S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

30 Jun, 2021

By Brian Scheid

U.S. workers' wages are on the rise, but so is inflation, which means rising prices of gasoline and groceries are effectively canceling out any gains for employees' wallets.

The wage figures and employment changes for June — set to be released in the U.S. Labor Department's July 2 jobs report — will offer greater insight into how the domestic economy is progressing on its recovery from the COVID-19 pandemic. The fresh data may also give clues as to when the Federal Reserve will start to roll back its support for the economy, which has largely supported markets since the crisis began.

"A solid jobs report on Friday may put a brighter spotlight on the Fed regarding the timing of tapering, while a weak report could entrench expectations that tapering doesn't start until early 2022," said Shannon Seery, an economist with Wells Fargo.

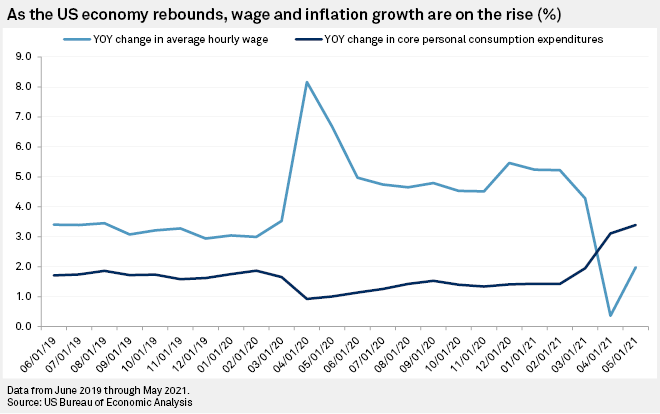

Economists expect average hourly earnings to jump 3.6% to June 2021 from a year earlier. But those higher wages are unlikely to give workers much buying power since inflation is also on the rise. The core personal consumption expenditure measure, the Federal Reserve's preferred measure of inflation, rose 3.4% from May 2020 to May 2021.

Based on economists' estimates, wages have increased year over year by an average of 3.5% so far, compared to 3.3% in 2019, 3% in 2018 and 2.6% in 2017.

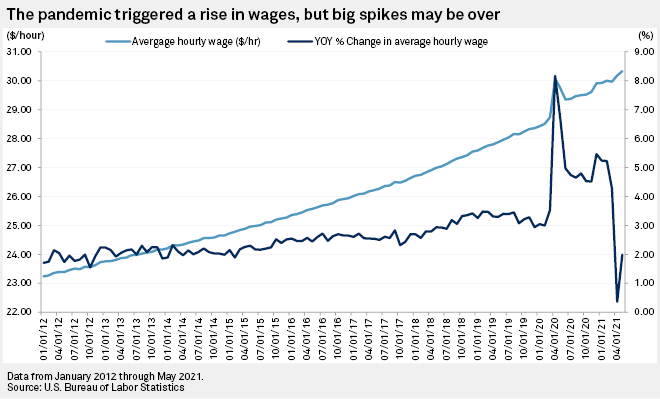

Wage movements have been volatile throughout the pandemic, largely due to many lower paying jobs disappearing and reappearing in response to lockdown restrictions. But wages are expected to rise through the summer as employers attempt to lure workers into filling a record number of job openings.

These higher wages are expected to continue to bolster inflation, which continues to climb as Fed officials claim those increases are likely temporary and a sizable rebound after the collapse in demand in 2020.

"We expect wage pressure to persist in coming months, adding to the broader inflationary environment," said Seery of Wells Fargo.

Rising wages, and their relationship with inflation, have drawn additional scrutiny from Fed officials, who have shifted their priorities from job growth to price stability as some members look to move beyond keeping rates near zero and continuing to buy $120 billion in securities, said Althea Spinozzi, a senior fixed-income strategist at Saxo Bank.

"Wages this week are more important than nonfarm payrolls because they underpin inflation expectations, which are now a focal point for the [Federal Open Market Committee]," Spinozzi said.

May's inflationary spike of 3.4% marks an acceleration from the past months. The core personal consumption expenditure measure rose 3.1% in April and 1.9% in March. The results for June will be released July 30.

"Production cutbacks, supply chain disruptions, elevated demand for durable goods, and higher shipping costs have led to significant price increases in several goods categories," wrote Jan Hatzius, chief economist at Goldman Sachs, in a June 29 note.

Used cars prices, for example, have shot up 37.9% year over year, Hatzius noted.

Meanwhile, average hourly earnings jumped from $29.74 in May 2020 to $30.33 in May 2021, pushing the three-month annualized rate up to 4.5%.

If wages come in above expectation in Friday's report, Spinozzi said, the Fed may use its August meeting to announce that talks of tapering monthly securities purchases are underway, with actual tapering beginning as soon as October.

However, Oren Klachkin, lead U.S. economist with Oxford Economics, said wages have been so distorted by the effects of the pandemic that it may be a futile effort to read much into them.

Klachkin cautioned against overlooking the employment numbers to be released along with wages July 2.

"Investors will be laser-focused on the jobs number since it's the most important gauge of how quickly the economy is returning to full strength," Klachkin said.

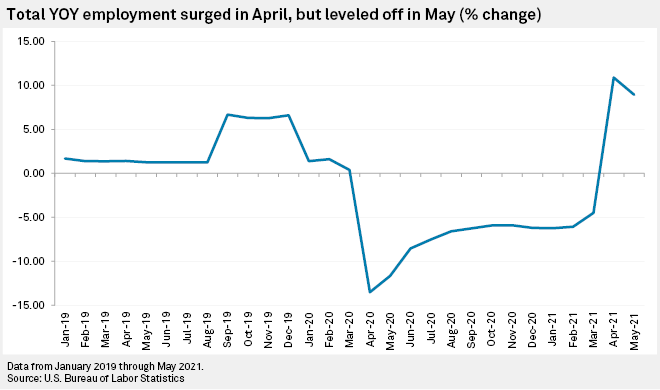

Employment growth

Year-over-year employment growth slowed to 8.95% in May, from 10.89% in April, reflecting both the rebounding economy and steep job losses in spring 2020. Spinozzi with Saxo Bank expects the Labor Department's report to show that about 700,000 jobs were added in June, putting year-over-year employment growth at about 5.6%. The U.S. market is still likely 7 million jobs short of pre-pandemic levels.

The jobs reports for April and May revealed job additions well below most economists' estimates, pushing back some forecasts for when the Fed may begin to slow its monthly purchases of $120 billion in Treasurys and mortgage-backed securities. Fed Chairman Jerome Powell has indicated a "string of months" of 1 million jobs gains would be needed before the central bank moves to tighten its ultraloose policy crafted in response to the pandemic.

Seery of Wells Fargo said the easing of a number of labor constraints could lead to a large gain in employment, including a decline in fears of contracting COVID-19 as vaccinations have increased and a slowing in the number of early retirements. Other factors, including the inability of some potential workers to find childcare and enhanced unemployment benefits working as a disincentive to return to the workforce, may take longer to abate, Seery said.

A decline in unemployment claims and increased hiring incentives from companies that have had difficulty filling a record number of open positions may create an "upside surprise" to the monthly jobs number, said Patrick Leary, head of trading at Incapital, in a June 25 note.

"But with the state of the labor markets right now, it's really a crapshoot to try to predict with any certainty," Leary wrote.