Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

5 Jul, 2022

By Brian Scheid

After the worst first half-year for U.S. stock markets in decades, equity analysts believe that the path forward depends on the Federal Reserve's ability to tame inflation and just how severe a potential recession will be.

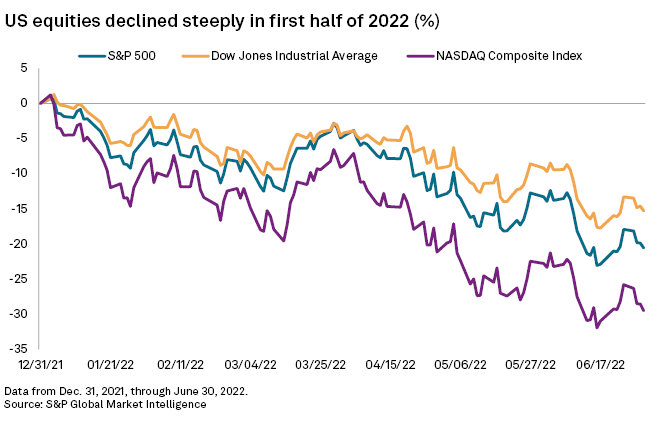

Over the first six months of 2022, the S&P 500 fell 20.6%, its worst start since 1970, when the large-cap index dropped 21% in the first half of the year.

The Dow Jones Industrial Average and the tech-heavy Nasdaq composite index declined 15.3% and 29.5%, respectively, in the first half of 2022.

"I think this is 'a' bottom, not 'the' bottom," said Steve Deppe, chief investment officer at Nerad + Deppe Wealth Management.

Deppe said he expects a modest rally this summer after the first six months of 2022 saw the largest increase in inflation since the early 1980s and a push by the Federal Reserve to raise rates faster than the market expected earlier this year.

The rally will be difficult to sustain, however.

"The last decade has conditioned investors to believe bear markets are a short, sharp, fast downturn that's over in the blink of an eye," Deppe said. "After a nice bear market rally, I think we'll see a second leg down attributed to the recession that was caused by higher-than-expected inflation, higher-than-expected interest rates and a Fed that's still all too hawkish."

Market flows

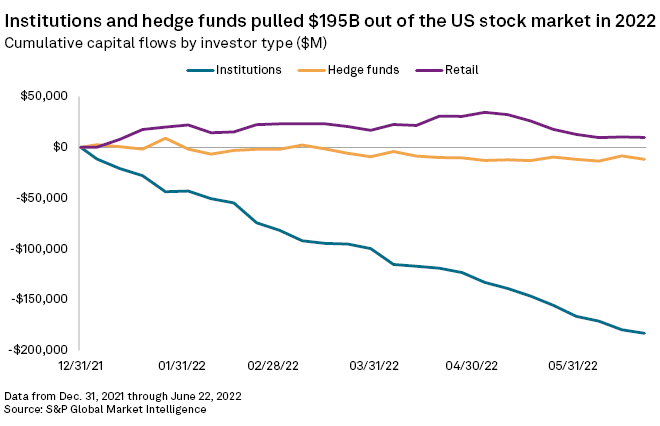

Institutional investors pulled nearly $183.2 billion from U.S. equity markets from January 1 to June 22, according to the latest S&P Global Market Intelligence data. Meanwhile, hedge funds have pulled $11.8 billion and retail investors have added $9.7 billion, the data shows.

Institutional investors tend to be key drivers of money outflows during bear markets, while hedge funds and retail investors move in and out of the market more frequently, said Christopher Blake, executive director of strategy and growth with S&P Global Market Intelligence.

Recession outcomes

Aggressive rate hikes from the Fed after two years of ultra-loose monetary policy with near zero rates could help trigger a recession and further declines in stocks. But the ultimate market response will depend on the severity of the recession, said Paul Schatz, president of Heritage Capital.

If there is no recession, the market has likely already hit bottom and stocks will rally into 2023, Schatz said. A mild recession means stocks will slide further through the year before rallying by 15% to 20% in 2023. A moderate recession could cause stocks to slip another 15% this year, with the decline continuing into early 2023.

The recession would have to be severe, including soaring agriculture commodity prices and crude oil skyrocketing to $200 per barrel, in order for substantial declines to take root in 2023, Schatz said.

Sector struggles

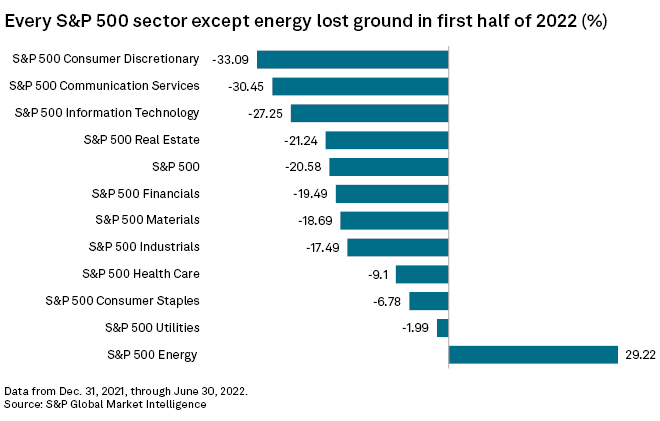

Ten of the S&P 500's 11 sectors lost ground in the first six months of 2022, including consumer discretionary stocks, which fell more than 33%.

"There's a lot of movement underneath the surface — consumer-based companies guiding down, energy and real estate companies guiding up," said Callie Cox, a U.S. investment analyst at eToro. "Sector trends tell the story of a slowing economy grappling with inflation."

Equity investors may already be factoring in an oncoming recession. Eight of the last 11 recessions have coincided with a 10% drop in the S&P 500, Cox said.

Energy stocks were the market's lone bright spot in the first half of the year, climbing 29.2% as oil prices rallied.

The energy run is likely nearing its end, according to Edward Moya, a market analyst with OANDA.

"Energy stocks will fall to the middle of the pack as the demand outlook will struggle with an unbalanced global economic outlook and further government actions may threaten profits," said Moya.

The energy sector will likely see a significant pullback over the coming year, said Deppe with Nerad + Deppe: "I think energy's dominance is over."