S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

14 Jun, 2021

By Garrett Hering and Krizka Danielle Del Rosario

| A technician inspects lithium-ion batteries at Vistra Corp.'s Moss Landing Energy Storage Facility in Monterey County, Calif., part of a wave of new U.S. battery stations. |

With generating capacity reserves tight and a range of severe conditions, ranging from heatwaves, drought and wildfires to tropical storms, looming, America's power grid is at high risk of experiencing outages this summer and fall. In response, builders of utility-scale battery storage stations are racing to get new projects up and running.

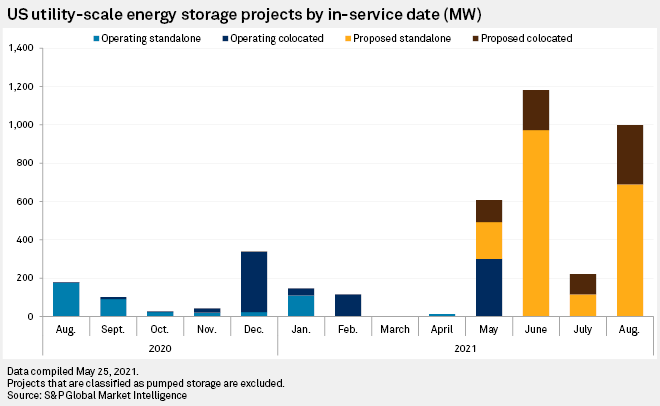

If the plans of developers and utilities pan out, total installed utility-scale energy storage capacity in the U.S., not including conventional pumped hydroelectric storage, could jump roughly 185%, to 5,582 MW, through August from a year prior, according to S&P Global Market Intelligence data.

This summer's storage surge, consisting mostly of four-hour lithium-ion battery systems designed to discharge during critical periods of peak demand, is centered in California and Texas, the country's two largest states by population and economic output, respectively.

Along with market reforms, improved planning and energy conservation, these large storage systems could help both states, which have arguably the nation's most fragile electric systems, ride through the summer turbulence with few of the sorts of widespread outages that have plagued them in the past 12 months.

California, which in recent years has struggled with blackouts related to wildfires, in August 2020 experienced two rounds of rotating outages amid a regional heatwave. Now the California ISO, the state's primary transmission grid operator, is battling with other southwestern states also thin on reserves over access to resources needed to keep the lights on this summer.

Texas, meanwhile, saw its primary power grid, managed by the Electric Reliability Council Of Texas Inc., severely buckle under the weight of a rare Arctic blast in February, leaving millions of residents without electricity for days. The state could be in for another rocky ride this summer, the North American Electric Reliability Corp. said in its summer 2021 assessment.

California could have more than 2,800 MW of largely four-hour lithium-ion battery storage at its disposal before September, nearly five times as much as a year before, while Texas could have about 1,400 MW, roughly eight times more, S&P Global data show. Combined, the two states account for three-quarters of the total installed nonhydro energy storage resources slated to come online by the end of August.

In Texas, nearly a dozen projects ranging from 50 MW to more than 200 MW in size are scheduled to start up this summer. The largest, the 203-MW Crossett Power Battery Storage system in Crane County, is one of six storage projects being developed in the state by Texas-based Jupiter Power LLC. Developers of all the ERCOT projects have paid financial security deposits, according to the grid operator.

ERCOT expects battery storage connected to its system to jump from 225 MW at the end of 2020 to 1,771 MW by the end of 2021 and 3,008 MW in 2022.

Balancing variable renewables

Given the capabilities of batteries to save energy for higher-value peak demand periods and stabilize the grid with quick surges of power, "we want to see as much [as possible], in terms of batteries, come to our market that will provide us the opportunity to really balance out the variable generation that we receive from our solar, and our wind, generation," Brad Jones, ERCOT's interim president and CEO, said June 10 at an energy industry conference.

In California, CAISO is preparing to connect more than 10,000 MW of renewable energy and energy storage resources in the next several years to fill a capacity gap caused by the scheduled retirement of the 2,240-MW Diablo Canyon nuclear station, the state's largest power plant, in 2025, as well as the scheduled retirement of numerous aging natural gas-fired facilities.

As of May 25, California already had added more than 800 MW of new battery storage capacity since August 2020, including 300 MW/1,200 MWh at Vistra Corp.'s Moss Landing Energy Storage Facility, which is co-located with a gas plant in Monterey County. Another 100 MW/400 MWh at the facility is under construction and scheduled to come online by August.

Underpinned by long-term resource adequacy contracts with Pacific Gas and Electric Co., the Moss Landing project is the largest asset in the PG&E Corp. operating arm's battery storage portfolio, which totals more than 900 MW with contractual online dates by Aug. 1.

Southern California Edison Co. is leaning heavily on battery-backed solar projects for the roughly 850 MW of new energy storage capacity expected to enter service by this summer, according to William Walsh, vice president of energy procurement and management at the Edison International utility subsidiary.

That includes several sections of NextEra Energy Inc.'s Blythe and McCoy solar-plus-storage complex in eastern Riverside County, Calif. Portions of the multiphase project, which has contracts for 523 MW/2,092 MWh of energy storage, recently connected to the grid.

"Those are the new project types ... that we're putting in our core portfolio that can help combine the best of both worlds in that we have the energy that's emissions free and then the capacity ... to discharge it on an emissions-free basis as well," Walsh said in a recent interview.