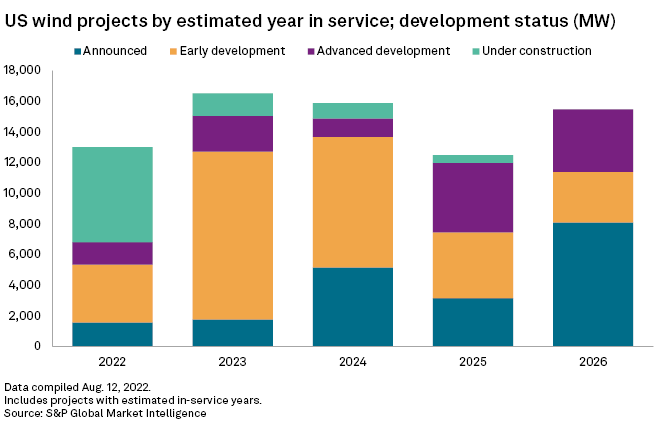

Looking ahead, the U.S. has a strong wind project development pipeline, with 73.4 GW through 2026, according to Market Intelligence data. Of that total, 31% is in advanced development or under construction. For 2022, 13 GW is in various stages of development, with almost 6.2 GW, or 48%, under construction and another nearly 1.5 GW, or 11%, in advanced development.

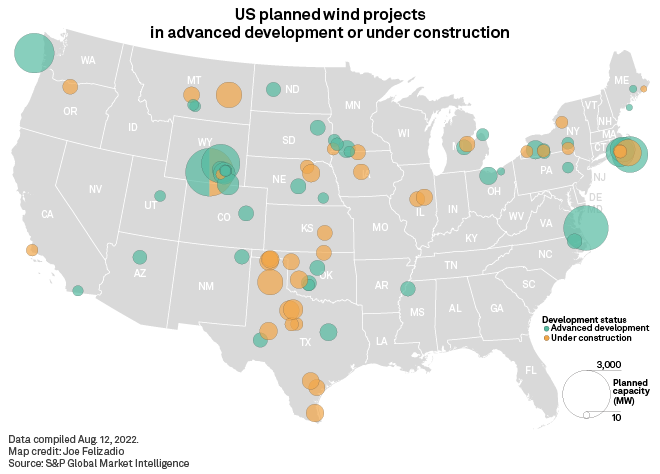

Wyoming leads the nation with 6.5 GW of wind projects in advanced development or under construction, though some of the projects have been pending for years. Texas came in second, with a roughly 4-GW pipeline of such projects. Massachusetts, which is targeting 4 GW of offshore wind capacity by 2027, came in third with 2.7 GW of projects.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.